How to Get Copies of Past Tax Returns

Forgot to save a copy of last year’s tax return and now you need it? No worries. There are several ways to get your hands on the information you need.

Check with your tax software provider.

If you completed your taxes using a DIY program, you should be able to log into your account and get a copy of your prior year return. Here’s how to view, download and print your returns filed with ezTaxReturn.

Go to the ezTaxReturn.com homepage

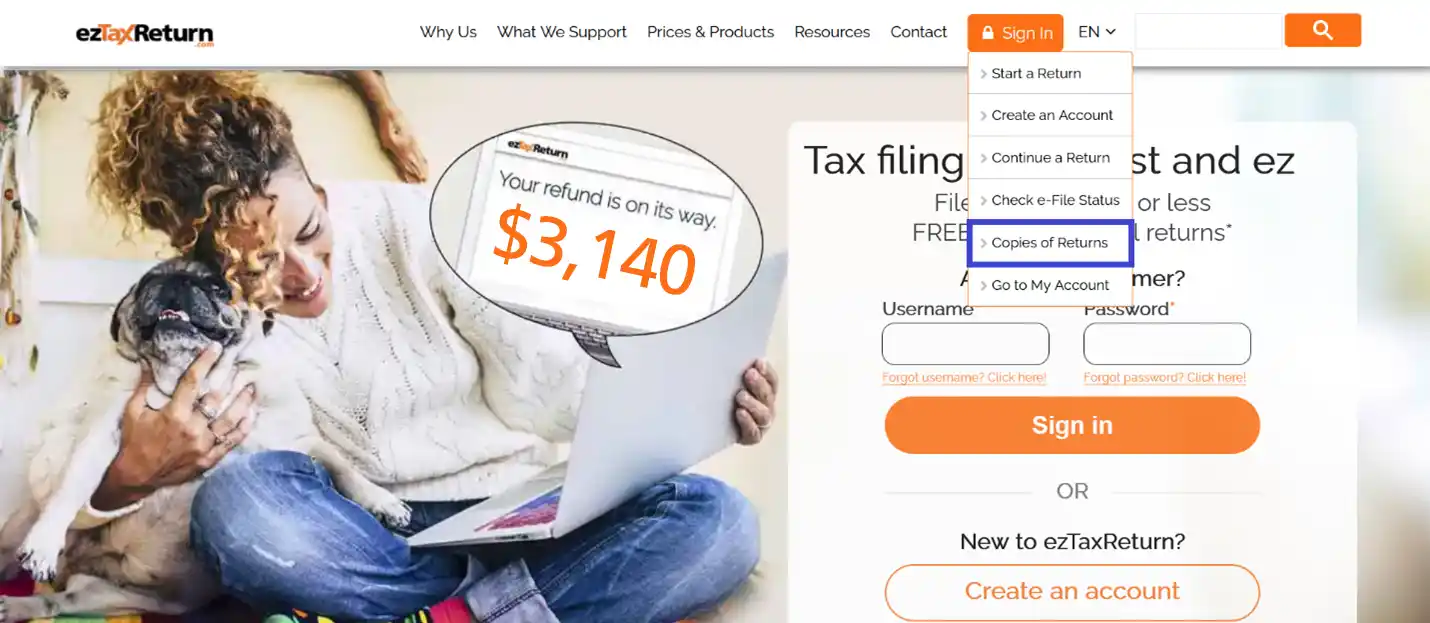

Click “Sign In” and select “Copies of Returns” from the dropdown menu.

