How Do I Print My IRS Payment Voucher?

Owe the IRS? If you choose to pay your balance due by check or money order, a completed payment voucher (Form 1040-V) will be included with the PDF of your return. The mailing address will be listed on the second page of your Form 1040-V.

To print your e-filed and accepted return:

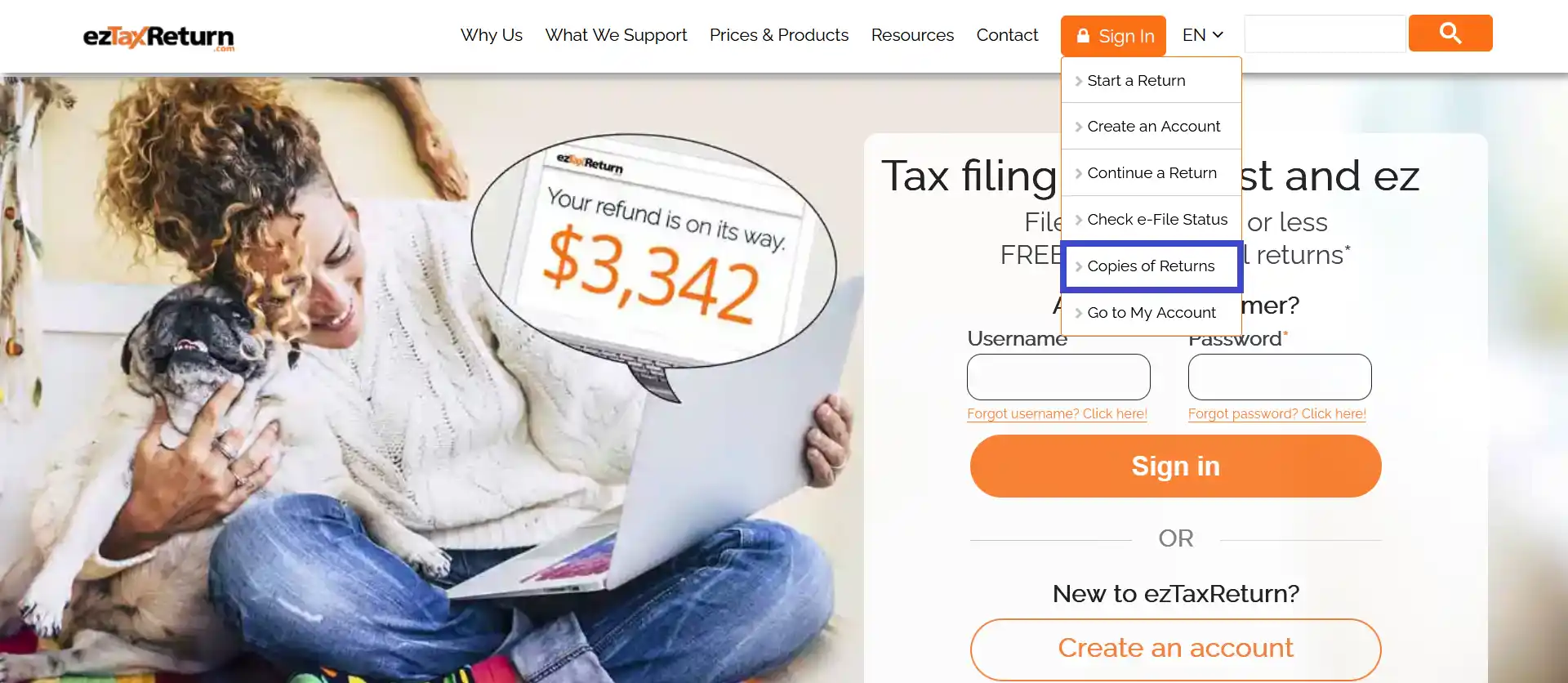

Go to the ezTaxReturn.com homepage.

Click “Sign In” and select “Copies of Returns” from the dropdown menu.

