Form 1099-NEC: Reporting Non-Employee Compensation

Form 1099-NEC reports non-employee compensation. If you are self-employed or an independent contractor, you should expect to receive this form from a business that paid you $600 or more for the year.

Where do I enter Form 1099-NEC?

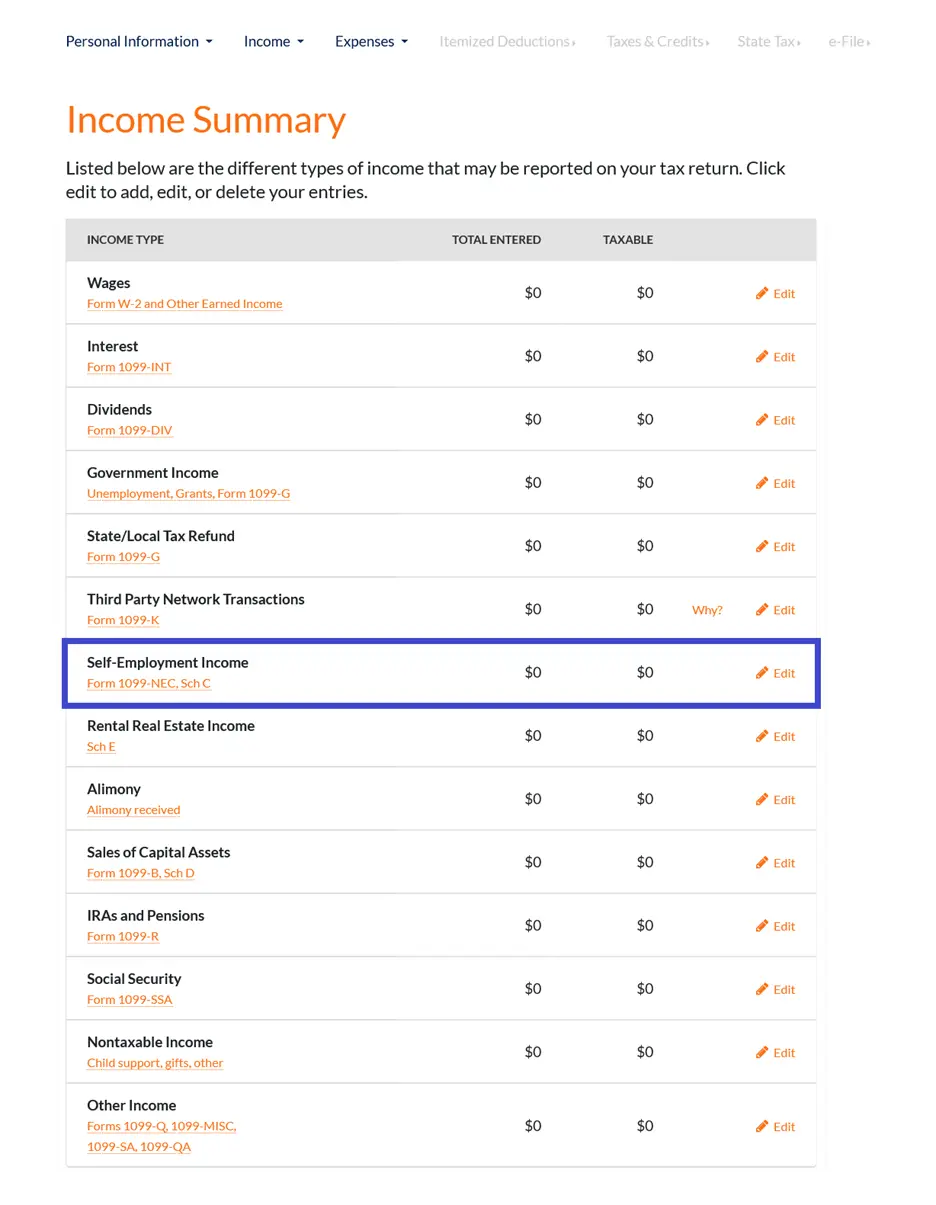

The Form 1099-NEC reports Non-Employee Compensation. You would enter this information in the "Income" section under "Self-Employment Income."

