Where Is My Louisiana State Tax Refund?

You can check the status of your Louisiana tax refund online by visiting LaTAP (louisiana.gov)

1. Scroll down to “Individuals” section and click “Check My Refund Status”.

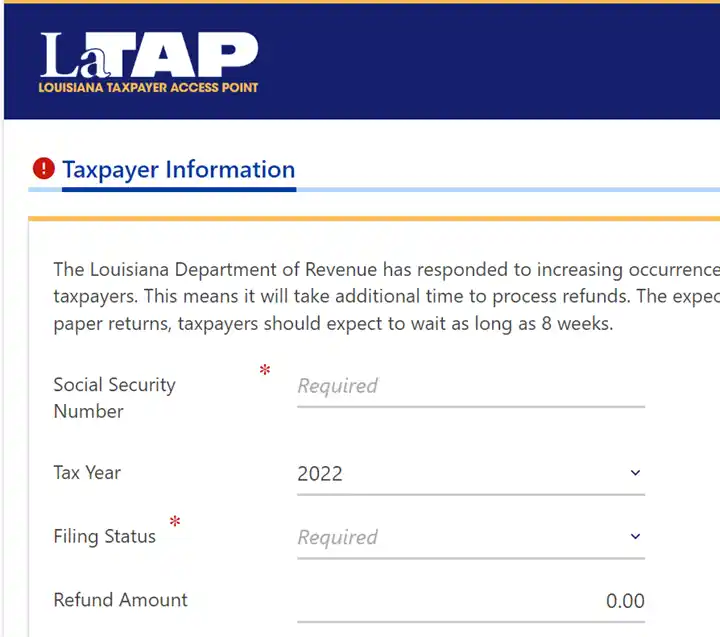

2. Enter your social security number. (For joint returns, enter Social Security of primary spouse).

3. Select the tax year.

4. Select filing status.

5. Enter refund amount.

Refund FAQs:

1. How long does it take to process a Louisiana state tax return and refund?

The processing time for an e-filed return is up to 4 weeks. Paper returns take 8 weeks to process.

2. Why is my tax refund withheld?

If you owe any money to another government agency, The Louisiana Department of Revenue (LDR) will withhold your tax refund to pay your outstanding debt.

If this happens to you, you’ll receive a letter in the mail that explains the debt amount withheld from your refund.

3. How can I obtain a corrected refund check because my original check had a misspelling of my name?

If you can’t deposit your refund due to a misspelling, you should notify the Louisiana Department of Revenue (LDR).

| How to request a corrected refund check | Where to send |

|---|---|

|

Mail a copy of your spelling correction request and include your:

|

Mail your request to:

Louisiana Department of Revenue P.O. Box 4998 Baton Rouge, LA 70821-4988 |

|

Send an email with your spelling correction request and include your:

|

Email your request to:

personal.inquiries@la.gov |

|

Call the Louisiana Department of Revenue (LDR) to correct the spelling of your name and have a refund re-issue. |

Call:

|