How Do I Track My Michigan Tax Refund?

You can check the status of your Michigan state tax refund by visiting https://etreas.michigan.gov/iit/p/iitWMR.

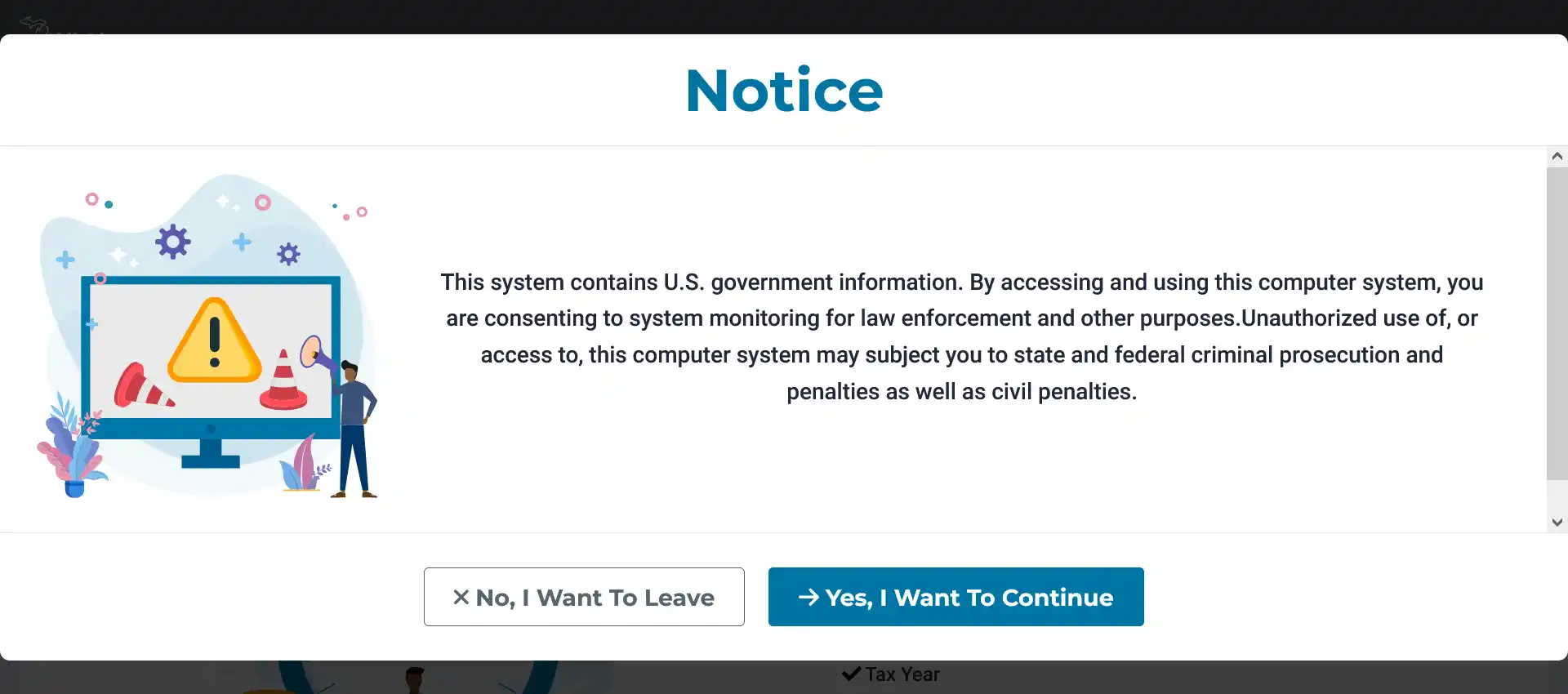

You will get a message that looks like this:

Click the “Yes, I Want To Continue” button.

