How Do I Check the Status of My Idaho State Tax Refund?

You can check the status of your Idaho state tax refund by visiting https://tax.idaho.gov/taxes/income-tax/individual-income/refund/

Click the button that says, “Check your refund status”.

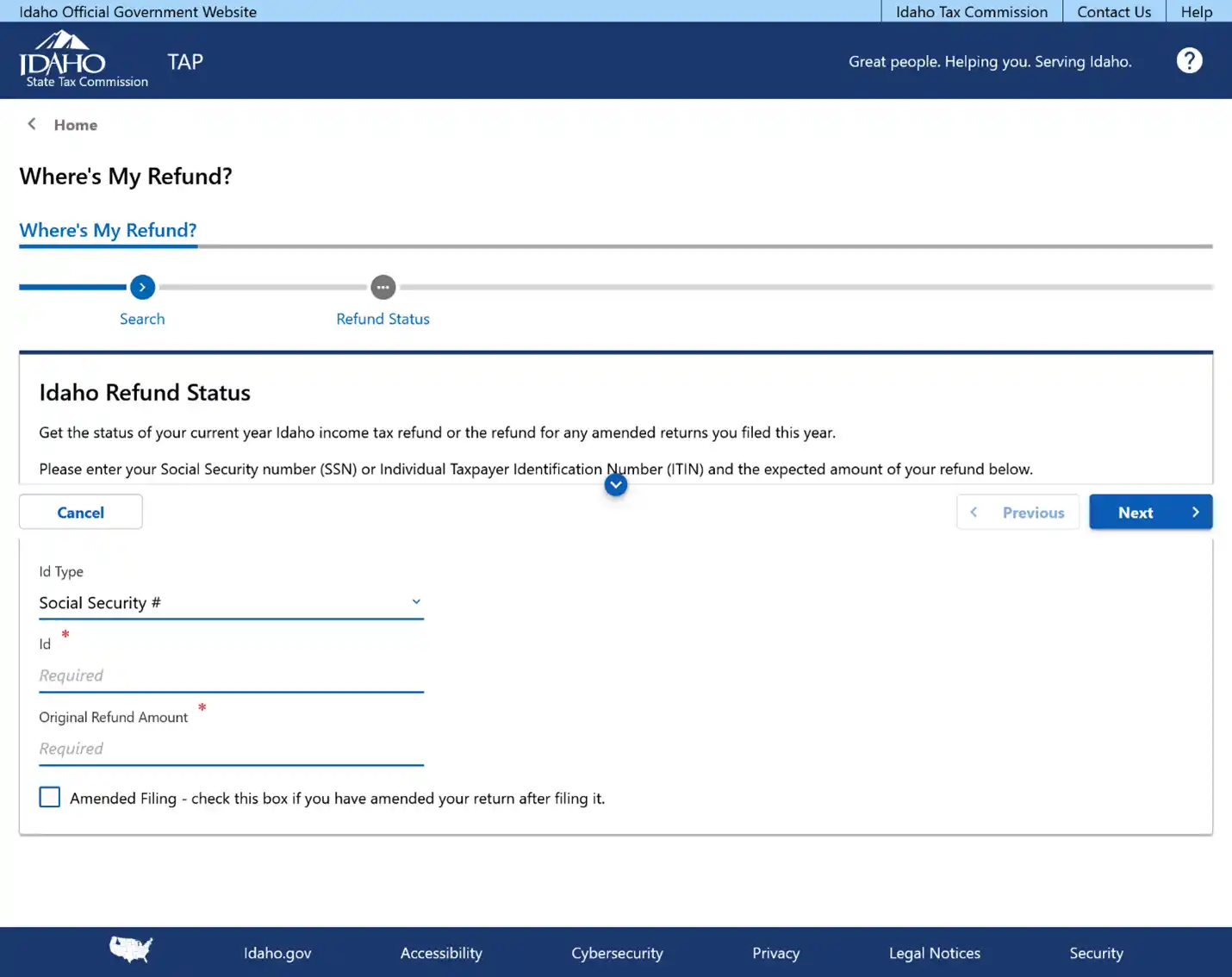

On this page, you will select your Id Type and enter your:

- Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Refund amount.

Once you’re done, click the “Next” button to get your Idaho Refund Status.

Tax Refund FAQs:

How long does it take to receive Idaho state tax refund?

Here are the typical tax refund timelines for Idaho state tax refunds:

- E-filers – 7 to 8 weeks after your tax return is accepted.

- Paper filers – 10 – 11 weeks after they receive your tax return.

Please note, there are some exceptions for the refund timelines.

- You are a first-time filer – It will take an additional three weeks for the Idaho State Tax Commission to enter you into their system.

- You received a notice requesting more information – once Idaho gets the information they’re looking for, it will take about six weeks to process your tax refund.

Why is my Idaho state tax refund less than expected?

If your tax refund is less than you expected, all or part of your Idaho income tax refund may have been seized for an unpaid debt such as child support, unreimbursed unemployment overpayments, sheriff’s garnishments, bankruptcy trustees or for unpaid federal tax debts. The Idaho Supreme Court can also intercept your tax refund for unpaid court fines.

How do I replace a lost tax refund check?

If you lost or haven’t received your tax refund check, contact Taxpayer Services to request a replacement check. You can call the call center at:

- (208) 334-7660 in the Boise area

- (800) 972-7660 toll free

- (800) 377-3529 Idaho Relay Service (TDD) for hearing-impaired callers

What happens when someone steals your identity and files taxes?

If you think you are a victim of identity theft, contact the Tax Commission as soon as possible. You can report via email to fraud@tax.idaho.gov or call one of the numbers below..

- (208) 334-7660 in the Boise area

- (800) 972-7660 toll free

- (800) 377-3529 Idaho Relay Service (TDD) for hearing-impaired callers

How can I get my tax refund to process faster?

There are several things you can do to speed up the refund process. You can:

- Review all your entries for accuracy.

- Make sure your address, Social Security number and W-2 information are correct.

- Verify your direct deposit information.

- Enter your driver’s license number when e-filing.