How Do I Change My Bank Information on My Tax Return?

Do you need to update your bank information for your tax refund? We’ve got you covered. The steps you’ll need to take to correct your bank account or routing numbers will vary depending on whether you have already e-filed.

If you have not yet e-filed, you can still edit your direct deposit information.

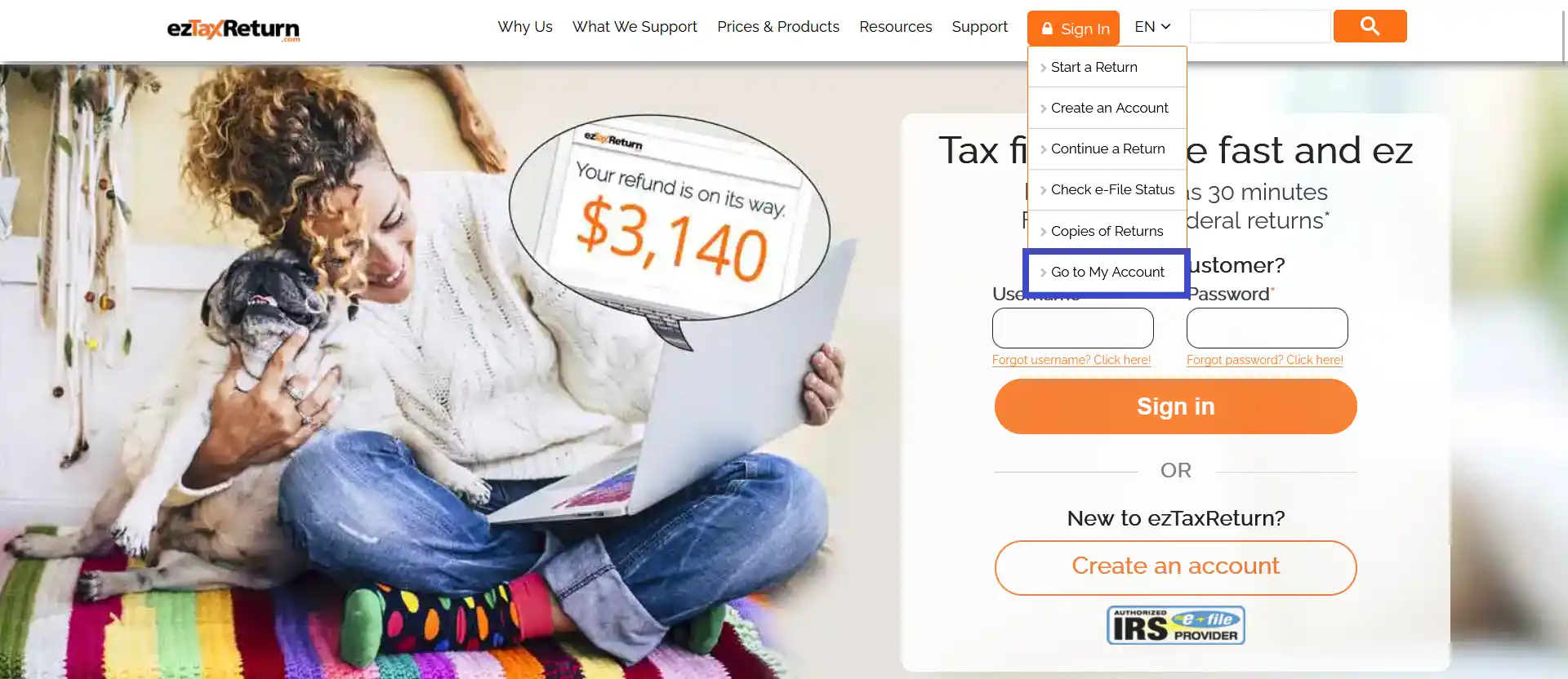

Please go to https://www.eztaxreturn.com/ and log in to your account.

