How Do I Check the Status of My State Tax Return?

When you e-file your federal and state returns together, some states will not acknowledge your state return until your federal return has been accepted by the IRS. If your federal return is rejected, your state return will automatically be rejected as well. You will need to correct your federal return, then resubmit both returns. Once your federal return has been accepted, it can take several more days for your state return to be processed.

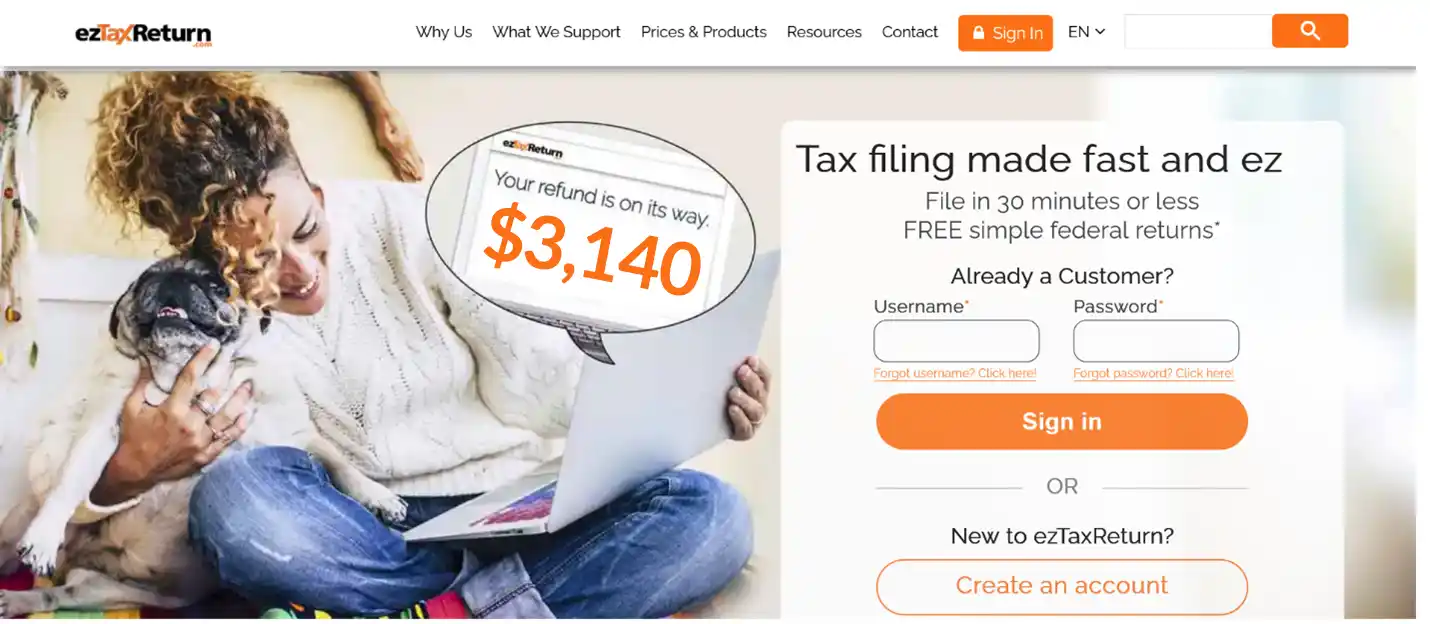

If you filed with us, to check on the status of your state tax return, go to theTo check on the status of your tax return, go to the ezTaxReturn.com homepage.

