Form 1098: Mortgage Interest Statement

Form 1098 is used by lenders to report the amount of mortgage interest, mortgage insurance premiums or points you paid if it’s $600 or more. If you do not meet the $600 threshold, your lender does not have to send you a copy of the form. You will receive a separate 1098 form for each mortgage.

What does the 1098 show?

A form 1098 shows the following information:

- The lender’s name, address, phone number and Taxpayer Identification Number (TIN).

- The borrower's name, address, and TIN.

- The amount of mortgage interest received.

- Your outstanding mortgage principal.

- Mortgage origination date

- Any refunds of overpaid interest

- Mortgage insurance premiums

- Points paid on a principal residence.

- The address or a description of the property.

- The number of properties securing the mortgage.

- The mortgage acquisition date

Does a 1098 form reduce taxes?

You may be able to use your 1098 form to claim a mortgage interest deduction. Doing so will allow you to reduce your taxable income by the amount of mortgage interest you paid during the year. The catch is you can only claim the deduction if you itemize instead of taking the standard deduction.

How do I get my 1098 mortgage income statement?

Your lender should mail your 1098 form by January 31st if you paid at least $600 in mortgage interest, mortgage insurance premiums or points during the year.

Do I have to report my 1098 form on my taxes?

Lenders must issue a form 1098 if you paid $600 or more in interest, mortgage insurance premiums or points. However, you don’t have to file your 1098 form unless you want to claim the mortgage interest deduction. To do so, you will need to itemize your expenses.

Where do I enter Form 1098 on my tax return?

Your mortgage interest (Box 1) and points paid (Box 6) are reported on Schedule A (Form 1040), Line 8a. If you have mortgage insurance premiums in Box 5, those can be deducted on Line 8d of Schedule A.