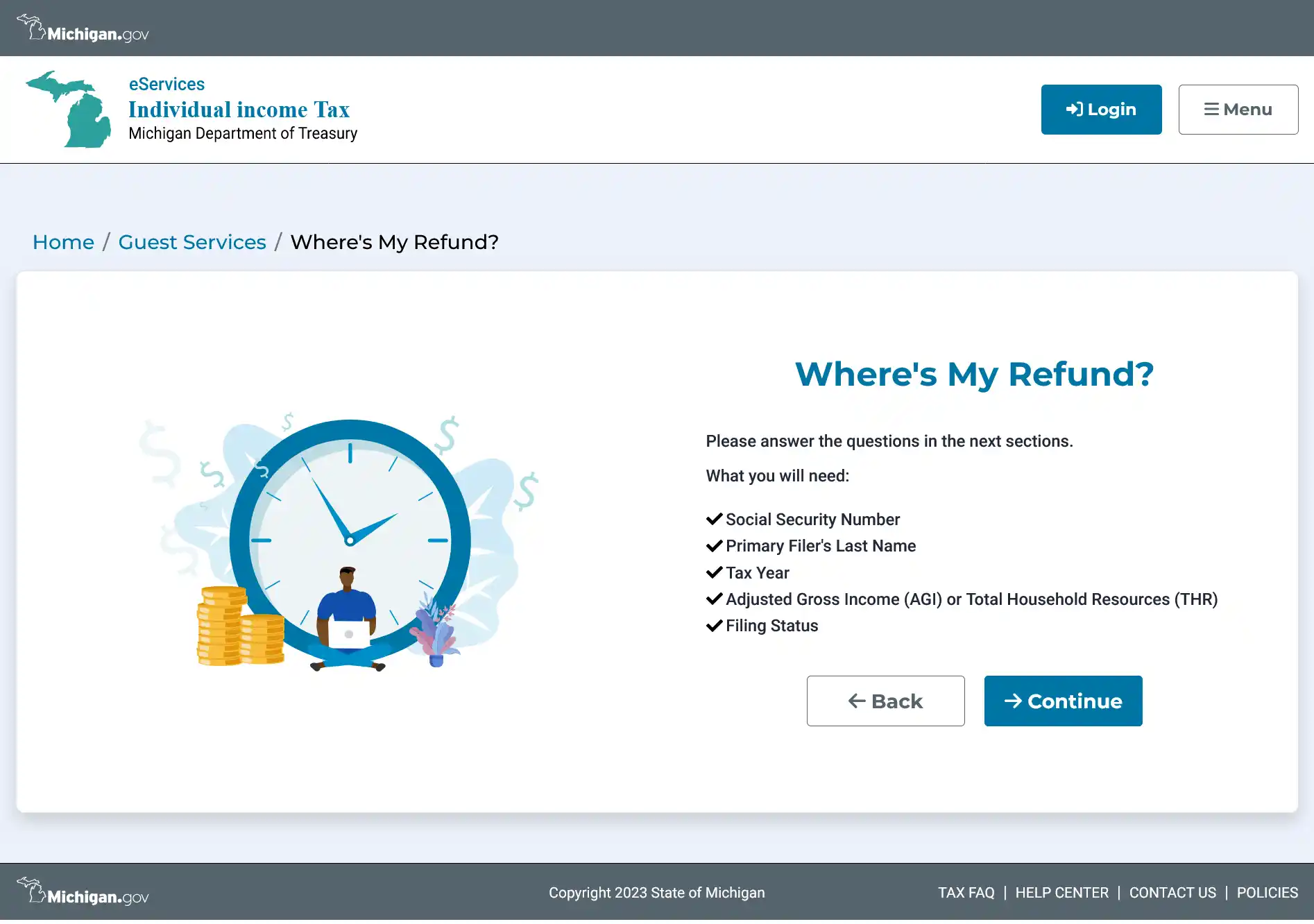

This will bring you to Michigan’s “Where My Refund?” tool. Click “Continue” to get started.