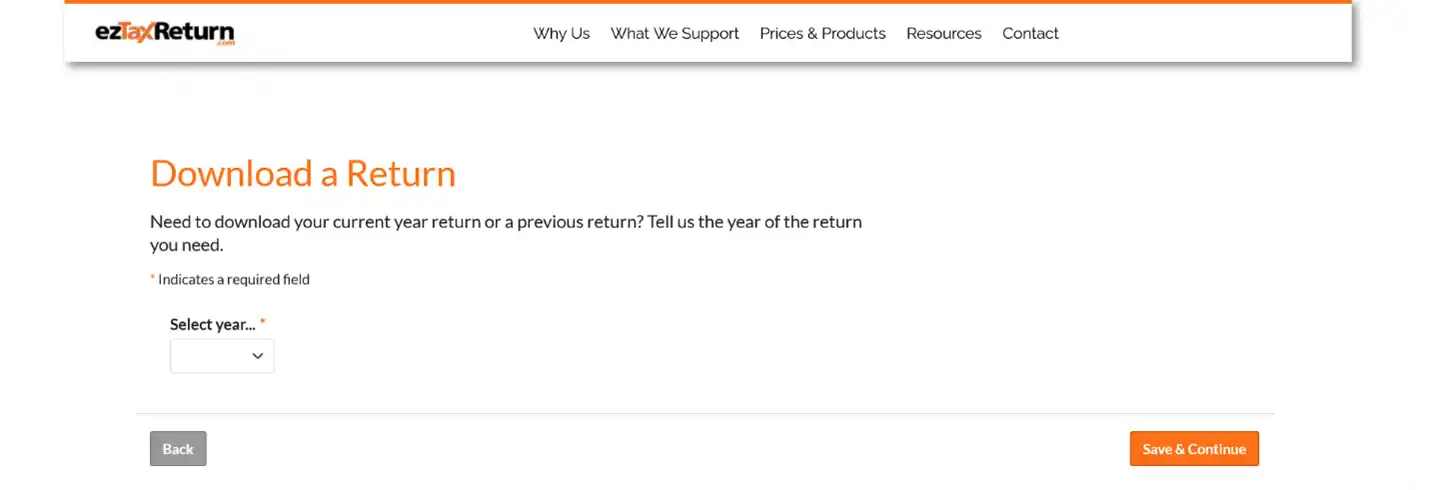

On the Download a Return page, select the year of the return you wish to download and proceed.

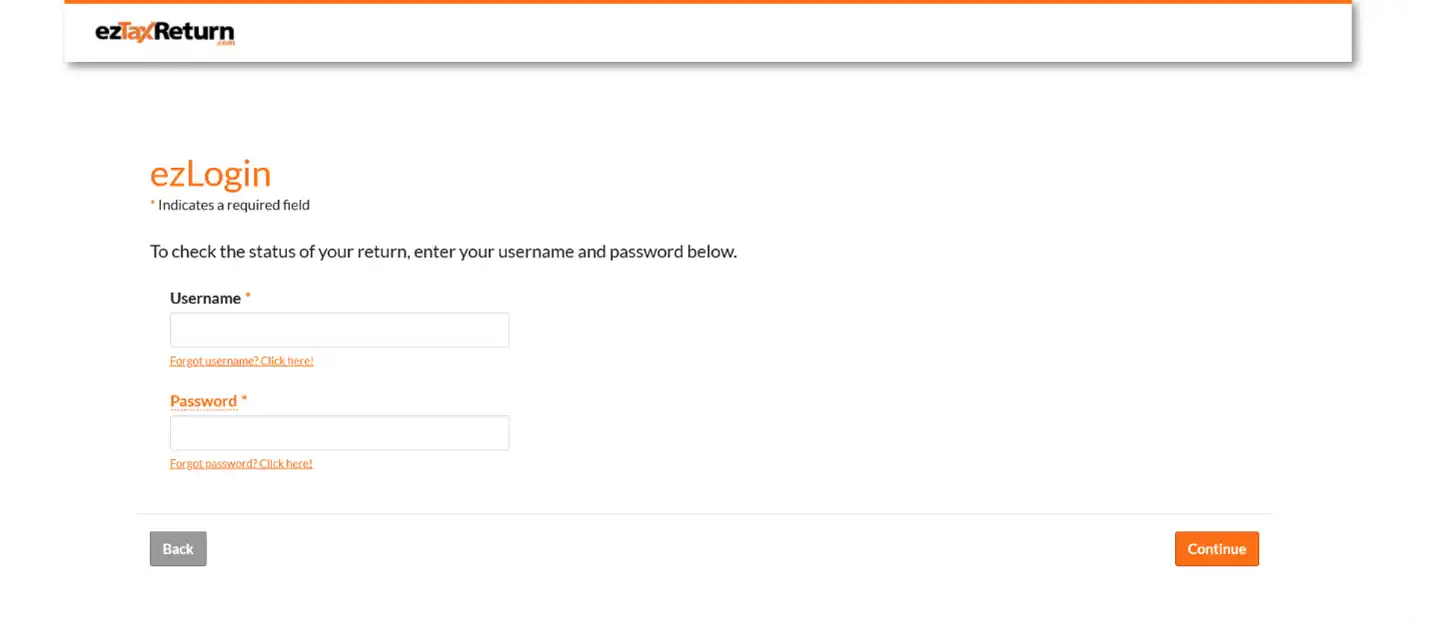

Enter your username and password to log in to your account. If you don’t remember your password, please click “Forgot password? Click here” to reset your password.

