How Do I Track My California State Refund?

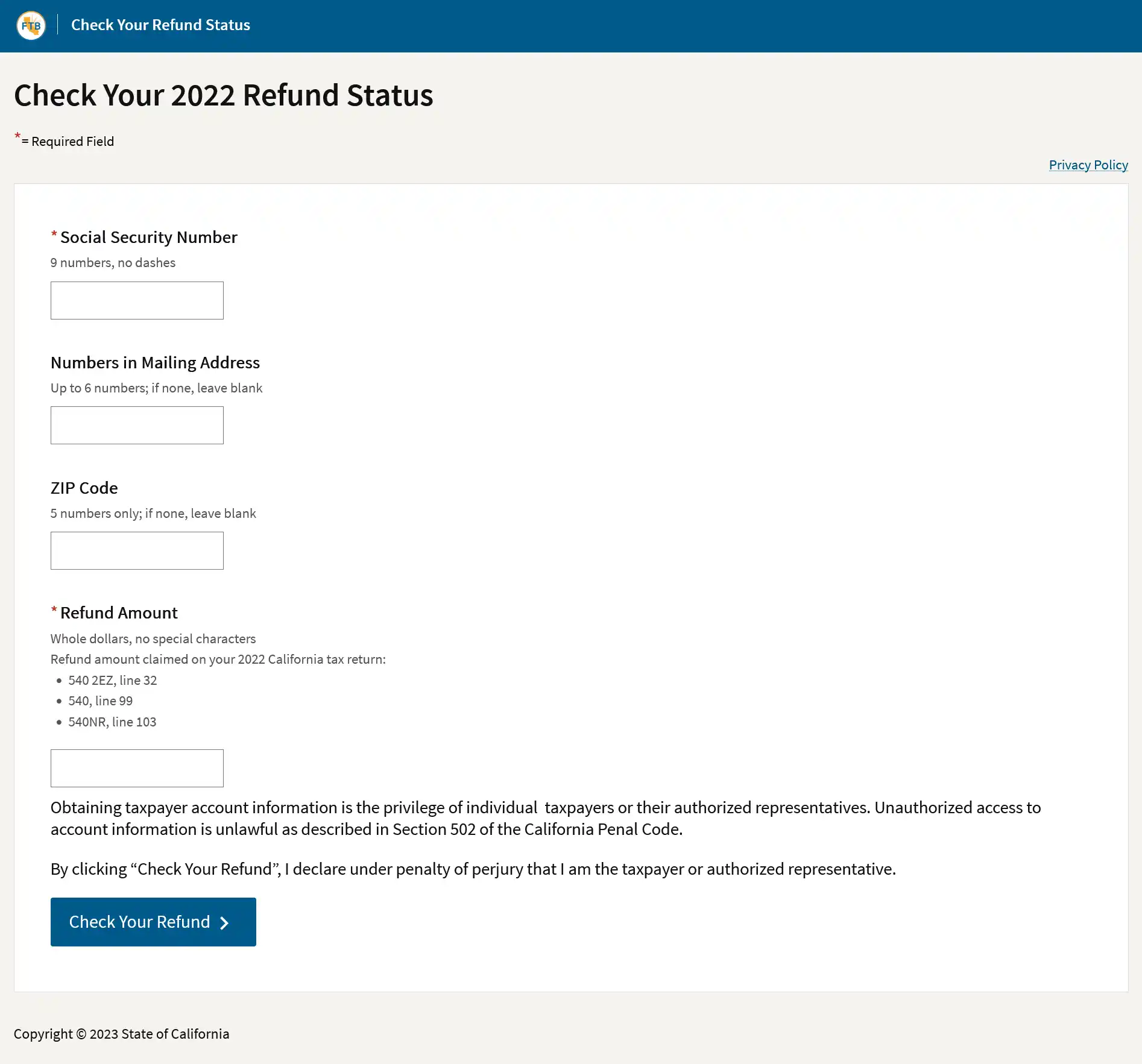

You can check the status of your California tax refund online by visiting https://webapp.ftb.ca.gov/refund/login

On this page, you will need to provide:

- Your social security number,

- Your zip code,

- The numbers in your mailing address, and

- Your exact refund amount.

Then click “Check Your Refund” for your refund status.

Refund FAQs:

When can I expect my California tax refund?

- If you e-file, it can take up to three weeks to receive your refund.

- For paper filers, it can take up to three months to receive your refund.

Why is my California state refund taking so long?

Your California state refund may be delayed due to calculation errors and missing or incomplete information on your tax return. Some tax returns also require additional review to keep taxpayers safe from fraud and identity theft.

Why is my CA refund different than expected?

If your refund was more or less than expected, either changes were made to your tax return, or you had a past due government debt. The Franchise Tax Board (FTB) can make changes to your tax return if:

- Your withholding and payments don’t match their records.

- You claimed a tax credit that you don’t qualify for.

- Your refund was used to pay a past tax debt.

In those cases, the FTB will mail you a Notice of Tax Return Change detailing the changes and updated refund amount.

How long do taxpayers have to cash a refund check before it expires?

Refund checks are good for six months after the date they are issued. If it’s been more than six months, you will need to request a new check from the FTB.

| Date on the check | How to request a new refund check | Processing time |

|---|---|---|

| 1 to 3 years old | Send the FTB a letter including:

| At least 8 weeks |

Mail your request to:

Returned Warrant Desk MS F283

Franchise Tax Board

PO Box 942867

Sacramento CA 94267-0001

If it’s been more than 3 years, you will need to request a replacement from the FTB.

| Date on the check | How to request a new refund check | Processing time |

|---|---|---|

| 3 years or more | You must request a Replacement Warrant Claim (3900A) form from the FTB. Include:

| Up to 18 months |

Mail your replacement form to:

Returned Warrant Desk MS F283

Franchise Tax Board

PO Box 942867

Sacramento CA 94267-0001