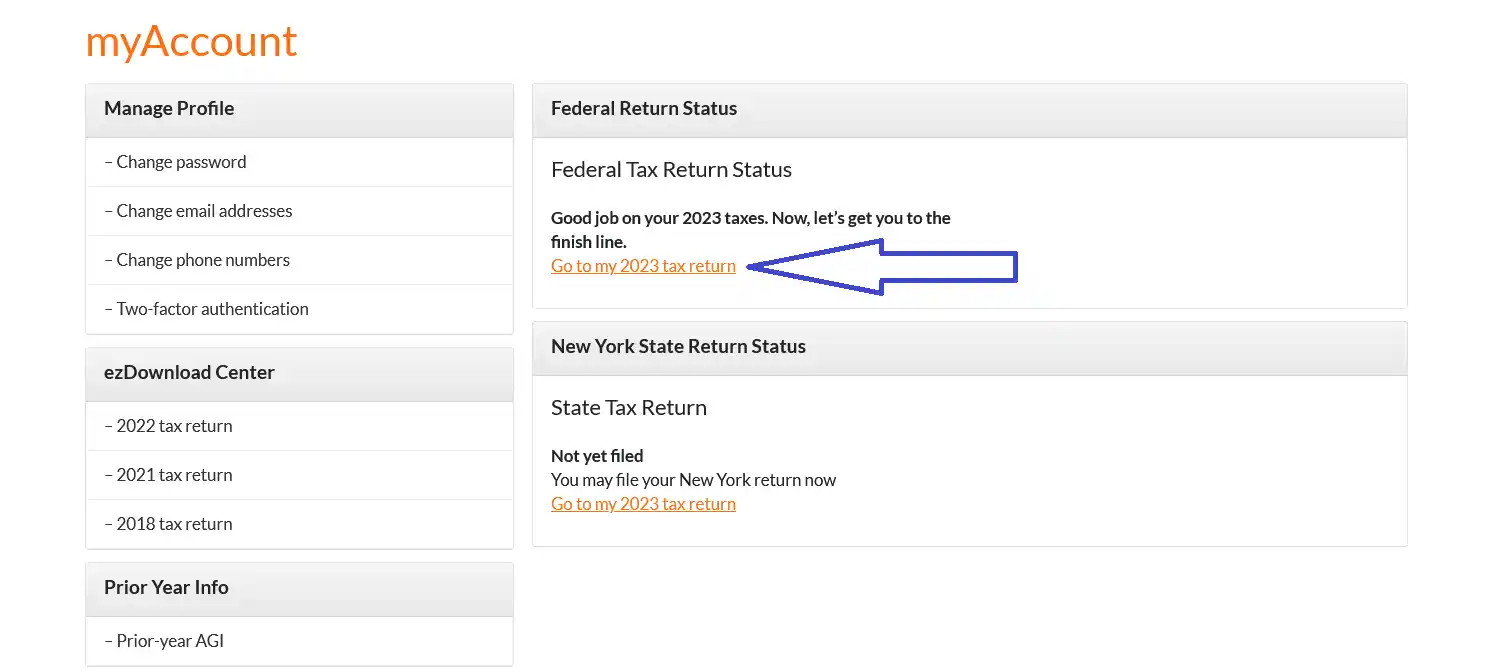

On the MyAccount page, click "Go to my 2025 tax return”.