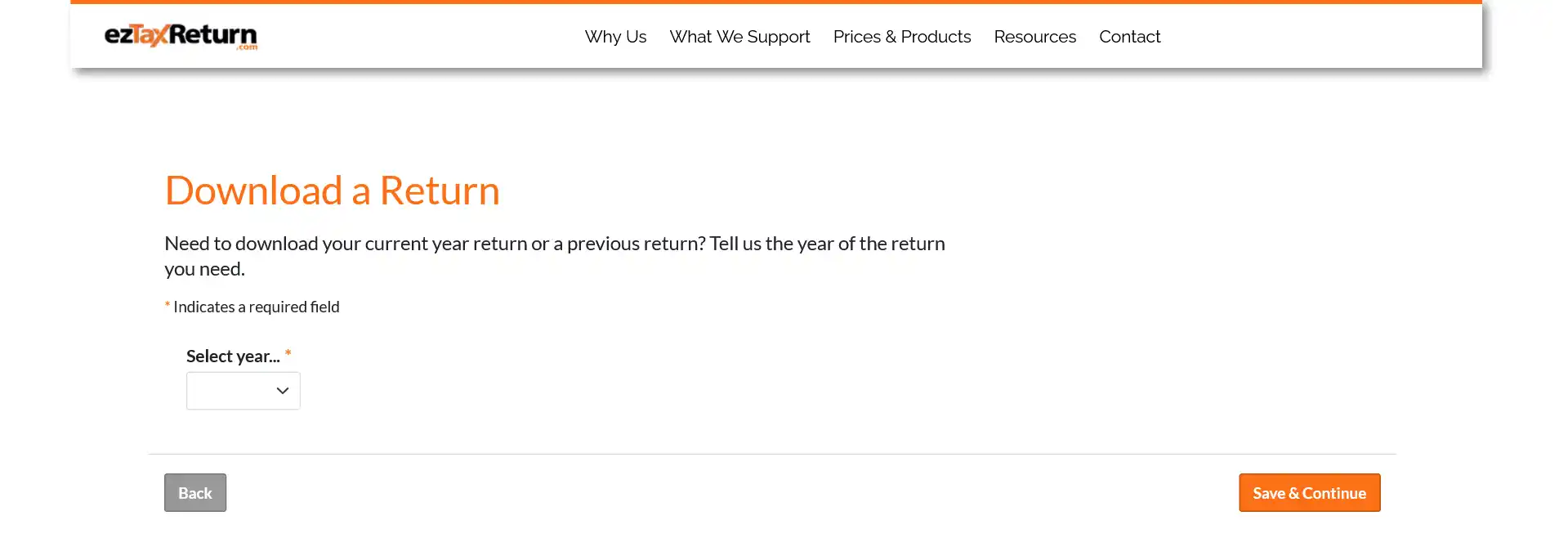

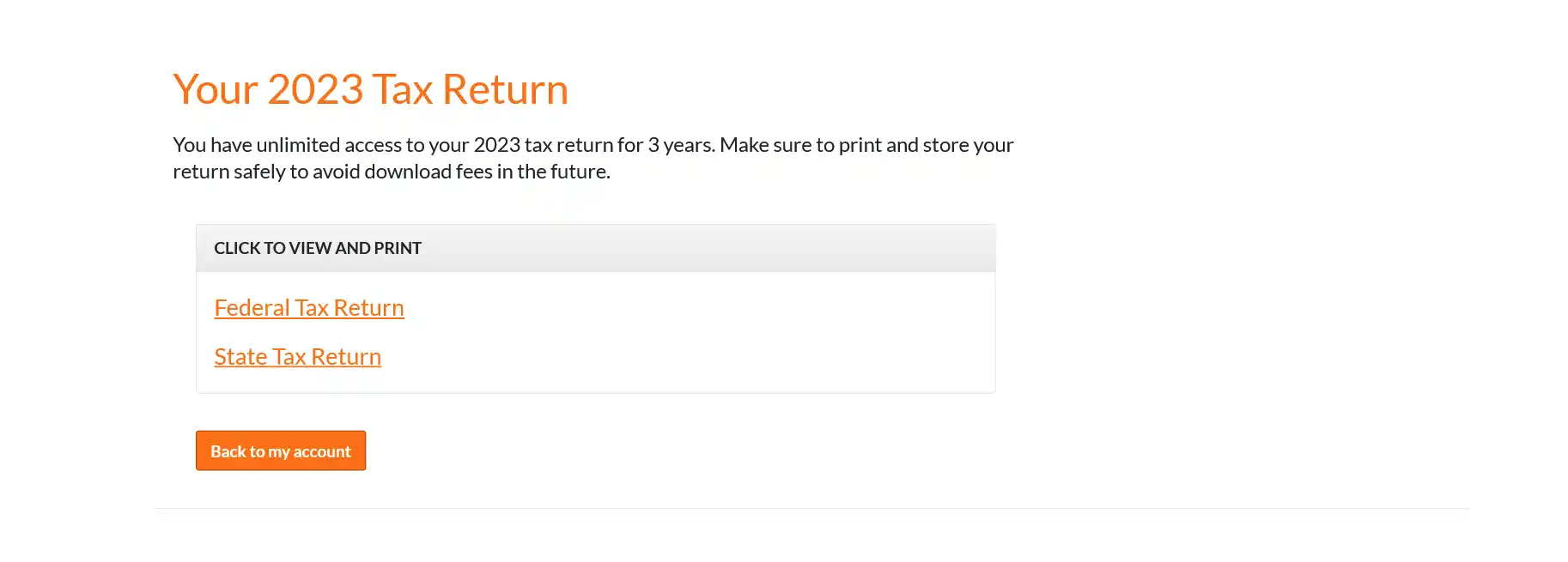

On the Download a Return page, select the year of the return you wish to download and proceed.