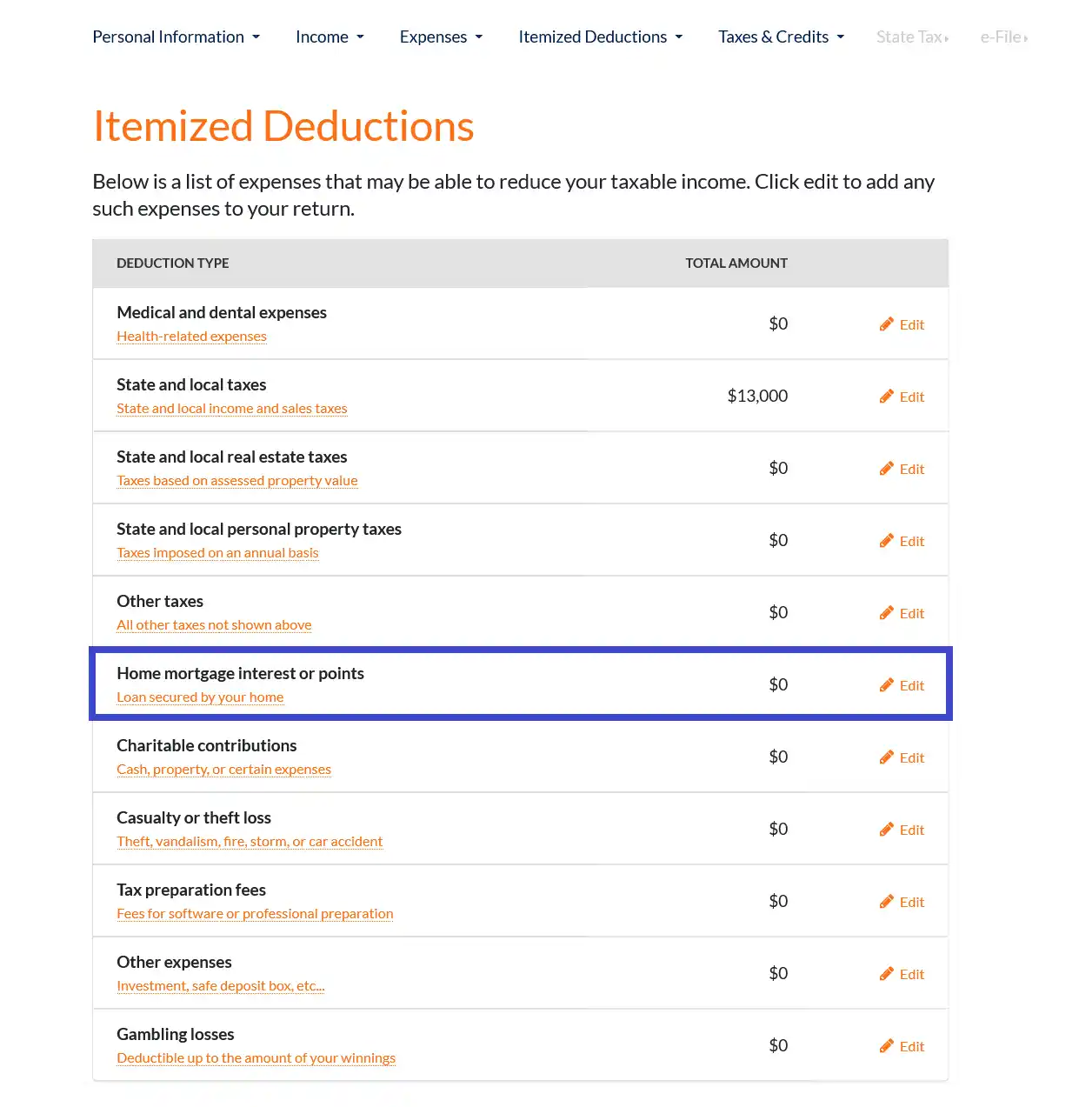

Mortgage interest or points entries are made in the "Itemized Deductions" section of the program, and will populate a Schedule A, if you decide to itemize.

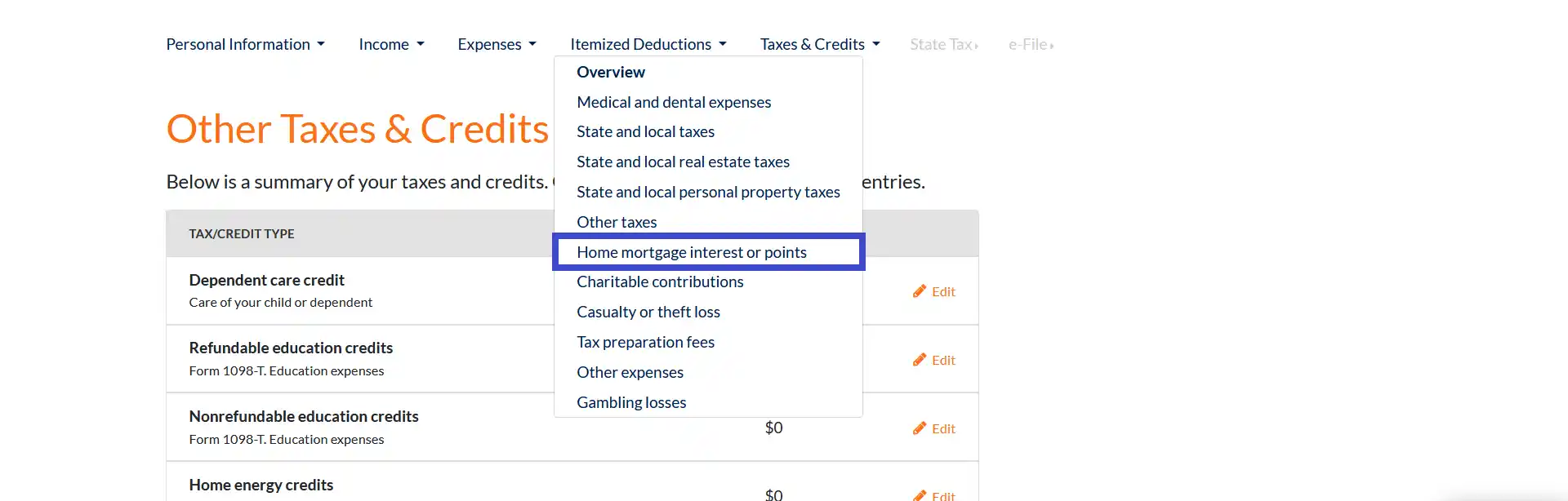

If you have already passed this section of the program, you can click the "Itemize Deductions" link on the navigation bar towards the top of the page and select the appropriate entry from the drop-down menu.

If you are on the "Itemized Deductions" screen, click on the "edit" link next to the appropriate line to add, edit, or delete a mortgage related entry.

Please Note: Choosing to itemize deductions is most useful if the total of the itemized deductions is greater than your standard deduction. The program will guide you through the decision process.