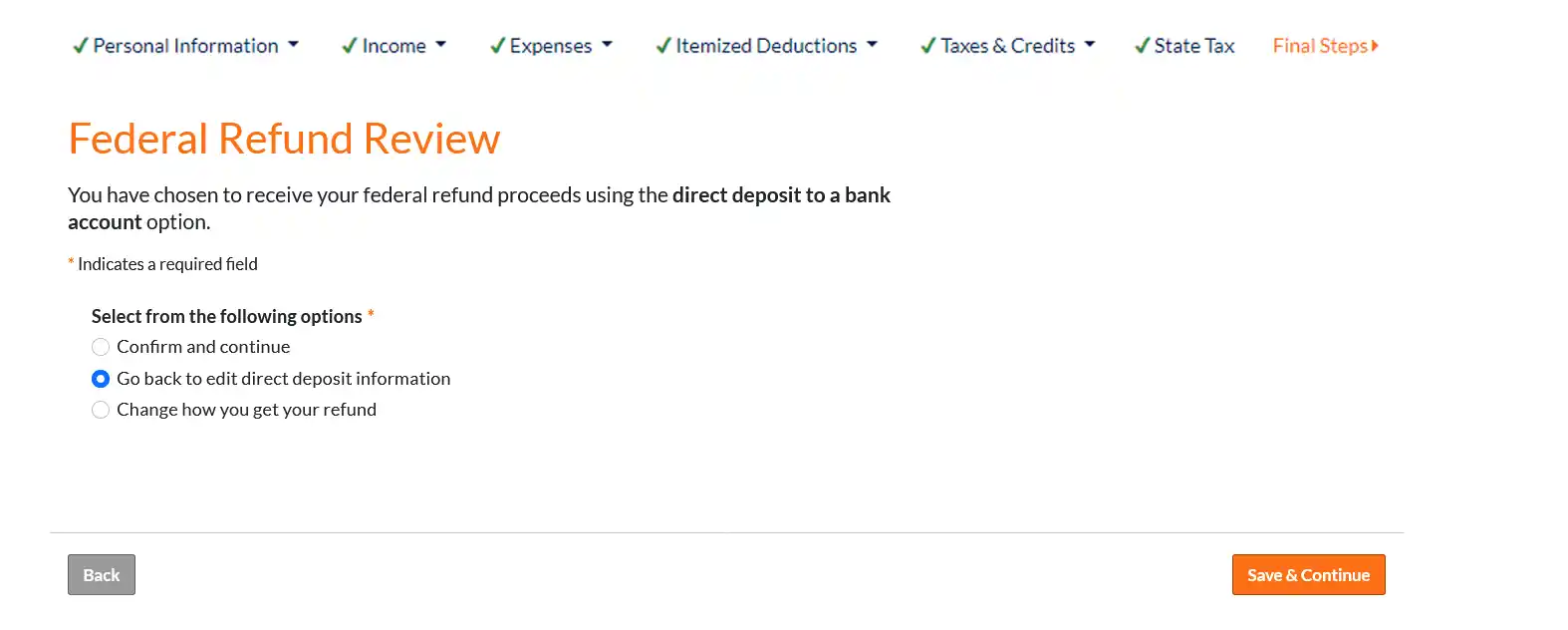

Continue through the program until you reach the "Federal Refund Review" screen.

Select "Go back to edit direct deposit information" and click "Continue."

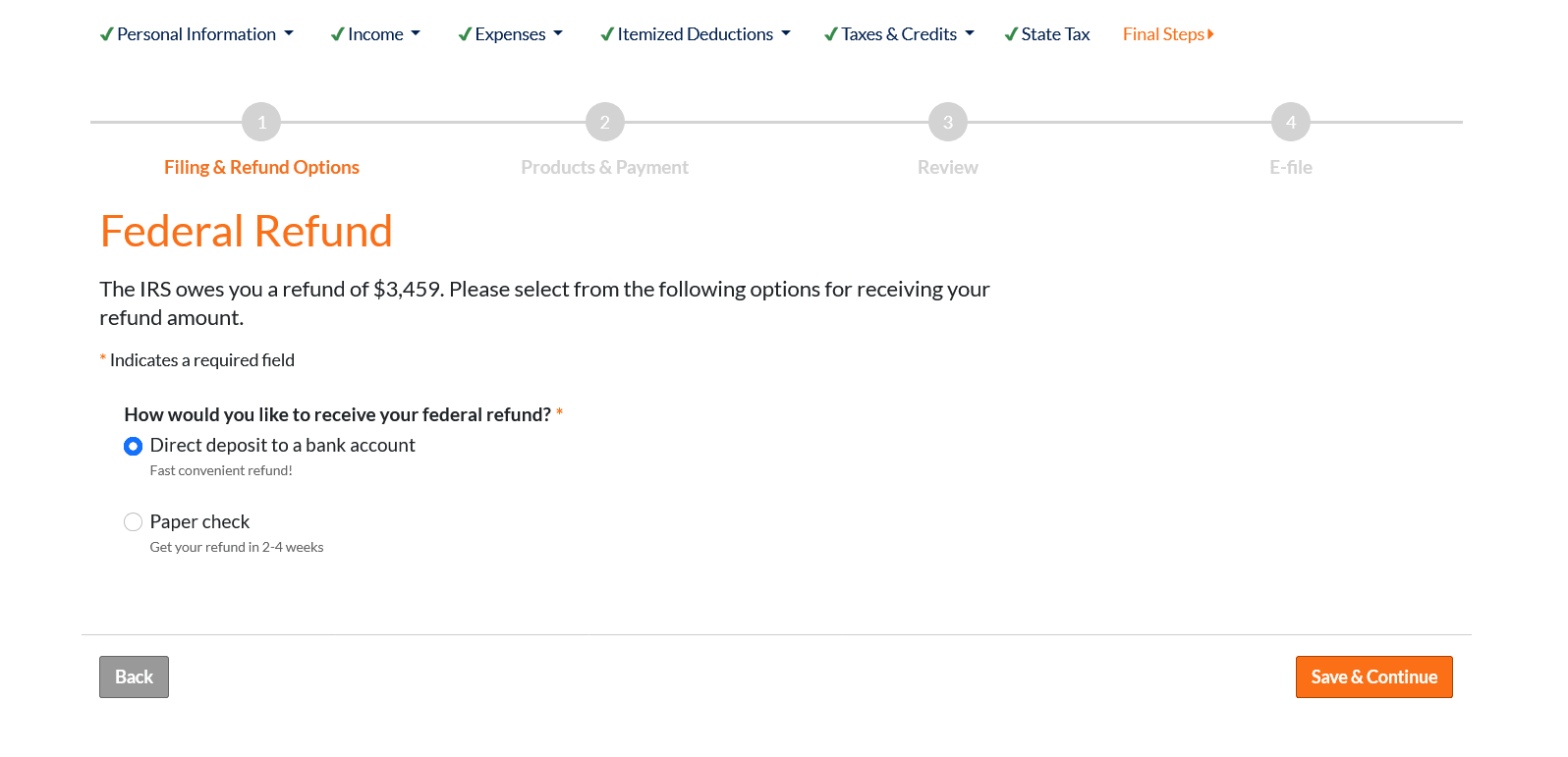

On the "Federal Refund" screen, select "Direct deposit to a bank account" and click "Continue."

