Form 1099-INT: Reporting and Maximizing Interest Income

Form 1099-INT is used to report the amount of interest you received from a bank, brokerage firm or other financial institution. It will also show any taxes withheld and whether any of the interest is tax exempt.

What is the minimum interest that must be reported?

You will receive Form 1099-INT if you earned at least $10 in interest. Even if you don’t get a 1099-INT, you should still report all interest credited to your account.

Does a 1099-INT count as income?

Yes, the amount of interest reported on form 1099-INT is considered taxable income and must be reported on your income tax return.

How do I report a 1099-INT to the IRS?

To report interest income from a 1099-INT, you will enter the interest income amount during the tax filing process. The most used boxes are:

- Box 1 of Form 1099-INT which reports your taxable interest.

- Box 2 reports the penalties you were charged for withdrawing money before the maturity date.

- Box 3 reports the interest earned on U.S. savings bonds, Treasury bills, Treasury notes, and Treasury bonds.

- Box 4 reports any federal taxes that were withheld from your interest income.

- Box 8 reports the amount of tax-exempt interest.

ezTaxReturn will ask simple questions to help you enter the 1099-INT details and help report it on your Form 1040.

How do I know if I have a 1099-INT?

Keep an eye on your mailbox around the end of January. If you earned more than $10 in interest, the bank or credit union will send you a 1099-INT. It's your record for your interest income. You can also check your online bank account as it is often provided it there too.

What interest income is not taxable?

Some types of interest income may be exempt from federal income tax. For example, interest from municipal bonds is often tax-exempt at the federal level. Additionally, certain savings bonds and other government-related interest may be tax-free in some situations. ezTaxReturn will help you determine if your interest is taxable during the filing process.

How do I claim interest without a 1099-INT?

If you earned interest but did not receive a Form 1099-INT, you are still required to report the income. You can usually find the total interest earned on your bank account statements. Report this income during the tax filing process, even if you don't have a physical 1099-INT form.

Where do I enter interest income?