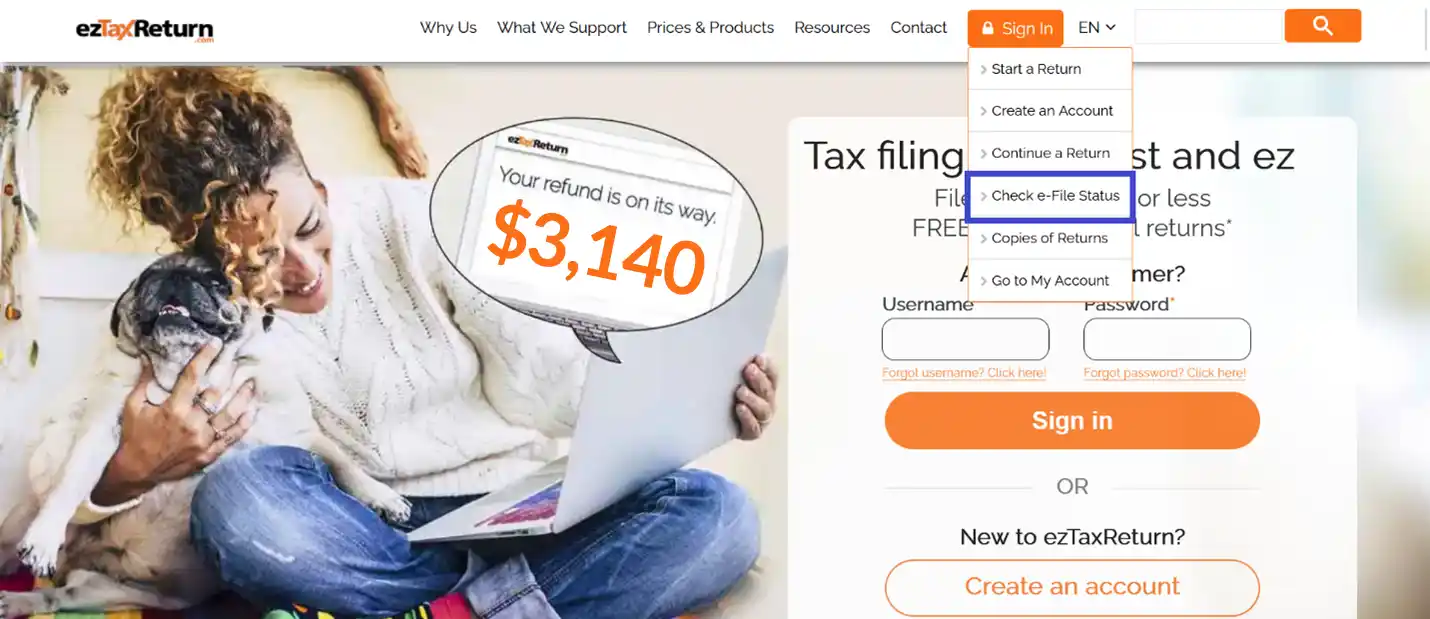

Go to “Sign In” and choose “Check e-File Status” from the dropdown menu.