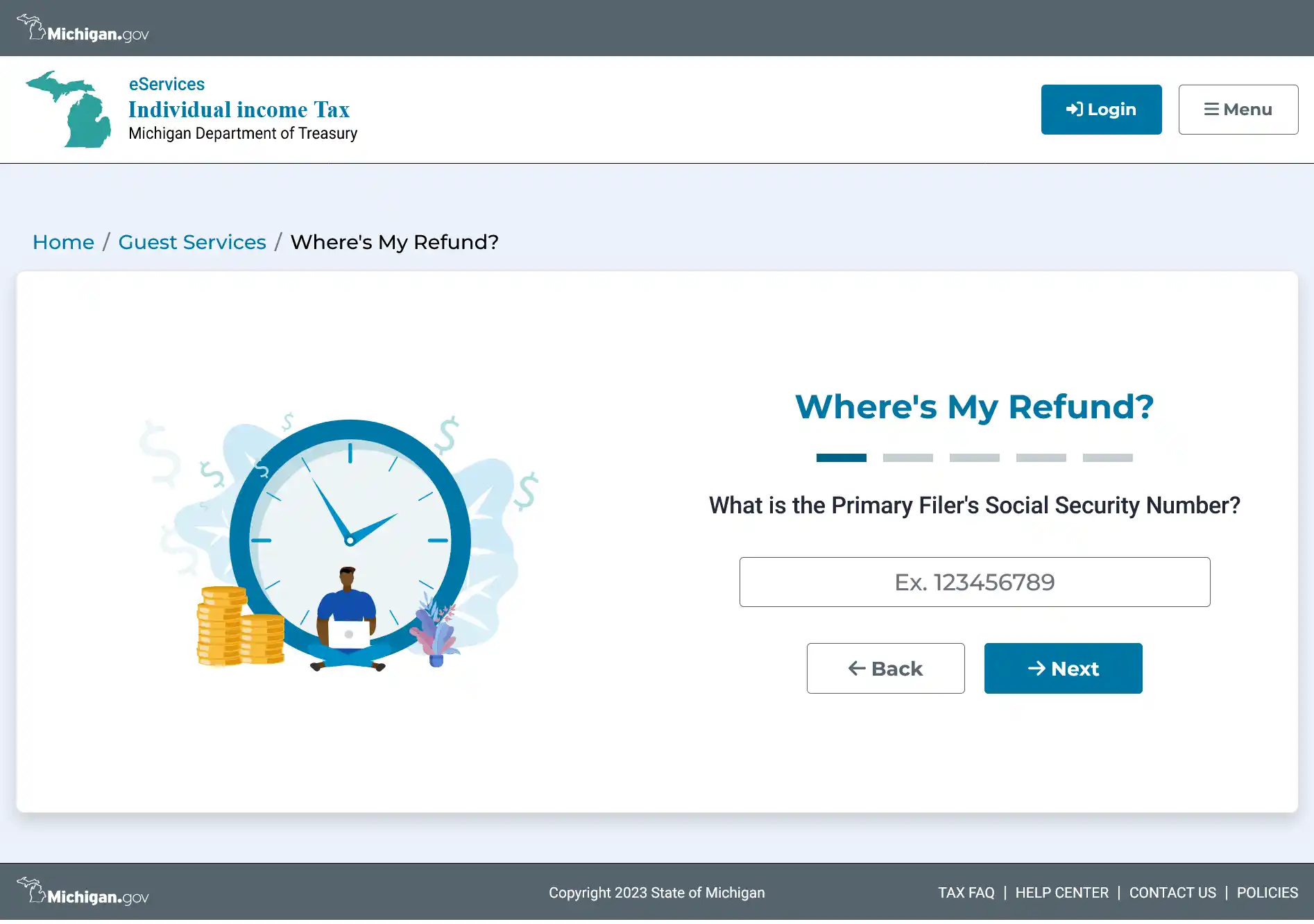

Enter the primary filer’s social security number, then click "Next”.

