How Do I Track My Illinois State Refund?

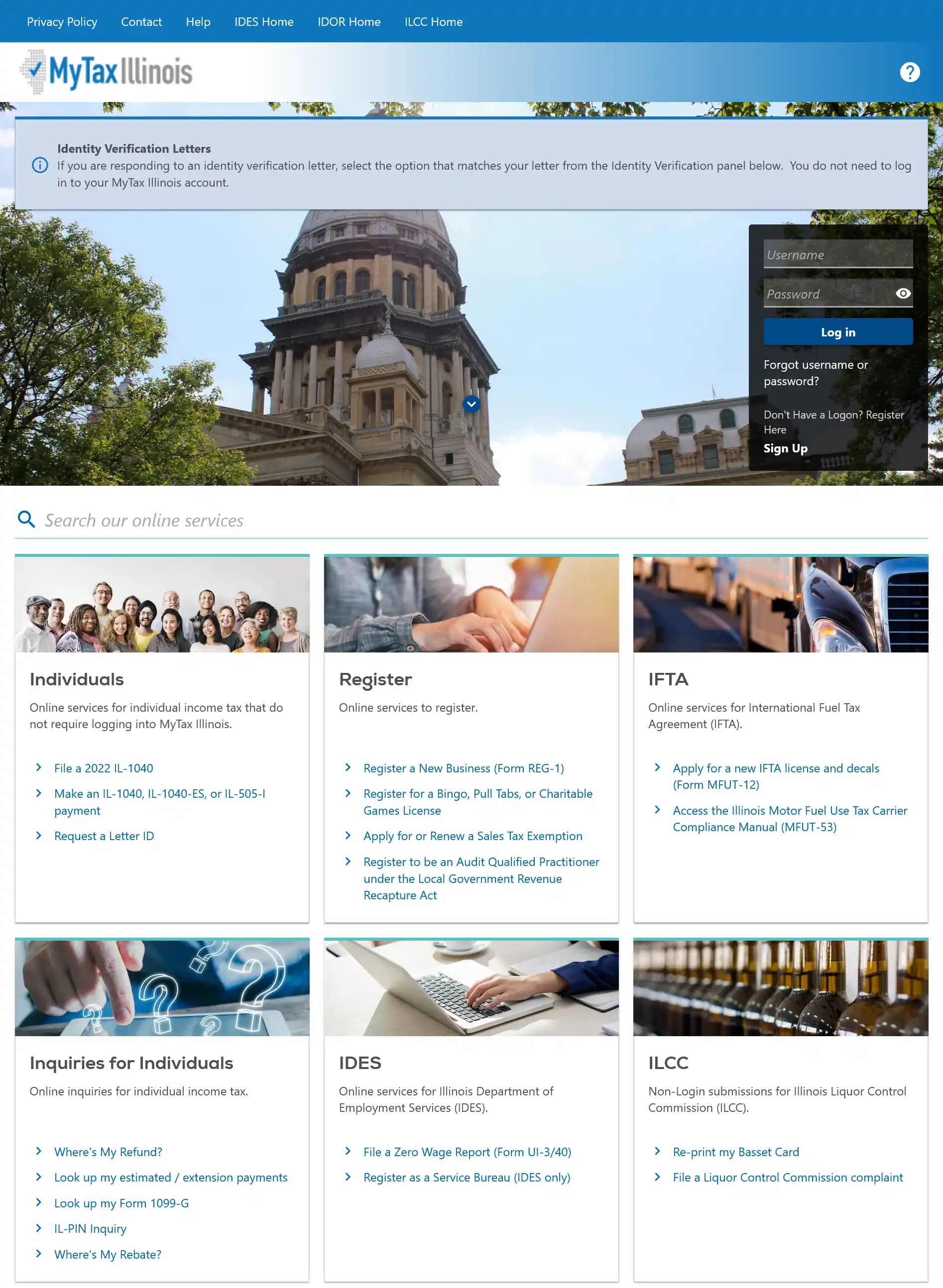

You can check the status of your Illinois state refund by visiting https://mytax.illinois.gov

Scroll down to Inquiries for Individuals and click “Where's My Refund?”.