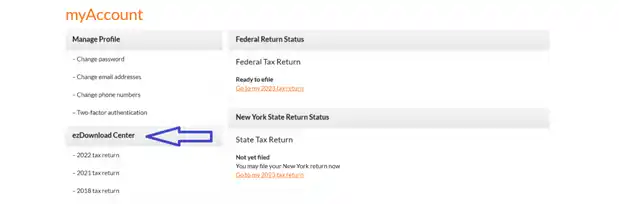

On your myAccount page, you will find links to all your available returns under the “ezDownload Center”. Please click on the year of the return that you wish to view and download.

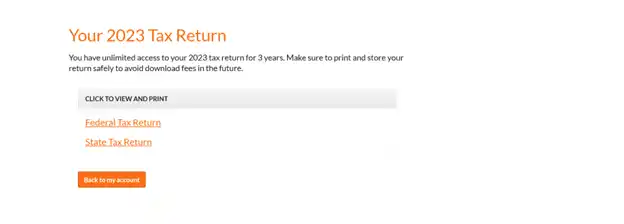

On the next page, click the links to view and print your returns.

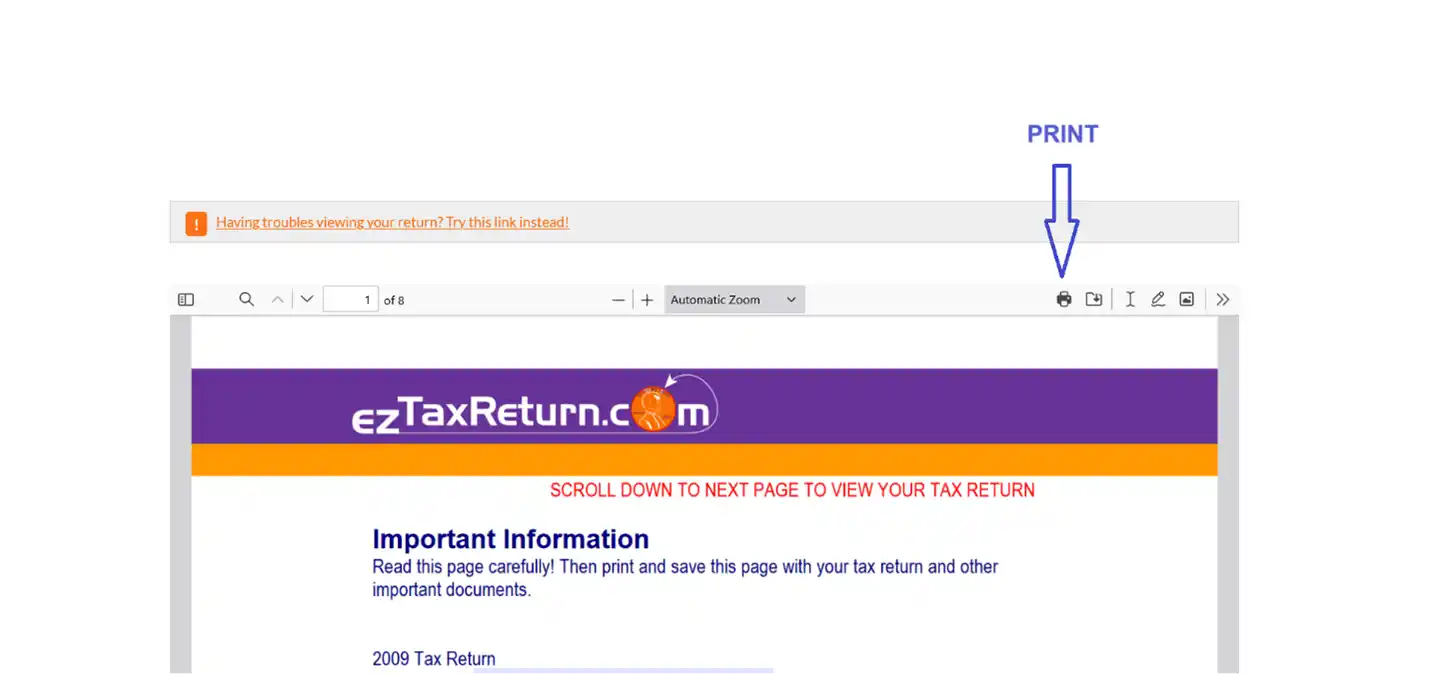

A separate window will pop up displaying your return. From here you can click the printer icon to print your return.