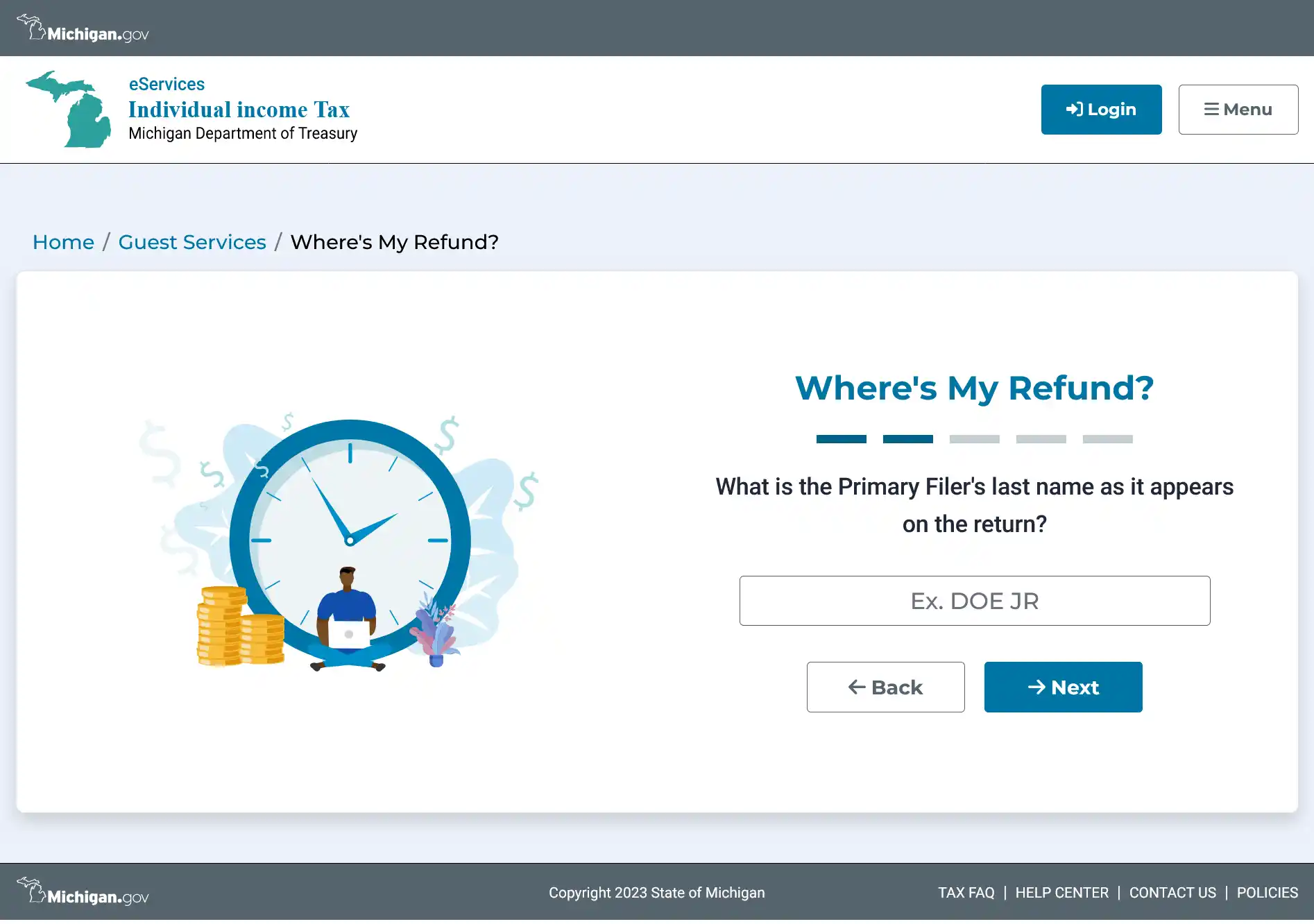

Enter the primary filer's last name as it appears on the return, then click “Next”.