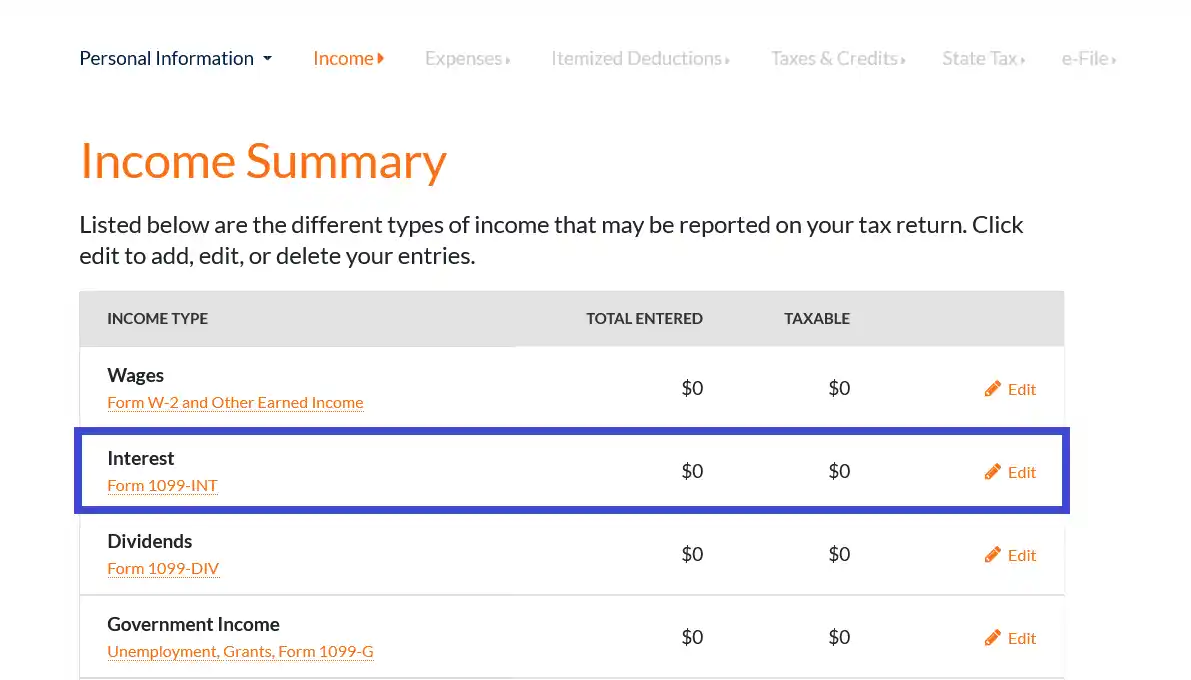

Interest income can be entered in the "Interest" section of the "Income" section of the ezTaxReturn.com program.

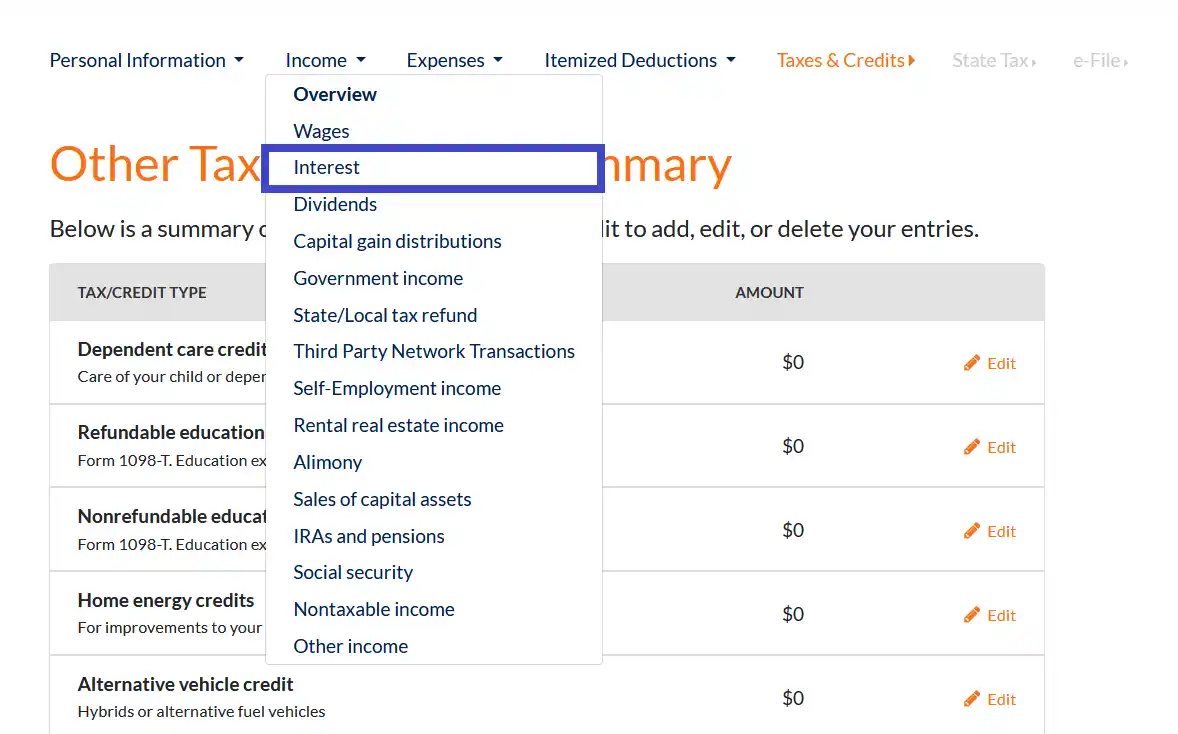

If you have already passed this section of the program, you can click the "Income" link on the navigation bar towards the top of the page and select "Interest" from the drop-down menu.

If you are on the "Income Summary" screen, click on the "edit" link on the "Interest" line. This will take you to a page where you can enter the information found on your 1099-INT.