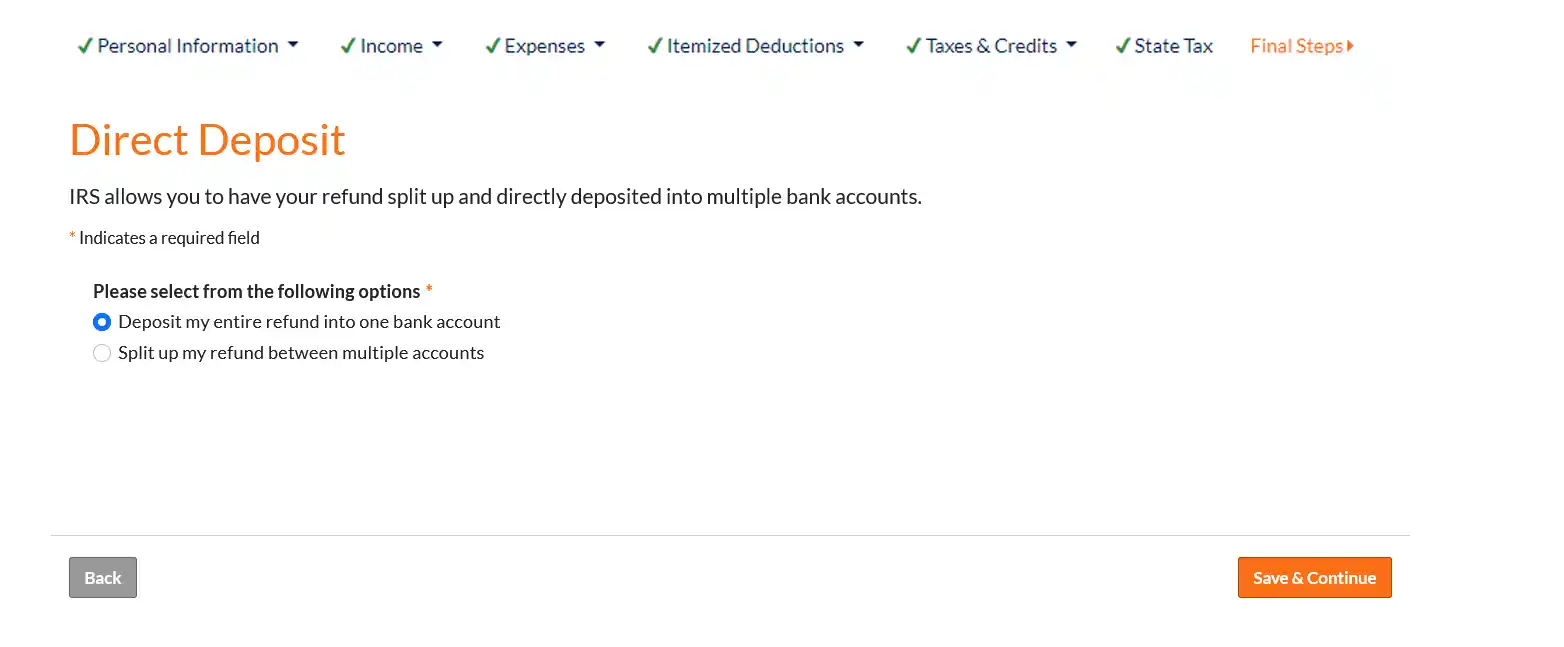

On the "Direct Deposit" screen, select your preferred options (one account or multiple accounts) and click "Continue." Depending on your choice, the next screen will be either "direct deposit" again or "direct deposit information." In either case, you will be able to review your routing number entries on this screen. We also recommend double checking your account number entries while you are on this screen.

Once your routing number has been corrected, continue through the program and efile your return.

If you’ve already filed your return, it cannot be stopped. You must wait for acknowledgement from the IRS.

- If your return is rejected, you will be able to edit your banking information before resubmitting your return.

- If your return is accepted, no changes can be made. You can try contacting the IRS at 1-800-829-1040 for assistance. If the IRS attempts to deposit the refund into the account you originally entered, the bank may return the refund. At that point, the IRS will mail a paper check to the address on your return.