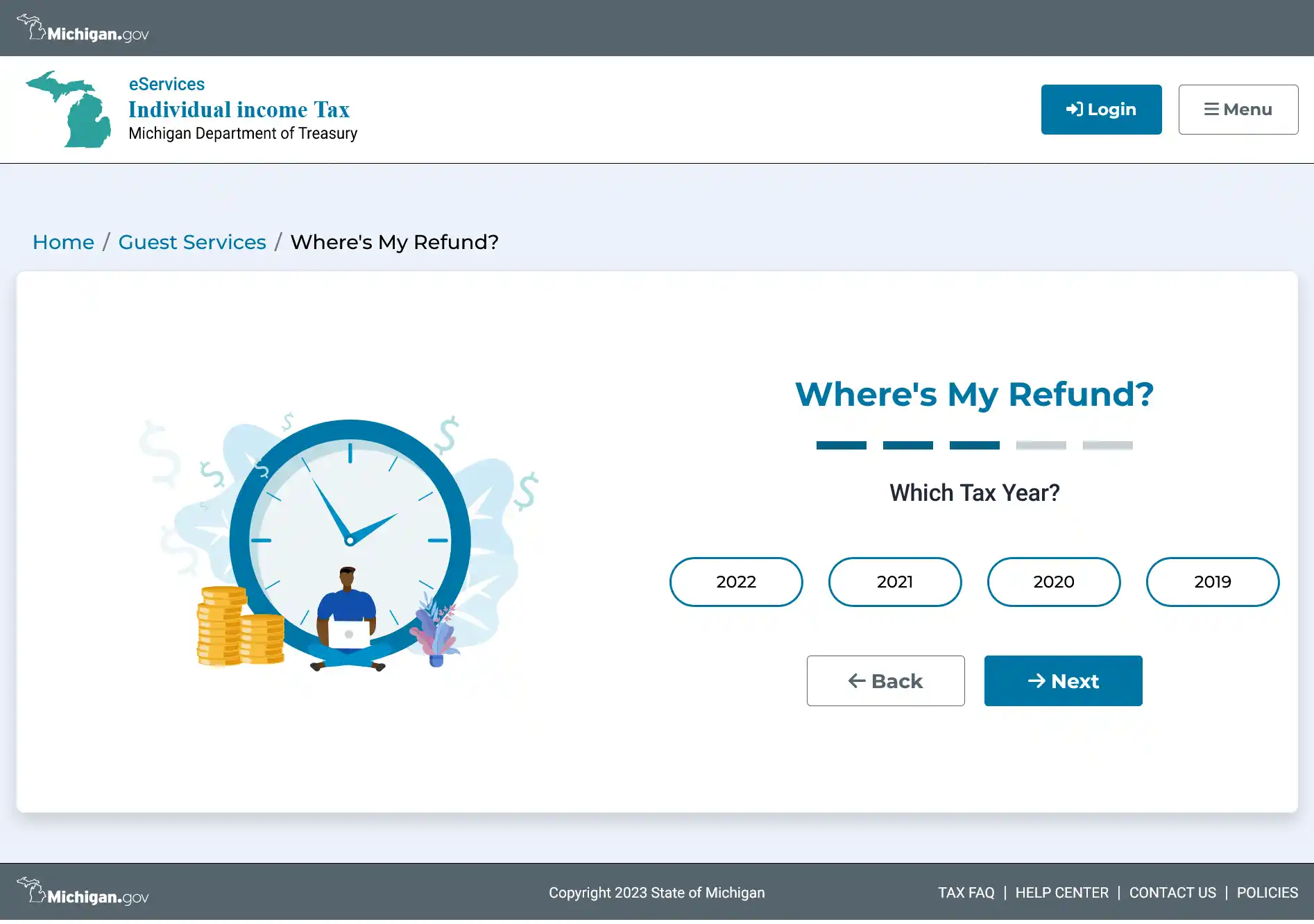

Select the tax year, then click “Next”.

