Form SSA-1099: Reporting Social Security Income

Form SSA-1099 shows the total amount of Social Security benefits you received during the year and any taxes withheld. If Social Security is your only income, your benefits may not be taxable.

This section provides a step-by-step guide on how to report Social Security income on your tax return. It also offers tips for accurate reporting, ensuring a smooth and error-free tax filing experience.

How do I enter my Social Security benefits?

You will be able to enter it in the "Social Security" section of the "Income" section of the program.

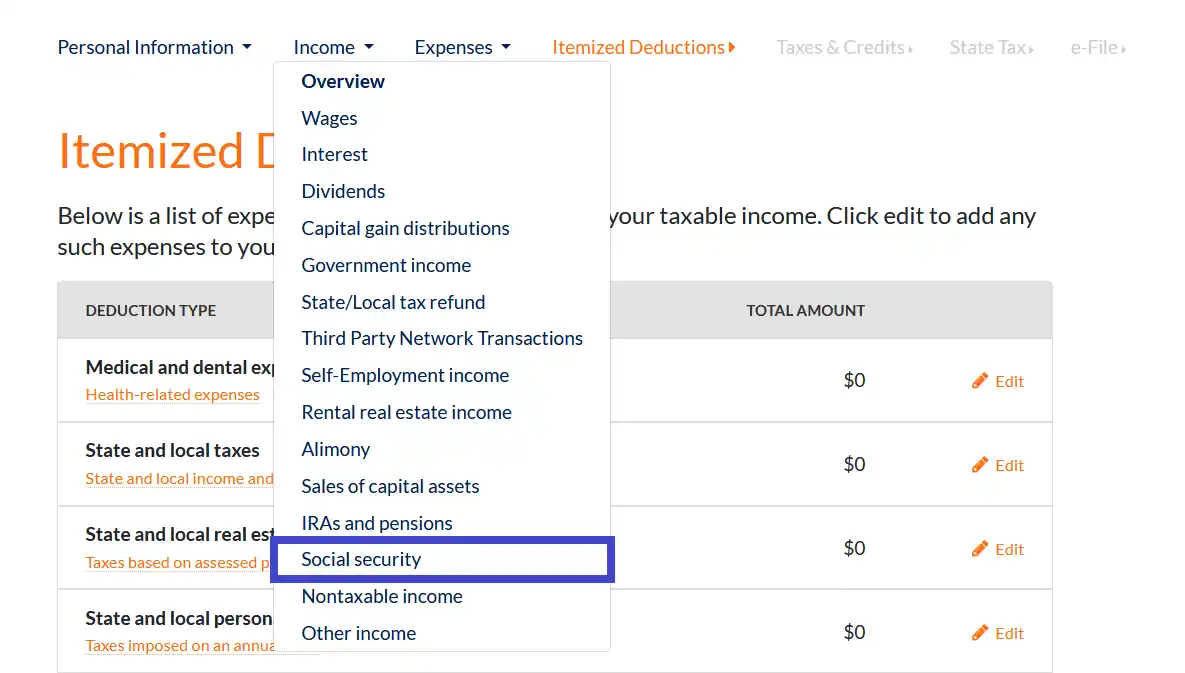

If you have already passed this section of the program, you can click the "Income" link on the navigation bar towards the top of the page and select "Social Security" from the drop-down menu.

