Form 1099-DIV: Reporting Dividends and Tax Strategies

Form 1099-DIV is sent to investors who received dividends and distributions from their investments. Banks and other financial institutions must issue Form 1099-DIV if your dividends and/or distributions exceed $10.

Do I need to report 1099-DIV on my taxes?

Yes, you need to report income from 1099-DIV on your taxes. Form 1099-DIV is used to report dividends and distributions you received during the tax year. The information on this form is essential for accurately reporting your income to the IRS.

What part of 1099-DIV is taxable?

All dividend and distribution income reported on Form 1099-DIV is taxable, including qualified dividends, non-qualified dividends, and any capital gains distributions. Non-qualified dividends are generally taxed at your ordinary income tax rates, while qualified dividends are typically taxed more favorably. Capital gains distributions are subject to different tax rates depending on how long the fund held the investments, also known as short vs. long-term gains .

How are dividends taxed?

Dividends are taxed at different rates depending on whether they are qualified or non-qualified. Qualified dividends, which meet specific criteria, are taxed at lower capital gains rates of 0%, 15%, or 20%, depending on your taxable income and filing status. Non-qualified dividends are taxed at your ordinary income tax rates, which can be up to 37%. The tax rates can vary depending on your income level.

How do I avoid paying taxes on dividends?

While you might not be able to avoid paying taxes on dividends, there are strategies to minimize the tax impact. Consider investing in tax-efficient funds, holding investments for the long term to qualify for lower capital gains rates, and taking advantage of tax-advantaged accounts such as IRAs and 401(k)s.

How do you report dividend income?

You report dividend income on your tax return by using Form 1040. The details from your 1099-DIV, including the total dividends received, are entered on the appropriate lines of your tax form. ezTaxReturn will walk you through simple questions to help you report your dividend income, so you don’t have to worry about where to report it.

Where do I enter dividend income?

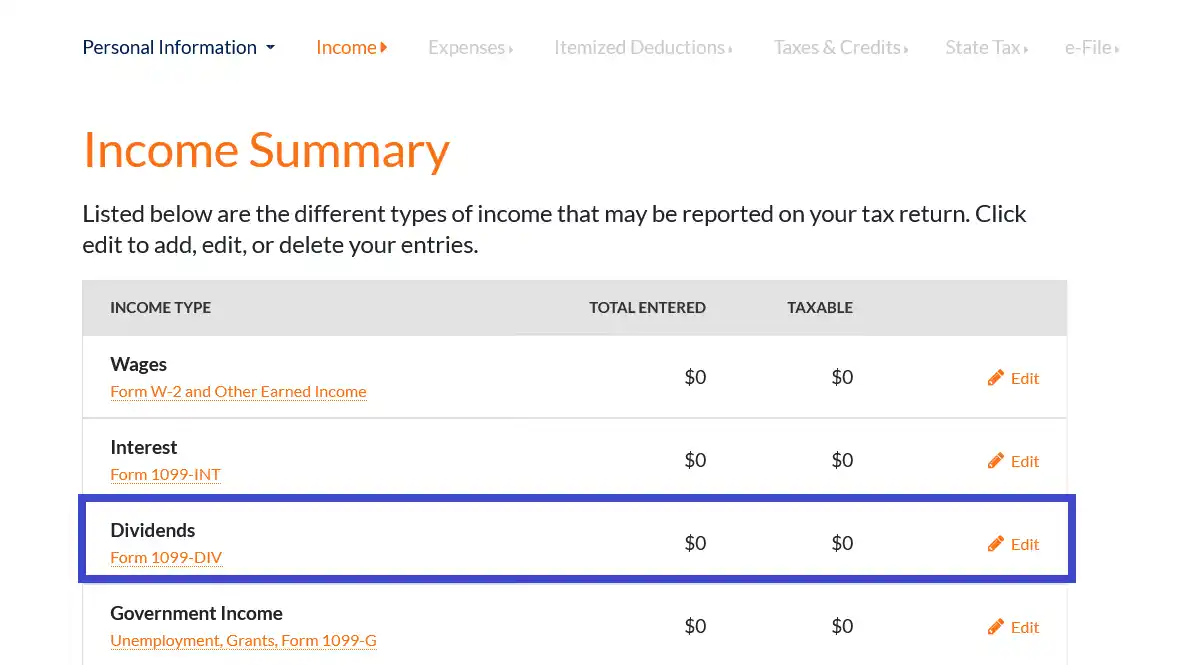

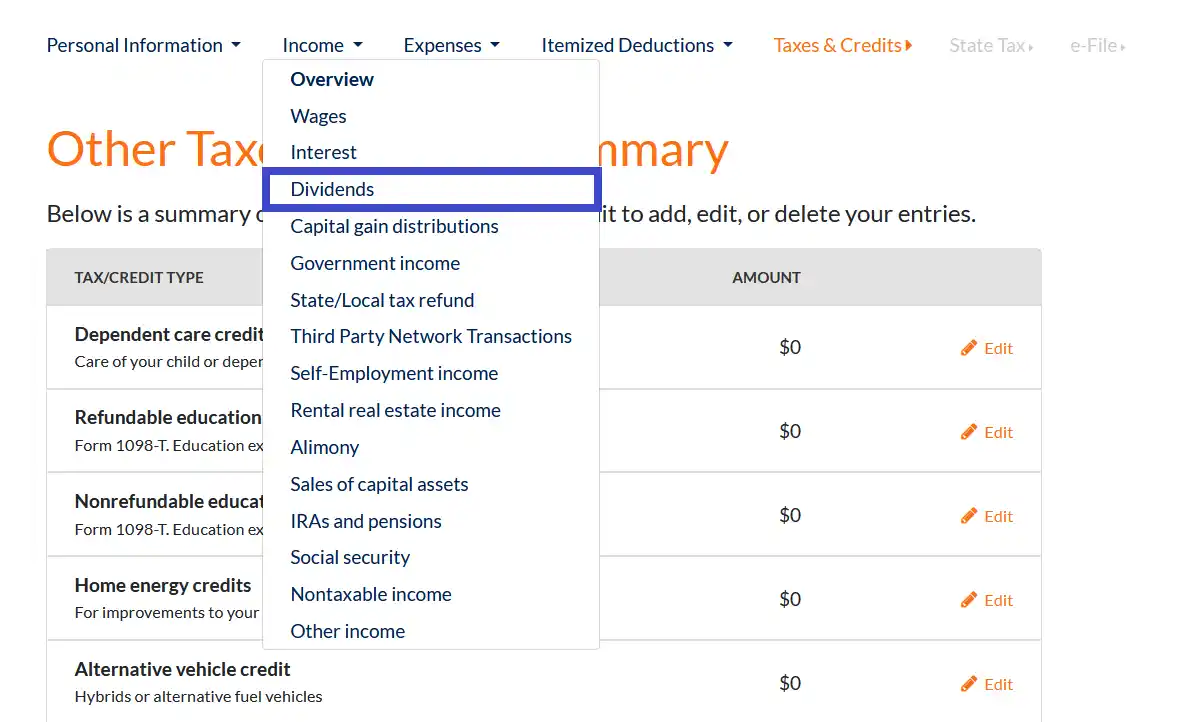

Dividend income can be entered in the "Income" section of the ezTaxReturn program.

If you have already passed this section of the program, you can click the "Income" link on the navigation bar towards the top of the page and select "Dividends" from the drop-down menu.

If on the "Income Summary" screen, click on the "edit" link on the "Dividends" line to add, edit, or delete a dividend income entry.