How Do I Check the Status of My New Mexico State Tax Refund?

You can check the status of your New Mexico state tax refund by visiting https://tap.state.nm.us/tap/_/

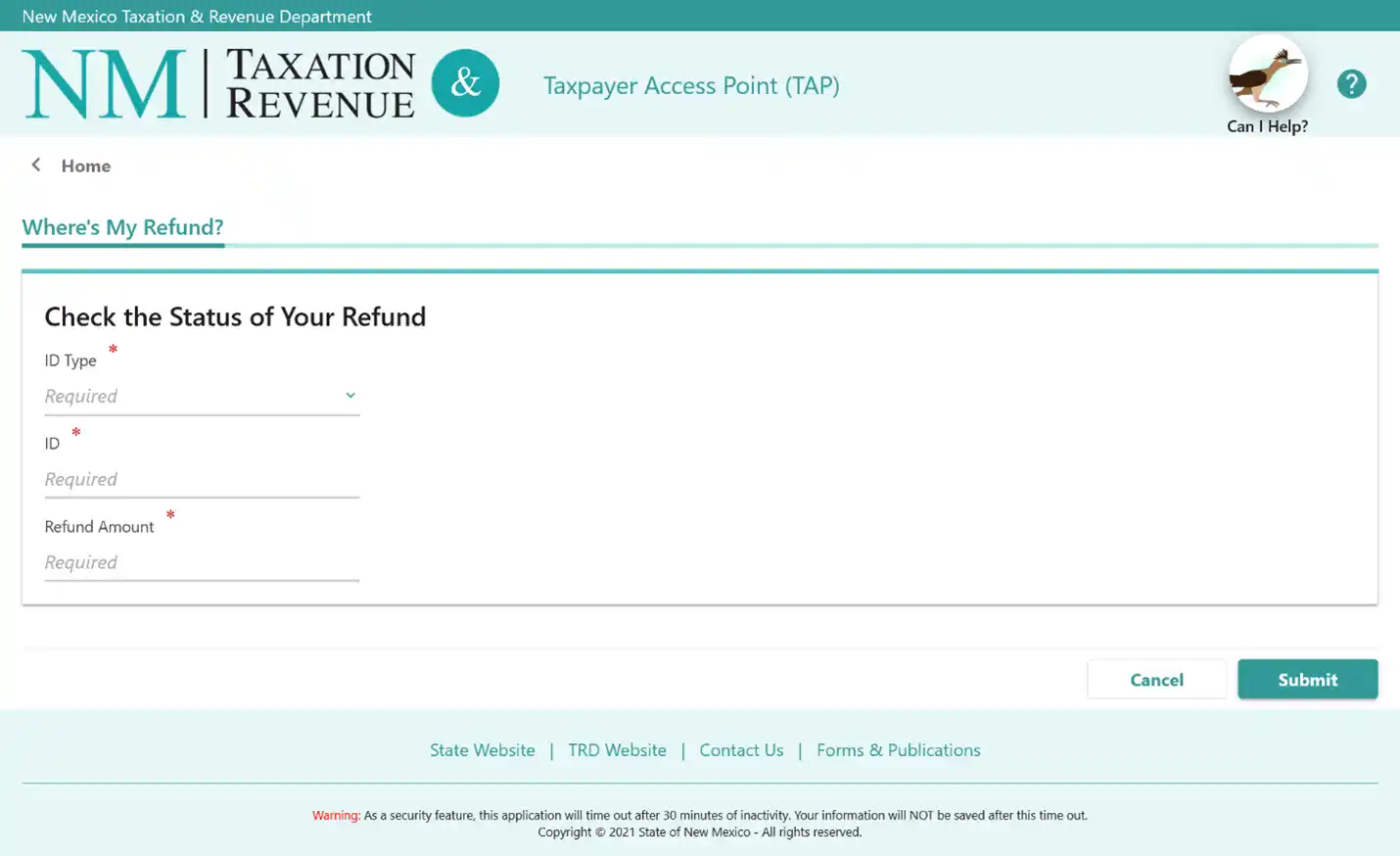

Scroll down to “Personal Income” and click “Where’s My Refund?”.

You will be asked to enter your:

- ID Type

- ID

- Refund Amount

Once you’re done, click “Submit” to check your refund status.

Refund FAQs:

When can I expect my New Mexico state tax refund?

The New Mexico Taxation and Revenue Department generally issues tax refunds for e-filed returns within 6 to 8 weeks. Paper returns take 8 to 12 weeks to be processed.

Why is my New Mexico state tax refund taking so long?

Tax returns that are paper filed or contain errors take longer to process. Use these tips to ensure you get your tax refund as fast as possible.

- E-file your tax return

- File early

- Double check your return for mistakes such as failing to report all your income, choosing the wrong filing status, forgetting to include dependents, missing credits and deductions.

- Use your current mailing address

- Request direct deposit

What do I do if I haven't received my tax refund?

If it’s been more than 30 days since your tax refund was issued and you haven’t received it, you’ll need to contact the New Mexico Taxation and Revenue Department at trd.taxreturnhelp@tax.nm.gov. They will verify your current mailing address and investigate the status of your tax refund.

If it’s lost, the Department may send you an Affidavit for Duplicate State Warrant which you’ll need to fill out, notarize and send back to them. Once that’s completed, it can take 8-12 weeks to be processed.

If your refund check isn’t cashed after 13 months, it will be turned over to Unclaimed Property. To get your tax refund, you’ll need to go through the Unclaimed Property process. Learn more:

https://www.tax.newmexico.gov/individuals/what-is-unclaimed-property/

Why is my tax refund amount different from the NM tax return I filed?

There are a couple reasons why your refund may be different than you expected.

- An adjustment was made by the NM Taxation and Revenue Department. If this is the case, they will mail you a “Return Adjustment Notice” explaining what you need to do.

- All or a portion of your refund was seized to pay a debt through the authority of the Tax Refund Intercept Program Act. The Taxation and Revenue Department will send you a letter explaining what the offset was for.