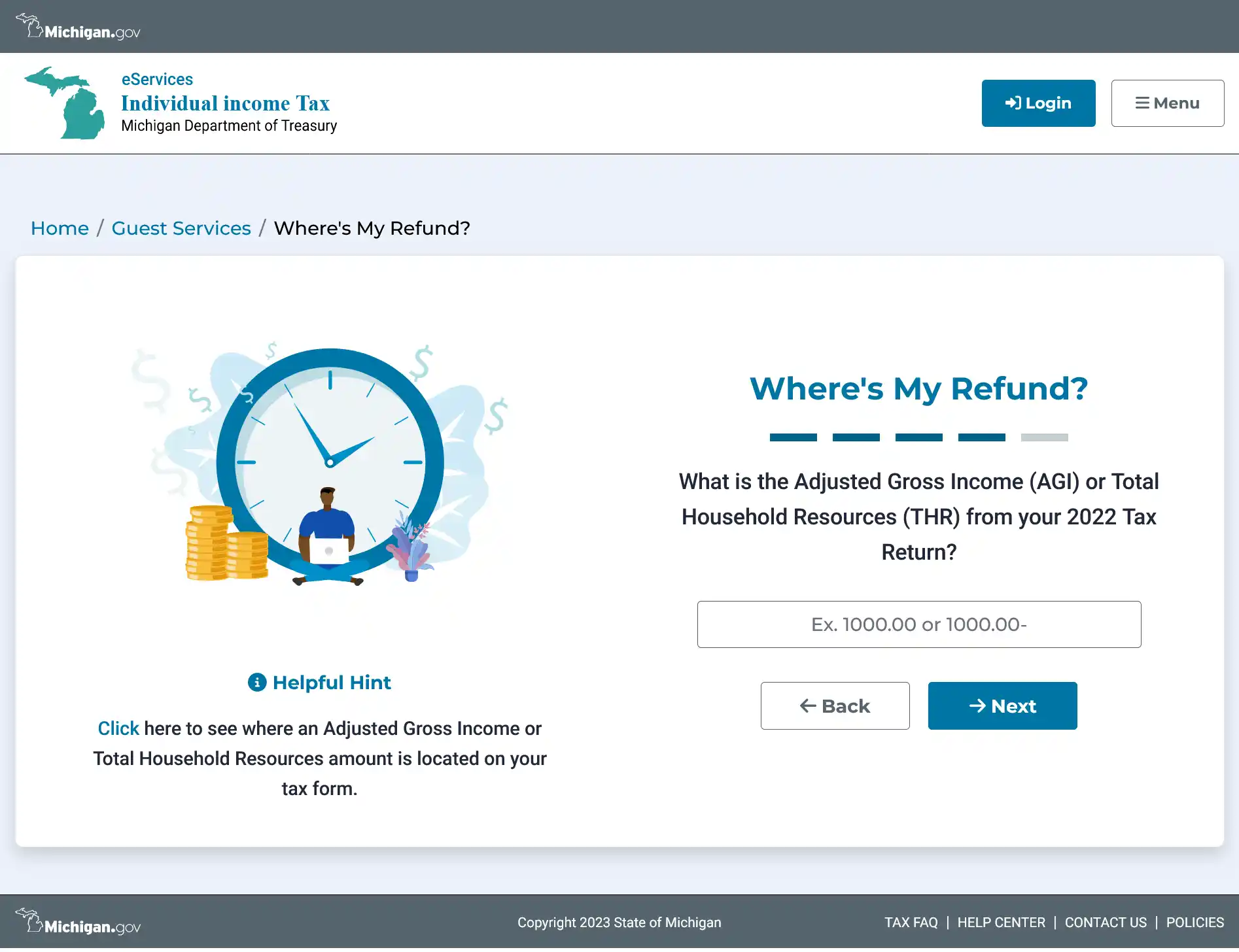

Enter the Adjusted Gross Income (AGI) or Total Household Resources (THR) from your 2022 tax return, then click “Next”.

