How Do I Claim Mortgage Interest on My Taxes?

Paying interest on a mortgage? You may be able to deduct the mortgage interest you’ve paid during the year and save money on your taxes. Read on to learn what the mortgage interest deduction is, who qualifies and how to claim it.

What is the mortgage interest deduction?

The mortgage interest deduction allows you to subtract the mortgage interest you paid during the year from your taxable income. As a result, you’ll pay less in taxes. The deduction is available if you itemize your expenses and meet the following guidelines:

- The mortgage must be used to buy, build, or substantially improve your main or second home.

- Your property must be listed as collateral for the loan.

- It must be a qualified home. You can claim the deduction for your main home or second home. It can be a house, condo, co-op, mobile home, house trailer, boat, or other property that has sleeping, cooking and toilet facilities.

How much of your mortgage interest is tax deductible?

The deduction limit depends on when you bought your house and the mortgage amount. In most cases, homeowners can deduct the interest on mortgages up to $750,000 ($375,000 for married filing separately). However, there are a couple exceptions:

- Mortgages taken out on or before October 13, 1987, are considered grandfathered debt. Your interest is fully deductible.

- If you took out a home equity loan to buy, build or “substantially improve” your home, you can deduct the interest. Homes purchased after October 13, 1987 and prior to December 16, 2017, are eligible for the $1 million limit ($500,000 for married filing separately). The same limit applies if you were under contract before December 15, 2017, but closed prior to January 1, 2018.

What qualifies as mortgage interest?

Here are a few things that count as deductible mortgage interest.

- Interest on a mortgage for your main homeYou can deduct the mortgage interest you pay on a house, condo, co-op, mobile home, house trailer, or boat. If you are a minister or in the military, and receive a nontaxable housing allowance, you can still deduct your mortgage interest.

- Interest on a mortgage for your second homeYou can also claim the mortgage interest for a second home, even if you don’t stay there during the year. However, if you rent it out, you must be there for at least 14 days or more than 10% of the days you rent it out. Otherwise, it will be considered a rental property and not a second home. If you have more than one second home, you will only be able to deduct the interest for one of them.

- Points paid on your mortgage Mortgage points are a form of pre-paid interest you pay to lock in a lower interest rate. One mortgage point costs 1% of your mortgage. You can deduct the points equally over the life of the loan, or the full amount in the year you paid if you meet nine requirements.

- Late payment charges on your mortgageIf you’re late on a mortgage payment, you can deduct the extra fee you’re charged.

- Prepayment penaltiesIf you are penalized for paying your mortgage off early, you can deduct the penalty as mortgage interest.

- Interest paid before selling your homeIf you sell your home, you can deduct the interest you paid before the date of sale.

- Interest on a home equity loanIf you took out a home equity loan to buy, build or “substantially improve” your home, you can deduct the interest.

Can I deduct mortgage interest if I take the standard deduction?

No, you cannot deduct mortgage interest if you take the standard deduction. The deduction can only be claimed if you itemize.

Does mortgage interest reduce my taxable income?

Yes, the mortgage interest deduction can reduce your taxable income. This itemized deduction allows you to subtract the amount of interest you paid on the loan during the year from your taxable income. With less taxable income, you will pay less in taxes.

What form do I need to write off mortgage interest?

Your lender will send you a 1098 form letting you know how much mortgage interest you paid during the year, if it was over $600.

Where do I claim mortgage interest on my taxes?

Mortgage interest is an itemized deduction which is calculated using Schedule A. If you choose to itemize, your total itemized deductions will be reported on line 12 of your Form 1040.