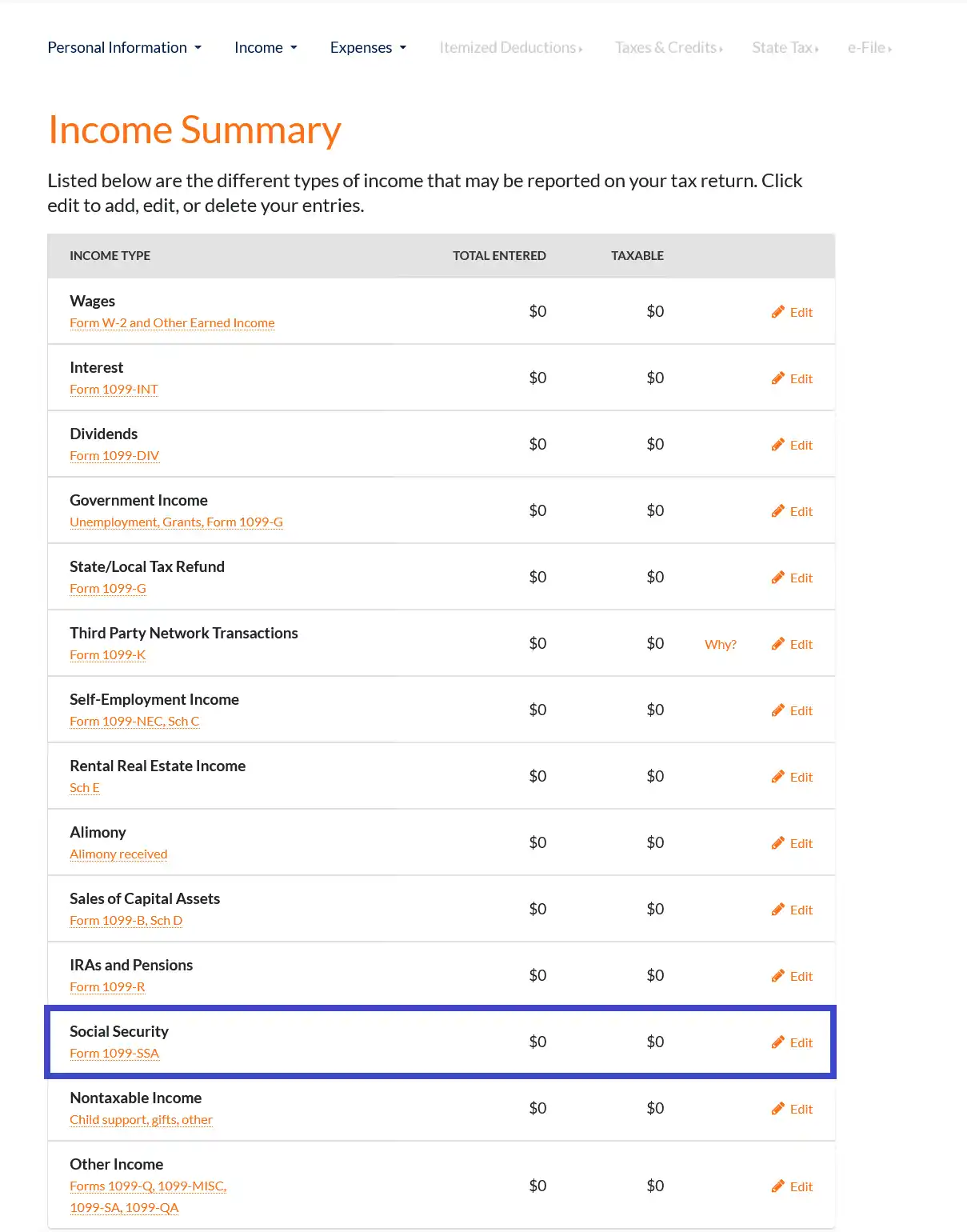

If you are on the "Income Summary" screen, click on the "edit" link on the "Social Security" line to add, edit, or delete a Social Security income entry.

This will take you through the questions and screens necessary to enter the information from your SSA-1099 form.

FAQs: Understanding Form SSA-1099

How do I get a copy of my 1099 SSA?

If you receive Social Security benefits, the Social Security Administration will mail you a copy of form SSA-1099 in January. Taxpayers who need a replacement form can get it beginning February 1st by:

- Creating or signing into your my Social Security account.

- Calling the SSA at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am – 7:00 pm.

- Contacting your local Social Security office.

Is SSA-1099 Considered Taxable Income?

Form SSA-1099 reports the total amount of Social Security benefits you received. These benefits may be taxable, depending on your total income and filing status. Generally, if Social Security benefits are your only source of income, your benefits are not taxable.

How Do I Find Out If My Social Security Income Is Taxable?

To determine if your Social Security income is taxable, add half of the total benefits reported on SSA-1099 to all your other income sources. If your combined income exceeds the base amount for your filing status, some of your benefits may be taxable.

What Do I Do with My Form SSA-1099?

You use the information on Form SSA-1099 to complete your tax return if you are required to file taxes. Report the total amount of benefits received, and any taxable portion will be calculated based on your total income.

Does Social Security Count as Earned Income?

No, Social Security benefits are not considered earned income. Earned income typically refers to wages, salaries, tips, and other taxable employee pay.

Do I Need to Report 1099 Income If I Didn't Receive a 1099?

Yes, you are required to report all income to the IRS, even if you did not receive Form 1099. This includes any income from self-employment, interest, dividends, and other sources.

Will the IRS Catch Me If I Don't File My Taxes?

It's important to file your taxes if you meet the filing requirements. The IRS has various means to track unreported income, and failing to file or report income can lead to penalties.

Conclusion

Understanding the SSA-1099 form is crucial for accurately reporting Social Security benefits on your tax return.

It's essential to know if and how your benefits are taxable, and what steps you need to take to report them correctly. Always consult a tax professional if you're unsure about your specific tax situation.