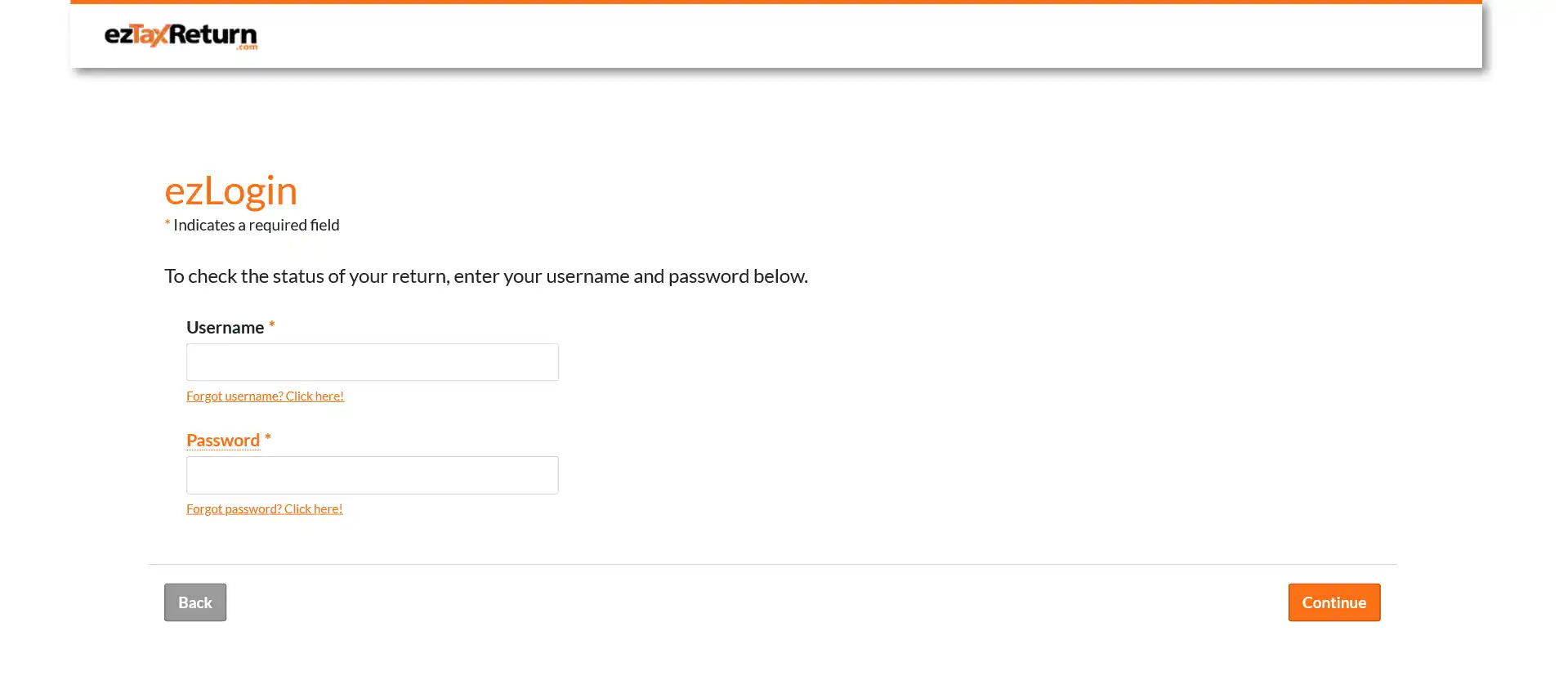

Log into your account.

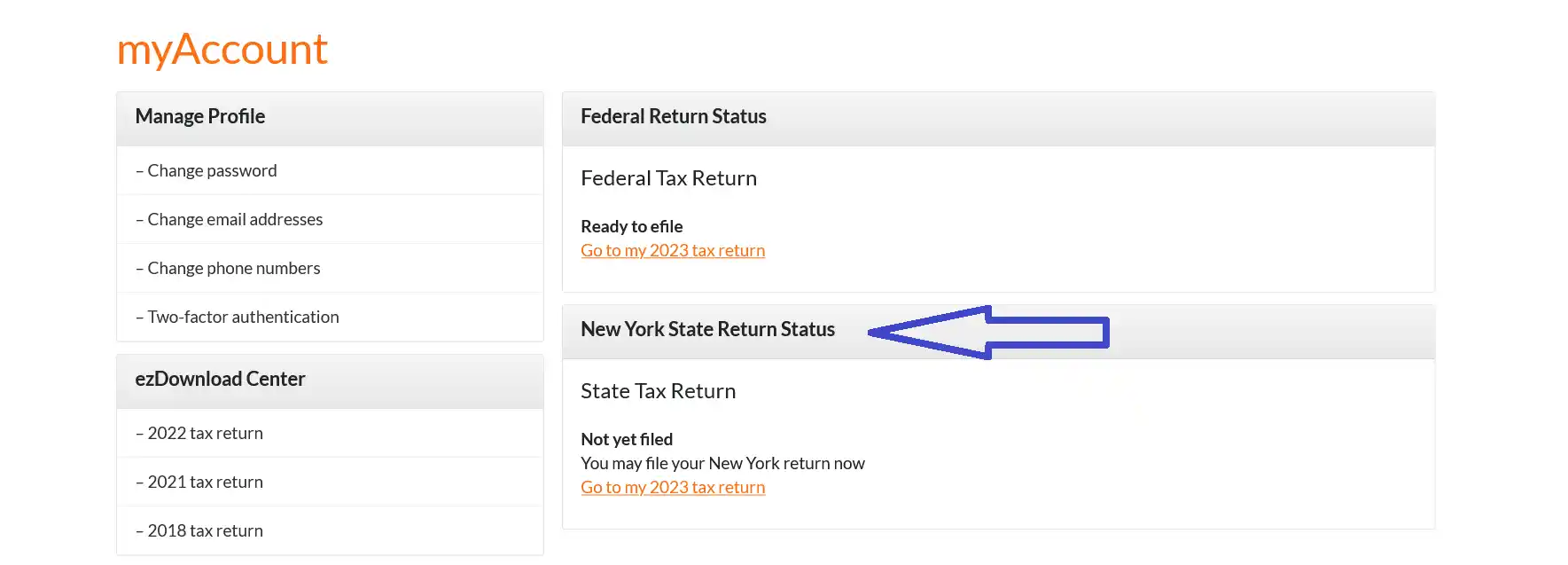

On your myAccount page you will see your state return status.