Looking to grow your savings without cutting all the fun out of life? Whether you’re saving for a big purchase, a rainy day, or just want to stop living paycheck to paycheck, these 7 money-saving challenges can help you put away real cash—up to $10,000 in one year. Ready to start? Let’s go.

1. The $5 Bill Challenge

Best for: People who use cash frequently.

Every time you receive a $5 bill, don’t spend it, save it. Put each $5 into a jar or envelope and resist the temptation to dip in early. By the end of the year, you could save hundreds without feeling the pinch.

Tip: You can modify this money-saving challenge by collecting $10 or $20 bills instead, depending on your budget.

Estimated savings: $500–$2,000/year

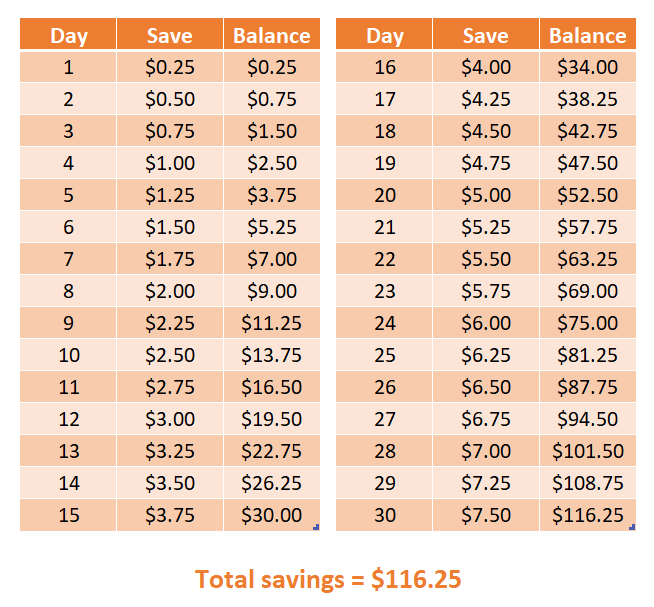

2. The 30-Day Quarter Challenge

Best for: Anyone looking for a quick savings win in one month.

Start by saving $0.25 on day one, $0.50 on day two, and continue increasing by a quarter each day. By day 30, you’ll save $7.50—and over $100 total by the end of the month.

Want more savings? Repeat this challenge every month to save over $1,200 in a year.

Estimated savings: $100/month or $1,200/year

3. The 365-Day Penny Challenge

Best for: Budget-conscious savers just getting started.

Save 1 cent on day 1, 2 cents on day 2, and continue this pattern for a full year. It’s manageable, even on the tightest budget. By day 365, you’ll have saved nearly $668 without even noticing.

Estimated savings: $667.95/year

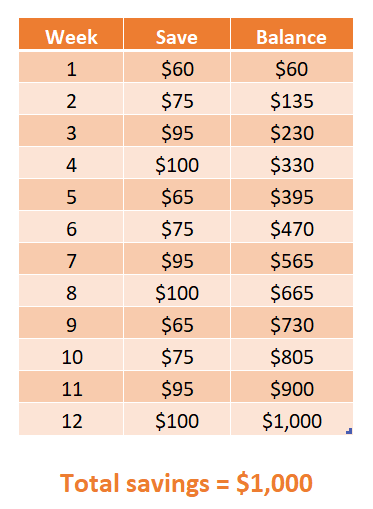

4. The 12-Week Challenge

Best for: Fast starters who want to build savings quickly.

Save between $60–$100 each week for 12 weeks. Follow a simple chart or choose your own amounts. Stick with it and you’ll reach $1,000 in just 3 months—great for kickstarting an emergency fund.

Estimated savings: $1,000 in 12 weeks

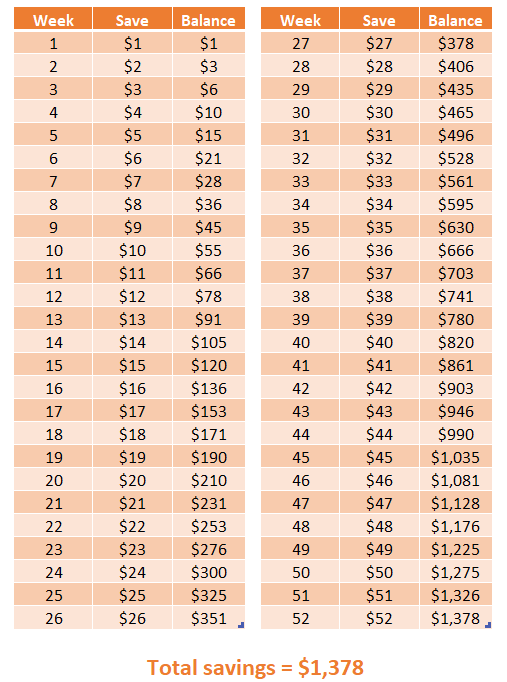

5. The 52-Week Money Challenge

Best for: Long-term savers who prefer a gradual approach.

