How Do I Paper File My Tax Return?

E-filing is the best way for most people to file taxes, but there are cases where you may be forced to paper file. For instance, if your return has been rejected multiple times or you need to complete a form that cannot be e-filed. Paper filing simply means that you are mailing your federal return to the IRS instead of submitting it electronically. Keep in mind that most states require you to e-file.

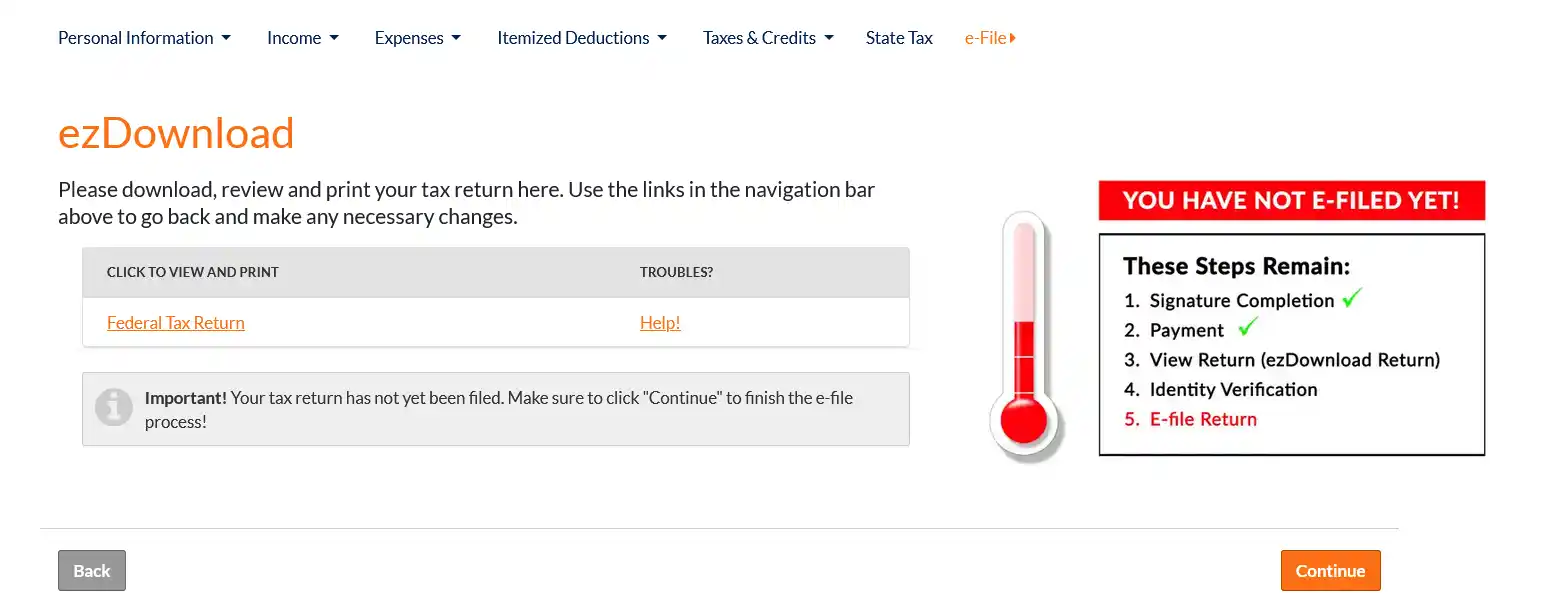

How do I download my tax return?

You will be able to download and print your return on the "ezDownload" page. Please continue through the program to reach this page during the e-File step. It will be after the signature and payment screens.

If you have already passed this portion of the program, use the "Back" button on the site (bottom left of page, not the browser back button) until you reach the "ezDownload" screen.

Where should I send my federal tax return?

The address to mail your return varies based on your state and whether you are enclosing a payment. The IRS mailing addresses can be found by visiting: https://www.irs.gov/uac/where-to-file-paper-tax-returns-with-or-without-a-payment

Please be sure to sign your return and include any supporting documents when paper filing.

Is it better to file taxes on paper or electronically?

There are several reasons why people prefer to file taxes electronically versus on paper.

- Faster refunds – The IRS issues most refunds within 21 days when you combine e-file and direct deposit.

- Security – All your information is encrypted and sent over a secure server to protect against identity theft.

- Convenience – You can use tax software to prepare your return from the comfort of your own home or ask your tax preparer to e-file for you.

- Accuracy – Tax software crunches the numbers and notifies you if there are issues with your return.

How do most people file their taxes?

According to the IRS, more than 90% of people e-file their tax returns.

How long do paper returns take to be processed?

If you filed an accurate tax return, you could expect your refund 4 weeks or more after the IRS received your return. It may take longer if your return contains mistakes or requires additional review. You can use the Where’s My Refund? tool to track your refund 4 weeks after paper filing.

Is the IRS still behind on processing paper returns?

The IRS is currently processing paper returns within a normal timeframe. Individual tax returns with a refund due are processed first. Those reflecting taxes owed will be processed last unless you include a payment. In that case, your payment will be immediately deposited, and your account will be credited.

Processing may be delayed if your return is missing information, has mistakes or there’s suspicious activity. If the IRS needs more information or would like you to verify something, they’ll send you a letter in the mail. Depending on how quickly you respond, it could take over 120 days to be resolved.