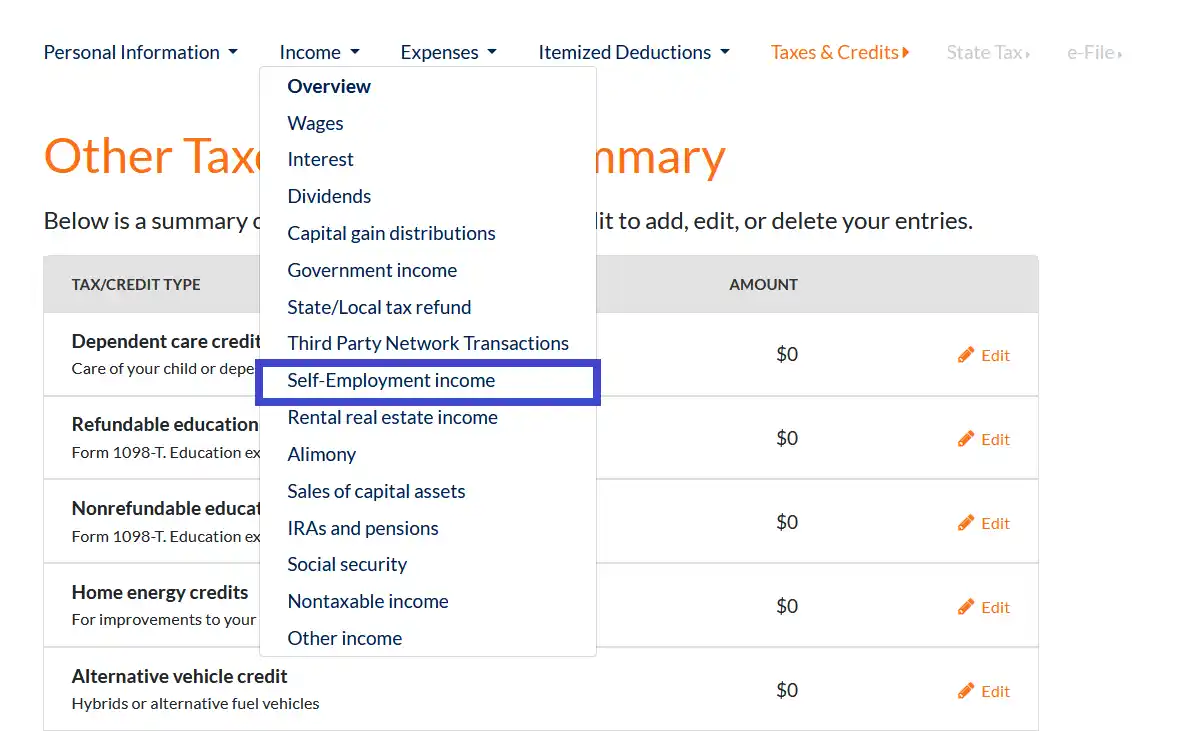

If you have already passed this section of the program, you can click the "Income" link on the navigation bar towards the top of the page and select "Self-Employment Income" from the drop-down menu.

If you are on the "Income Summary" screen, click on the "Edit" link on the "Self-Employment Income" line to add, edit, or delete a self-employment income (1099-NEC) entry.

FAQs

Why use 1099-NEC?

Form 1099-NEC is used to report payments made to non-employees, such as independent contractors, freelancers, and self-employed individuals. It ensures accurate reporting of income and taxes to the IRS.

What is 1099-NEC income?

1099-NEC income refers to the compensation received for services performed by someone who is not an employee. It includes fees, commissions, prizes, and awards for services performed as a non-employee.

When is the 1099-NEC due?

The payer must furnish Form 1099-NEC to the payee by January 31st of the year following payment. For electronic submissions, the due date is also January 31st.

How do I report 1099-NEC income?

To report 1099-NEC income on your tax return, include it as part of your business income on Schedule C. This form is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor. This schedule is then attached to your Form 1040 tax return.

How is a 1099-NEC taxed?

The nonemployee compensation shown in Box 1 of your Form 1099-NEC is reported as self-employment income. If your self-employment net income was at least $400, it will be subject to self-employment taxes. This covers Social Security and Medicare taxes for individuals who work for themselves. You may also be required to make quarterly estimated tax payments.

What do I do if I have multiple 1099s?

Receiving multiple 1099-NEC forms can be common if you work with several clients. All of your 1099 forms for the same business can be grouped together. The combined income figure will be reported on Schedule C (Profit or Loss from Business) if you're self-employed. If your 1099-NEC came from a sporadic activity or hobby, it will be reported on line 8 of Schedule 1 (Form 1040). Tax preparation software can assist in aggregating this information and calculating your total income and tax liability.

Can I deduct expenses with 1099-NEC?

Yes, as a self-employed individual or independent contractor, you can deduct business-related expenses from your 1099-NEC income. These deductions can include costs like office supplies, travel expenses, and home office deductions, reducing your taxable income.

Is a 1099-NEC considered earned income?

Yes, income reported on a 1099-NEC is considered earned income. This is relevant for both self-employed individuals and independent contractors.

Conclusion

Understanding and properly reporting income from Form 1099-NEC is crucial for self-employed individuals and independent contractors.

This form not only helps in accurate tax reporting but also allows for the deduction of legitimate business expenses. Staying informed about the specifics of 1099-NEC helps ensure compliance with tax laws and can assist in effective financial planning.