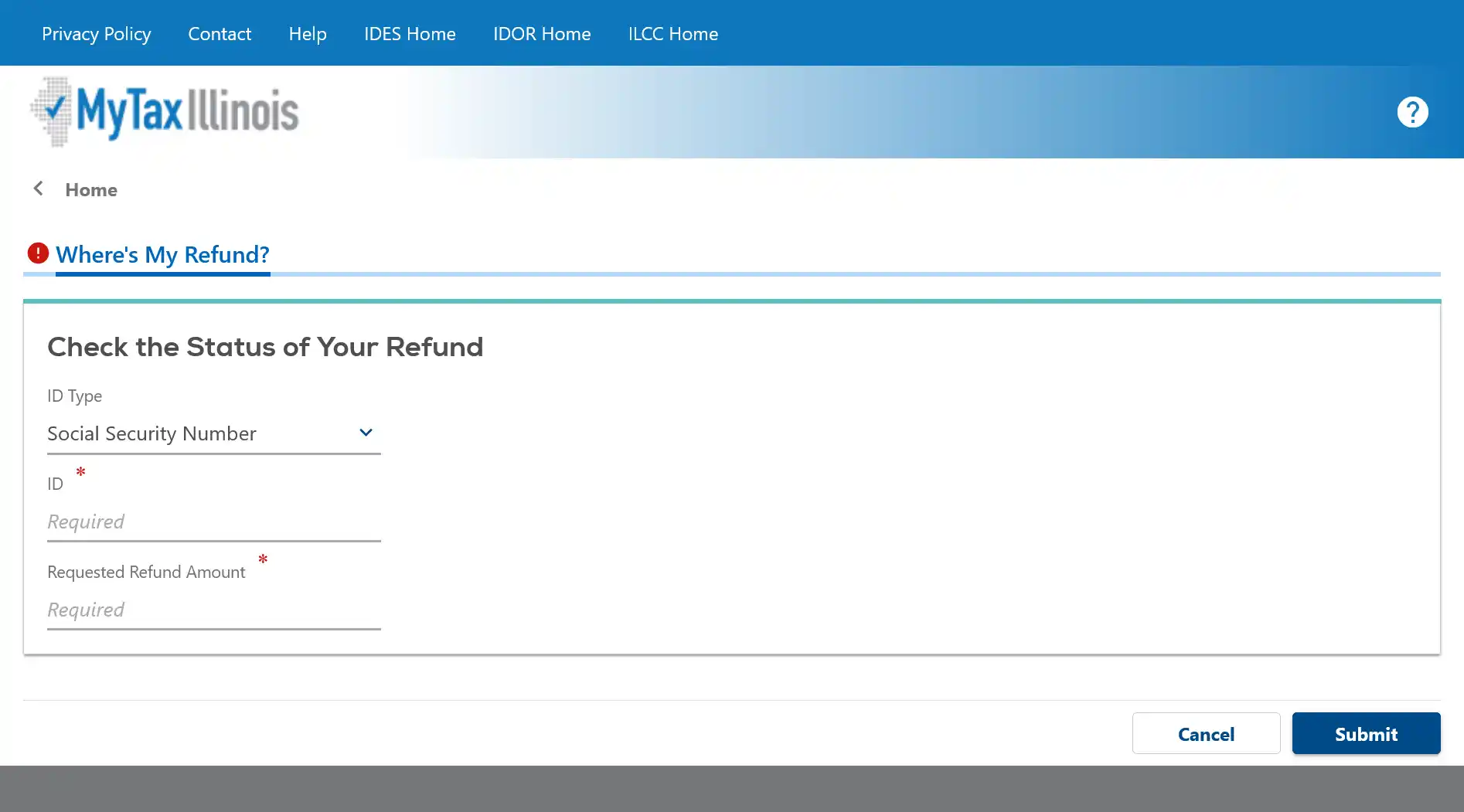

On this page, you will need to:

- Select your ID Type from the dropdown (Individual Tax ID Number or Social Security Number).

- Enter your ID number.

- Provide your Requested Refund Amount.

Once you are done, click the “Submit” button to check your refund status.

Refund FAQs:

How long does it take for Illinois to process refunds?

Refund times can vary. If you e-file and have your refund direct deposited into your bank account, you will get your refund faster.

What do I do if my tax refund was not what I expected?

If your refund amount is more or less than the amount shown on your tax return, the Illinois Department of Revenue (IDOR) will send you a notice within 7-10 business days explaining the difference.

How do I replace a lost tax refund check?

You must call the Illinois Comptroller's Office at 1-800-877-8078 for a replacement check.

What can I do to ensure I get my Illinois refund as quickly as possible?

The fastest way to get your refund is to e-file as soon as you get all your tax documents and request to have your refund deposited directly into your bank account. Before you submit your return, make sure you:

- Enter the correct name, Social Security number, address, and direct deposit information.

- Review all your entries.

- Include any required supporting documents.