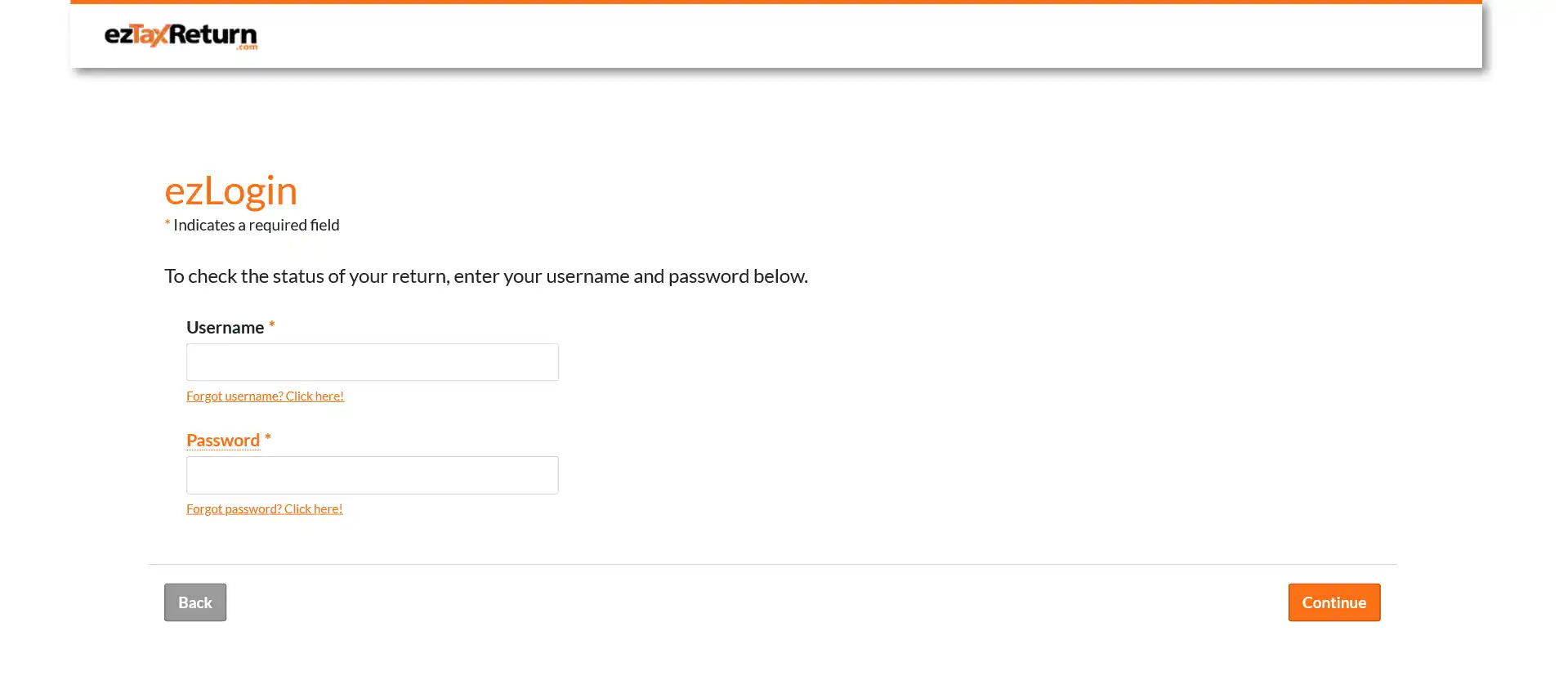

Enter your username and password to sign into your account. If you don’t remember your password, click “Forgot password? Click here” to reset it.

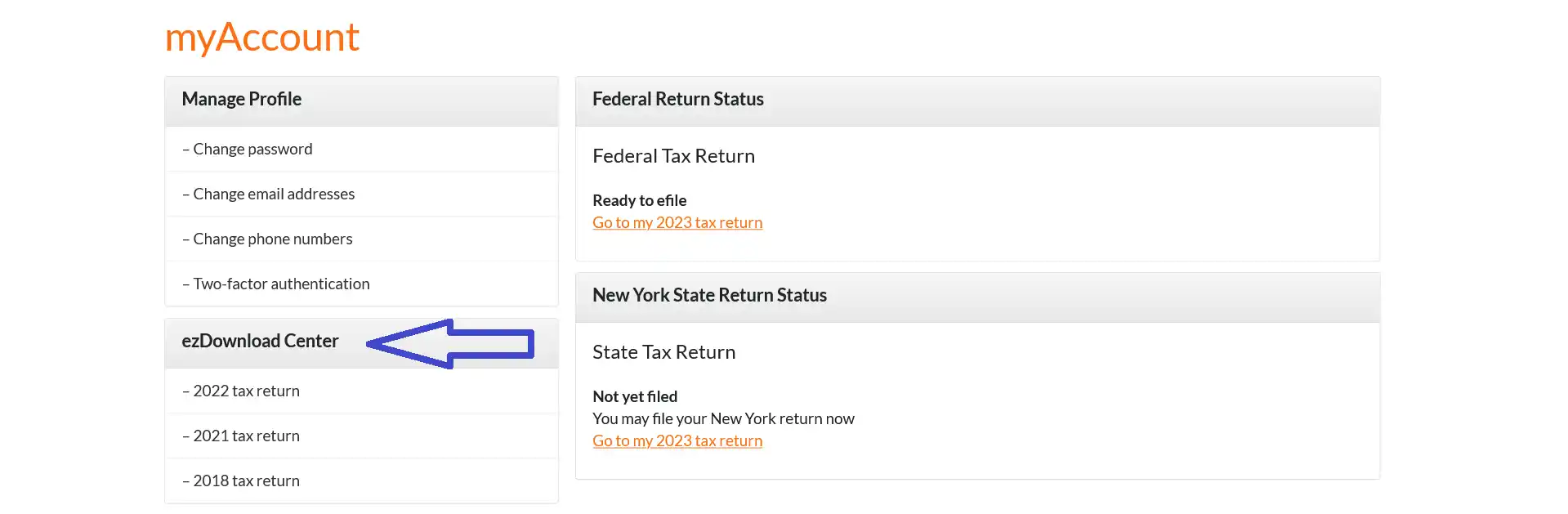

On your myAccount page, your available returns are listed under the “ezDownload Center”. Click on the return that you want to download.

On the next page, click the links to view and print your returns.

A separate window will pop up displaying your return. Click the printer icon to print it out.

IMPORTANT: Adobe Reader needs to be installed on your computer to view and download your returns.