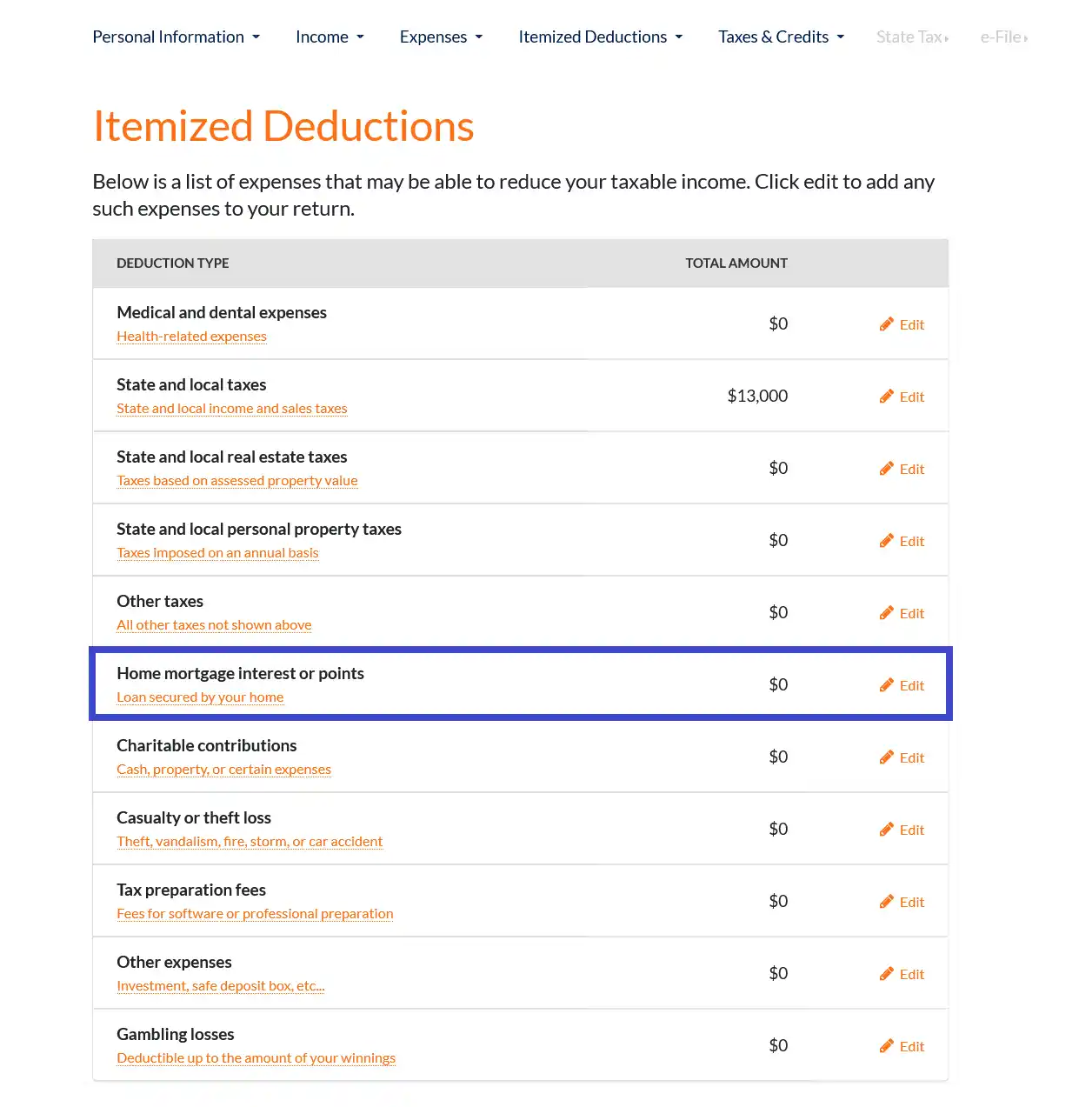

To report your mortgage interest, you can click the "Itemize Deductions" link on the navigation bar towards the top of the page and select the appropriate entry from the drop-down menu.

On the "Itemized Deductions" page, click on the "edit" link next to the appropriate line to add, edit, or delete a mortgage related entry.

Note: Itemizing makes sense if the total of your itemized deductions is greater than your standard deduction. The program will compare both to help you decide.