How Do I File Taxes for a Deceased Person?

First and foremost, we would like to say that we are sorry for your loss. When a taxpayer passes away, their surviving spouse or appointed representative must file their final tax return. The return should be prepared the same way it would if they were still alive. This means reporting all their income from the beginning of the year until the date of their death and claiming any credits and deductions they’re eligible to take. Here’s what you need to know about filing a deceased’s final tax return.

Does a tax return need to be filed for a deceased person?

Just like all other taxpayers, a tax return must be filed for a deceased person if they made a certain amount of income for the year. Even if they don’t meet the requirement, you should still prepare a return anyway to get a refund of any taxes withheld.

Who is responsible for filing a deceased person’s taxes?

When someone passes away, their surviving spouse or representative is responsible for filing their final tax return.

How do I file a tax return for a deceased person?

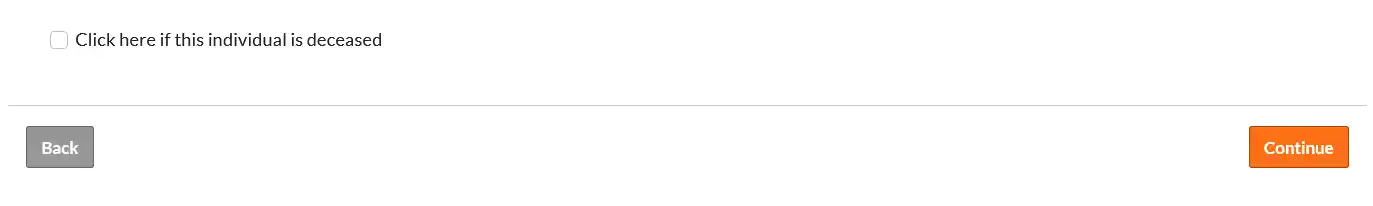

You can use ezTaxReturn to file a deceased person’s tax return. When preparing the taxpayer’s final tax return, you must note that they passed away. On the Personal Information page in our program, you will see a checkbox that says, “Click here if this individual is deceased”.

Click the box, then press the “Continue” button to follow the software through the rest of your return.

What filing status do I use if my spouse passed away?

Depending on how long ago your spouse passed away, your tax filing status may change. Choosing the right filing status is important because it can impact your filing requirements, tax rate, standard deductions, and eligibility for certain tax breaks.

The first yearEven though your spouse passed away, the IRS still considers you to be married for the entire year. You can use the Married Filing Jointly or Married Filing Separately status. The exception is if you got remarried the same year. In that case, you will not be able to file a joint return with your deceased spouse. You would have to use the Married Filing Separately status for your deceased spouse’s return.

The next two yearsFor the following two years, you may be able to file using the Qualifying Surviving Spouse (formerly Qualifying Widower) status. To be able to use this status, you must meet the following IRS requirements:

- You were entitled to file a joint return with your spouse the year they passed away (it doesn’t matter whether you actually filed as Married Filing Jointly).

- The year for which you are filing is one of the first two years after the year in which your spouse passed away.

- You have a child, stepchild or adopted child living with you that you claim as a dependent (a foster child does not qualify).

- You have paid more than half the cost of running your household.

- You have not remarried as of the end of the year for which you are filing.

If you got remarried the same year that your spouse passed, you won’t be able to file a joint return with your deceased spouse. Instead, you can file a return with your new spouse using the Married Filing Jointly or Married Filing Separately status.

What documents are needed to file taxes for a deceased person?

In addition to Form 1040, court-appointed representatives should include a copy of their court appointment document (this can be submitted with our program). Representatives who aren’t court-appointed must complete Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer to claim a refund.

Who signs the tax return for a deceased person?

- E-filing – The surviving spouse or representative should follow the directions provided by the tax software.

- Paper filing – The filer should write deceased, the deceased person's name, and the date of death across the top. It should be signed by:

- Appointed representative and the surviving spouse if it’s a joint return.

- If there’s no appointed representative, then the surviving spouse should just sign the return and write “filing as surviving spouse” in the signature area.

- If there’s no appointed representative or surviving spouse, whoever’s in charge of the deceased person’s property should sign the return as "personal representative".

When are final tax returns due?

You have until April 15th of the year following the taxpayer’s death to file a final tax return. However, you can request an extension if you need additional time.

What happens if a deceased person is due a tax refund?

If a deceased person is due a tax refund, the person claiming the refund must fill out Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer unless they are a surviving spouse or court-appointed representative.

How do I pay a deceased person's taxes?

If a deceased person owes taxes, you can choose how to pay when you submit the return. The IRS accepts checks, money order, direct debit, or credit card. If you cannot afford to pay the full amount right now, you may qualify for a payment plan or installment agreement.

Do you need to contact the IRS when someone dies?

No, you do not need to contact the IRS. However, on the final tax return, the surviving spouse or representative must note that the person has died.

Do I need to send a death certificate to the IRS?

No, you do not need to send a death certificate or any other proof to the IRS.