How Do I Check the Status of My Missouri State Tax Refund?

You can check the status of your Missouri tax refund by visiting https://dor.mo.gov/taxation/return-status/

Begin by clicking the “Get Started!” button.

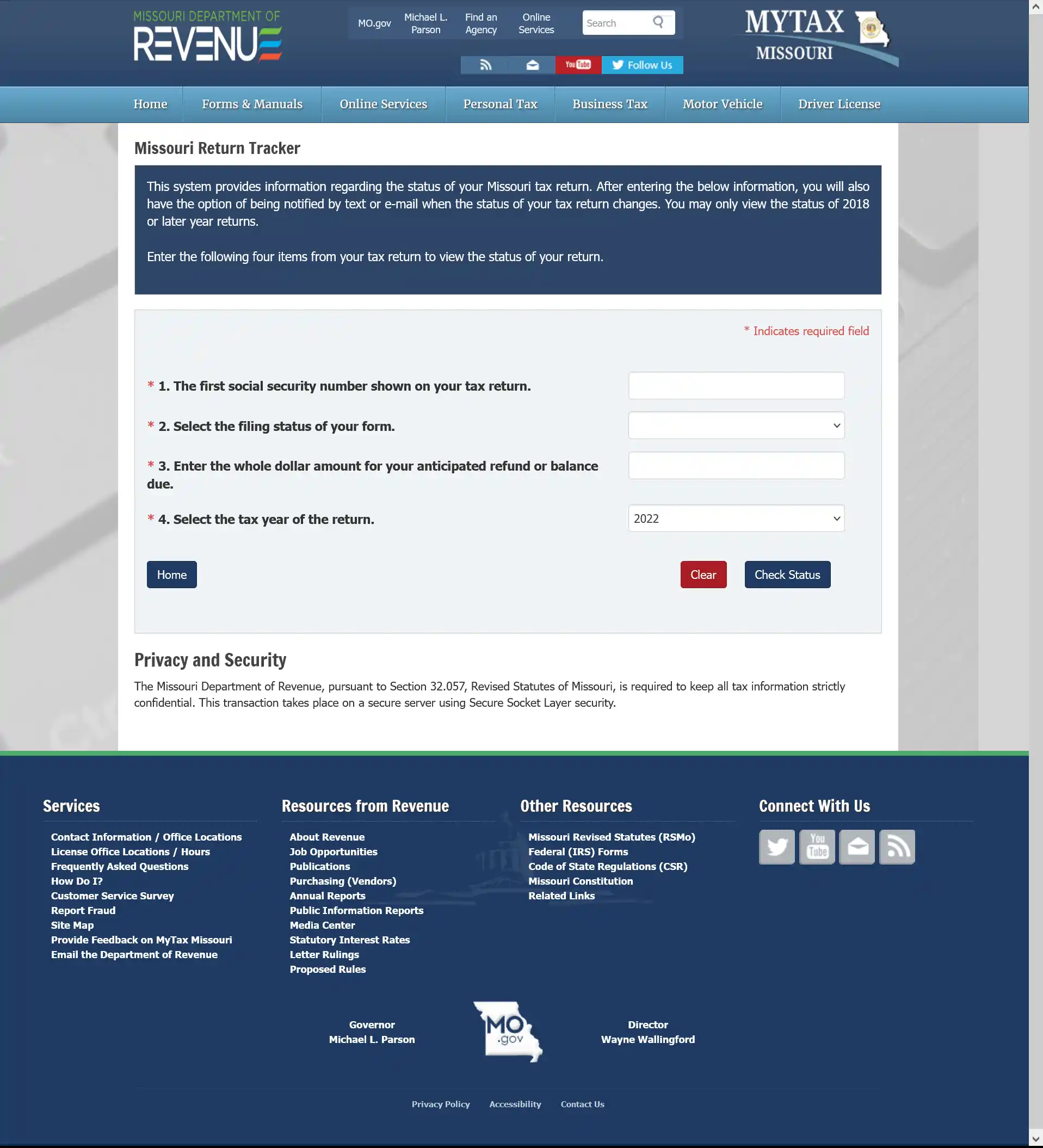

On this page, you will need to enter:

- Your social security number;

- Your filing status;

- The whole dollar amount for your anticipated refund; and

- The tax year of your return.

Then, click the “Check Status” button to view your refund status.

Refund FAQs:

When will my Missouri refund information be available?

- E-filers – Within 5 business days of filing.

- Paper filers – Within 3-4 weeks of mailing in your return.

Is my Missouri tax refund taxable?

Your tax refund may be taxable if you:

- Received Form 1099-G reporting a state or local income tax refund, credit, or offset; and

- Claimed itemized deductions on your prior year federal tax return.

Why did Missouri intercept my refund?

If you owe income taxes from a previous year, the Missouri Department of Revenue can seize your federal or state tax refund and apply it to your tax debt. Business owners can also have their refund seized if they owe sales tax, use tax, employer's withholding tax, or corporate income tax. You will receive a letter via USPS if adjustments are made.