Start by saving $1 in week 1, $2 in week 2, and continue increasing by $1 each week. By week 52, you’ll stash away $52—and a total of $1,378 by year’s end.

Pro Tip: Too tough during the holidays? Mix it up! Pick any amount from the list each week based on what you can afford.

Estimated savings: $1,378/year

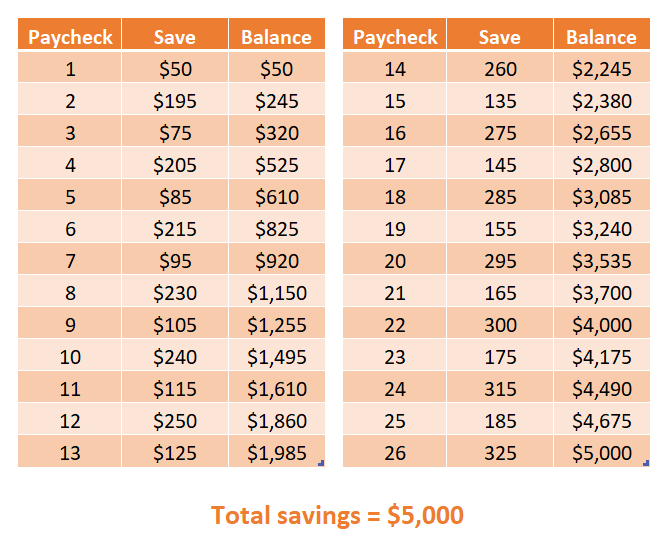

6. The $5,000 Bi-Weekly Challenge

Best for: Those with steady income aiming to build a strong emergency fund.

This challenge aligns with your paydays. Every two weeks, save a set amount (ranging from $100–$250 depending on your comfort level). Stick to the schedule and you’ll save $5,000 by year-end.

Tip: Saving regularly after payday removes the temptation to spend.

Estimated savings: $5,000/year

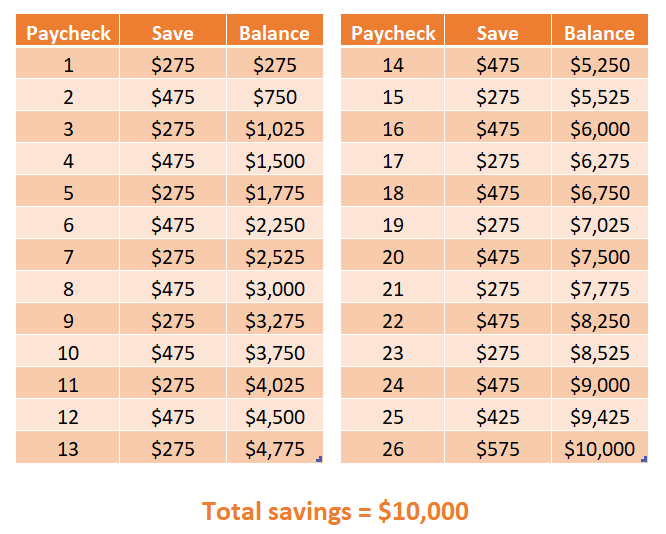

7. The $10,000 Challenge

Best for: Big dreamers saving for a home, wedding, or business.

Every two weeks, save a target amount (typically $275–$575). It’s ambitious, but definitely doable—especially with a little help from your tax refund. For example, the average tax refund so far this year is $2,945. That alone covers nearly a third of your goal.

Estimated savings: $10,000/year

Final Tips to Stay on Track

- Set a calendar reminder each week to stay consistent.

- Track your progress using an app, spreadsheet, or printable chart.

- Automate transfers if using a bank account to remove temptation.

- Celebrate milestones—every $500 or $1,000 is worth a reward!

Use Your Tax Refund to Supercharge Your Savings

One of the easiest ways to get a head start on your savings goal is by using your tax refund wisely. Many of these money-saving challenges get a huge boost when you put your refund directly into savings.

Ready to file? File your taxes online the fast and ez way with ezTaxReturn. It’s secure, simple, and helps you get the maximum refund fast.

FAQs

How can I stay motivated to save?

Set a visual goal, like a photo of what you’re saving for, and break big numbers into smaller milestones.

What’s the best savings challenge for beginners?

Start with the penny or $5 bill challenge—low effort, high reward.

Can I combine multiple challenges?

Absolutely! Many people do the $5 bill and 52-week challenge together to maximize savings.

The articles and content published on this blog are provided for informational purposes only. The information presented is not intended to be, and should not be taken as, legal, financial, or professional advice. Readers are advised to seek appropriate professional guidance and conduct their own due diligence before making any decisions based on the information provided.