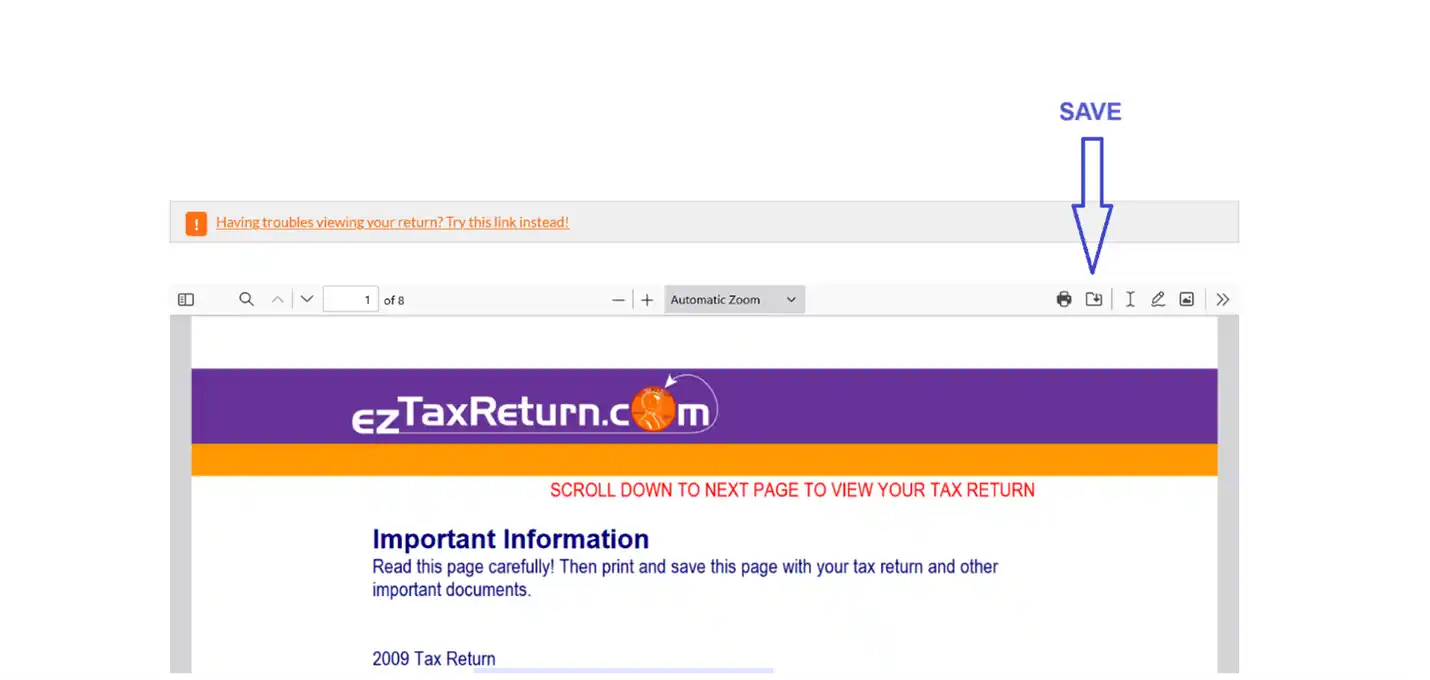

Or click the folder icon to save it.

IMPORTANT:

IMPORTANT:

Adobe Reader needs to be installed on your computer to view and download your returns.

If you paid to do your taxes with ezTaxReturn.com, you can get unlimited copies of your returns for up to three years free of charge. Those who filed a free simple return must pay a small fee to access their returns after May 18th.

Get a tax transcript.

If you’re unable to get a copy of your return, you have the option of ordering a free tax transcript from the IRS. Although your identifying information will be partially hidden, you will be able to see all your financial entries and adjusted gross income. You can get your transcript:

- Online – Use Get Transcript Online to immediately view, download and print your transcript. If you’re a new user, you’ll need to have a photo ID handy.

- By Phone – Call 800-908-9946 to request a transcript over the phone. Your transcript will be mailed to you in 5-10 days.

- By Mail – Complete and send Form 4506-T, Request for Transcript of Tax Return to the IRS.

Request a copy of your tax return from the IRS.

The IRS can provide you with copies of your tax return going as far back as seven years. However, there is a $30 fee for each copy you request. To get your copy from the IRS, you must download and complete Form 4506, Request for Copy of Tax Return, then mail it to the appropriate IRS address listed on the form. It can take up to 75 days for them to process your request.