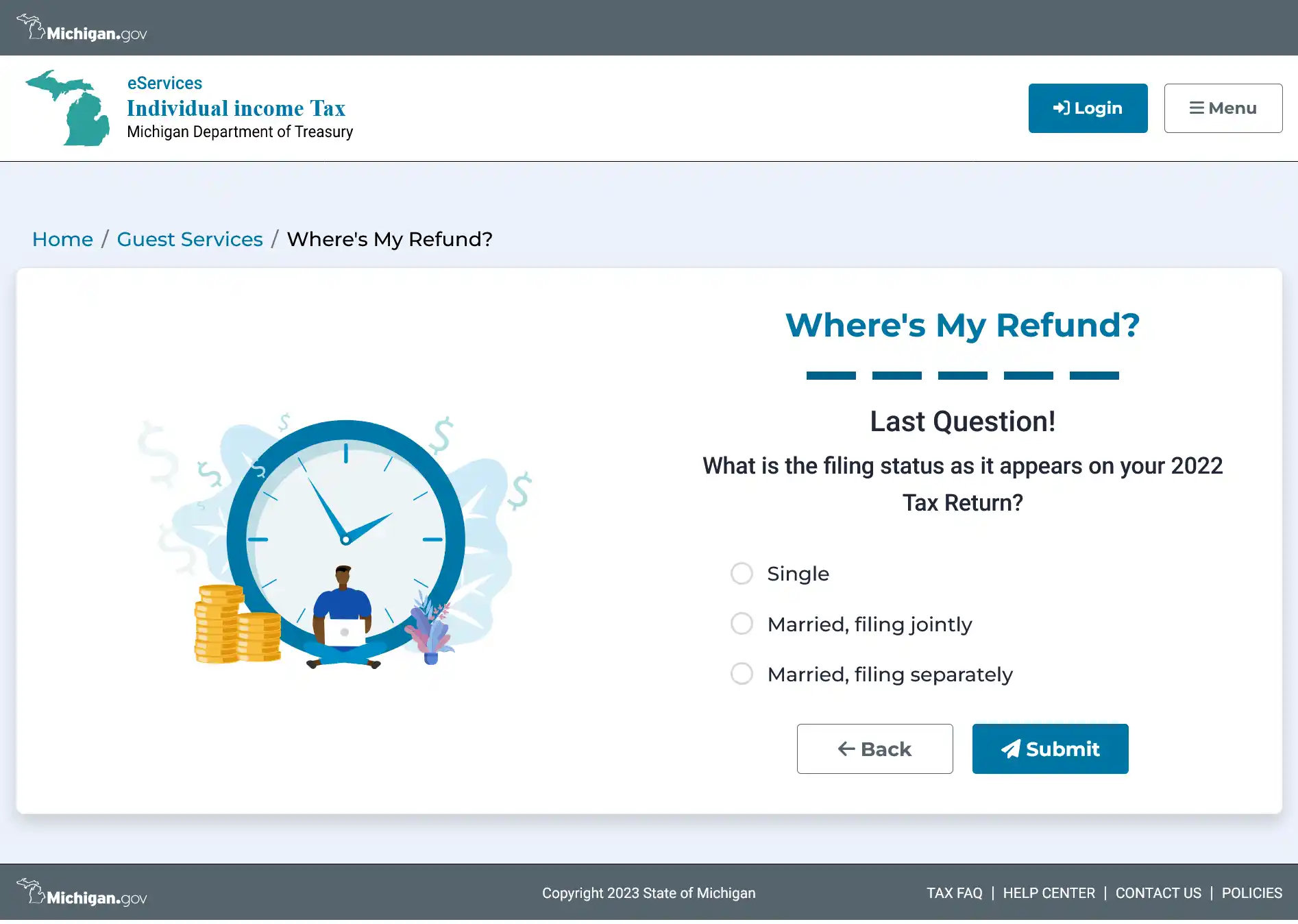

Finally, you are asked to enter your filing status. Make your selection then click “Submit” to get your refund status.

Refund FAQs:

How long will it take to process my Michigan State return?

- E-filers can begin tracking their refund 3-4 weeks after their tax return is accepted.

- Paper filers should wait 6-8 weeks before checking their refund status.

Why is my Michigan state refund less than expected?

If your refund is less than expected a portion of your refund may have been withheld for past-due taxes, child support, overpayment of unemployment benefits or another kind of debt. Michigan’s Department of Revenue will provide an explanation in a letter or on your refund check.

What should I do if my tax refund is adjusted or denied?

- Read the explanation provided in the letter or on your refund check.

- Review your return for math errors.

- If an adjustment was made to your Property Tax Credit (MI-1040CR), use one of these checklists to review your information and see what you need to submit to respond.

- If you agree with the Department’s findings, you don’t have to do anything.

What happens if my direct deposit goes to a closed account?

If your tax refund was issued to a closed account, your bank will return the direct deposit and Michigan’s Department of Treasury will send a check to you. Typically, you will get your refund check within 6 weeks of Michigan receiving the returned direct deposit.

What happens if my bank account number is wrong on my tax return?

Unfortunately, neither ezTaxReturn nor the Department of Treasury can update your account number once you e-file. You will need to take the following steps:

- Notify your bank about the error. They may be able to catch it and deposit the funds into your account.

- If the refund is deposited into the account number listed on your return, but it belongs to someone else, you will need to work with your bank to resolve the issue.

- If the refund cannot be deposited and the bank returns the payment, a refund check will be sent to you 6 weeks after Michigan receives the returned payment.