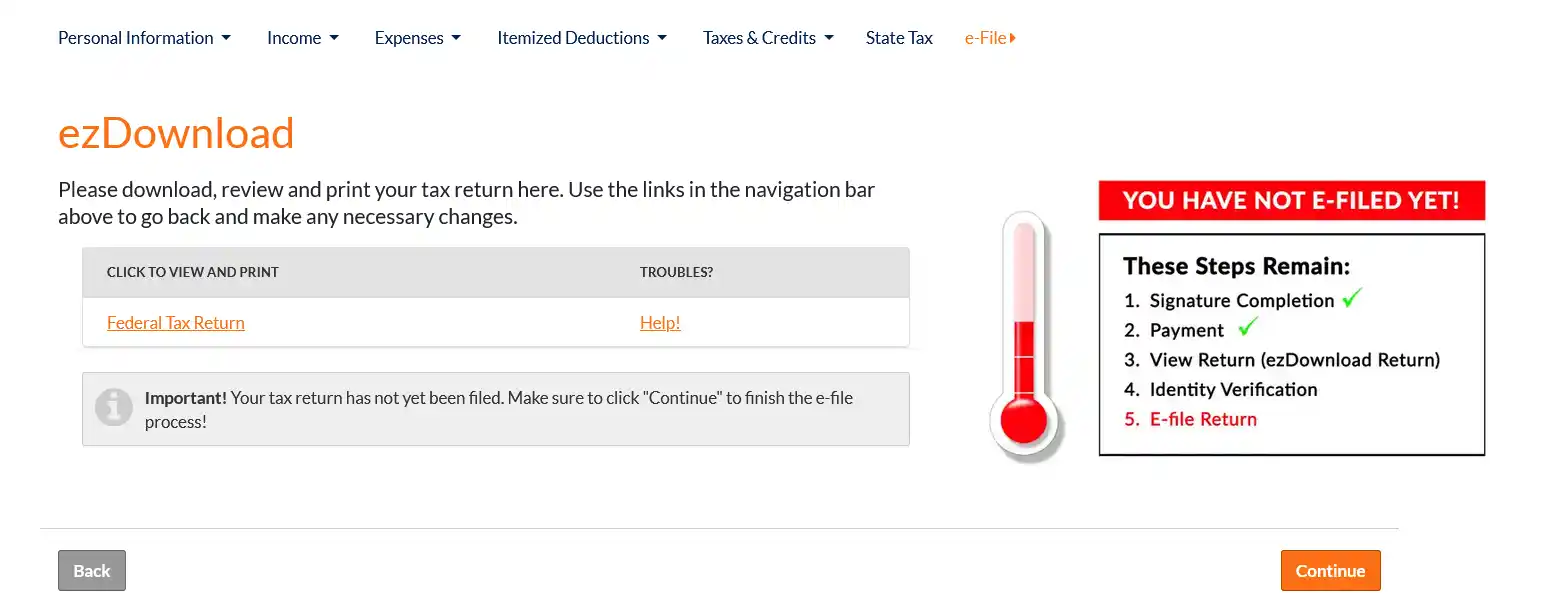

If you have not e-filed yet: You will be able to print your return and the included payment voucher on the "ezDownload" page. This page is after the signature and payment screens.

If you’ve already passed this section of the program, use the "Back" button on the site (not the browser back button) until you reach the "ezDownload" screen.

Form 1040-V FAQs

What is Form 1040-V for?

Form 1040-V is a payment voucher that you send with your check or money order when you owe money to the IRS. You can find your balance due on the “Amount you owe” line of your 2024 Form 1040 or 1040-SR.

What does a payment voucher look like?

You can find Form 1040-V by visiting: https://www.irs.gov/pub/irs-pdf/f1040v.pdf

How do I fill out a 1040-V?

There are four sections to complete on a 1040-V.

- Line 1 – Your social security number (SSN). If filing a joint return, use the first SSN shown on your Form 1040.

- Line 2 – If this is a joint return, enter the second SSN listed on your tax return.

- Line 3 – Enter the amount you’re paying by check or money order.

- Line 4 – Enter your name and address.

Do not staple the voucher to your payment or tax return.

What do you write on a check for IRS payment?

Your check or money order should be made payable to “United States Treasury”. The following information needs to be included somewhere on the payment:

- Your name

- Your address

- Your phone number

- Your SSN or ITIN. Use the first SSN shown on your return if filing jointly.

- Enter the year and tax form you filed. For example, “2024 Form 1040” or “2024 Form 1040-SR”.

- Enter the payment amount as $XXX.XX. Do not include any lines or dashes.

How do I send a 1040-V payment voucher?

The mailing address varies depending on where you live. You can find the list of mailing addresses on the second page of Form 1040-V. Choose the one that applies to you.