How Do I View, Download, or Print a Prior-Year Tax Return?

How to download your prior-year returns that were e-filed and accepted.

Go to the ezTaxReturn.com homepage.

Click “Sign In” and select “Copies of Returns” from the dropdown menu.

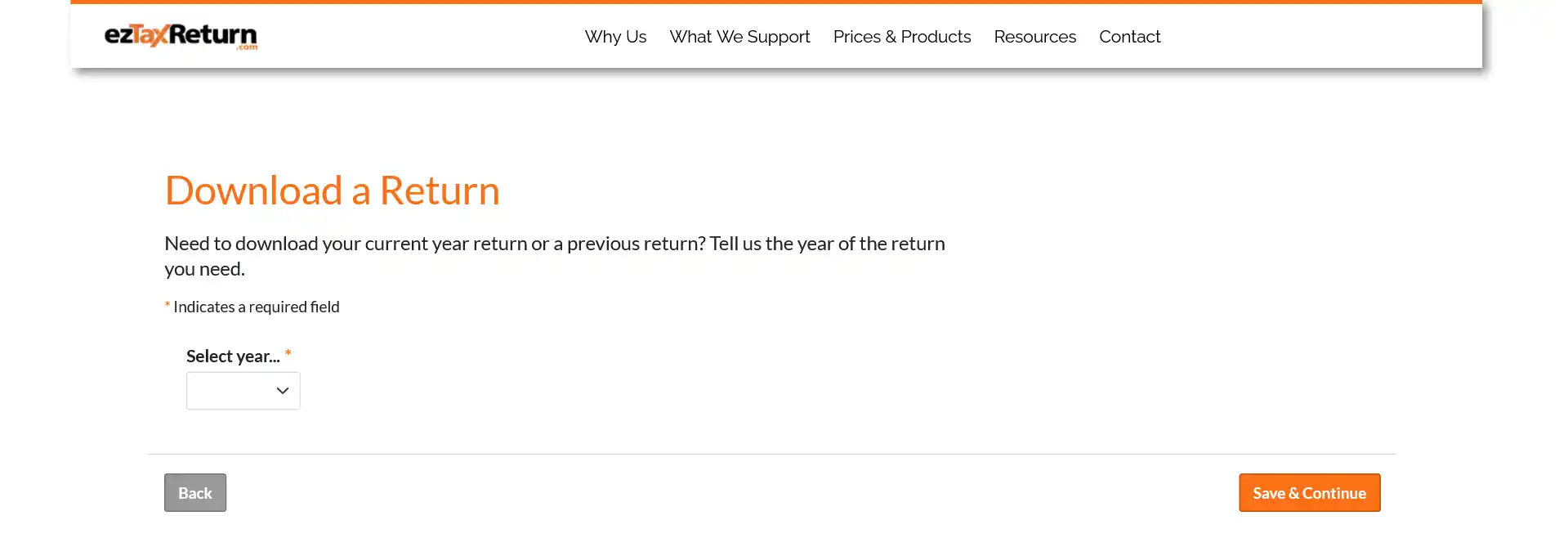

On the Download a Return page, select the year of the return you wish to download and proceed. Please be advised that our storage policy for your returns allows us to keep records for up to six years.

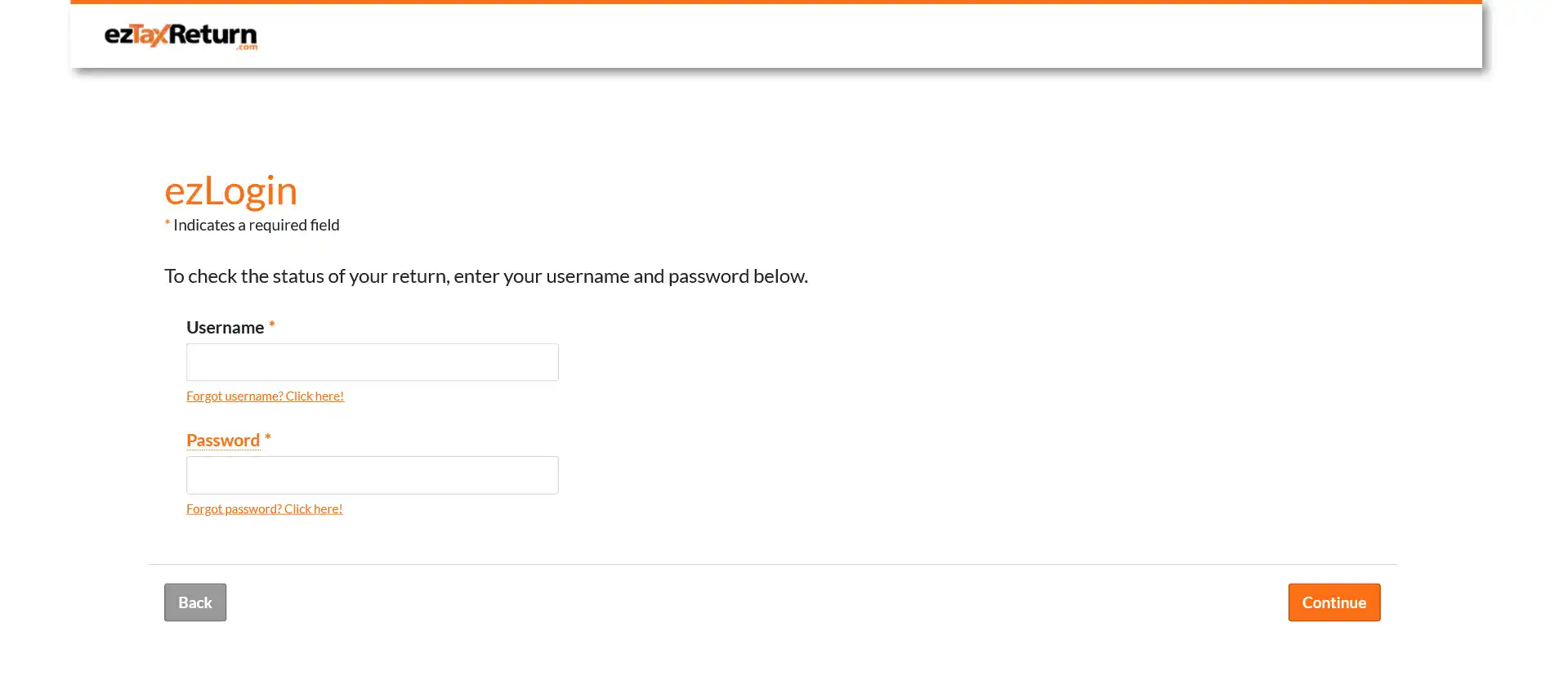

Enter your username and password to log in to your account. If you don’t remember your password, please click “Forgot password? Click here” to reset your password.

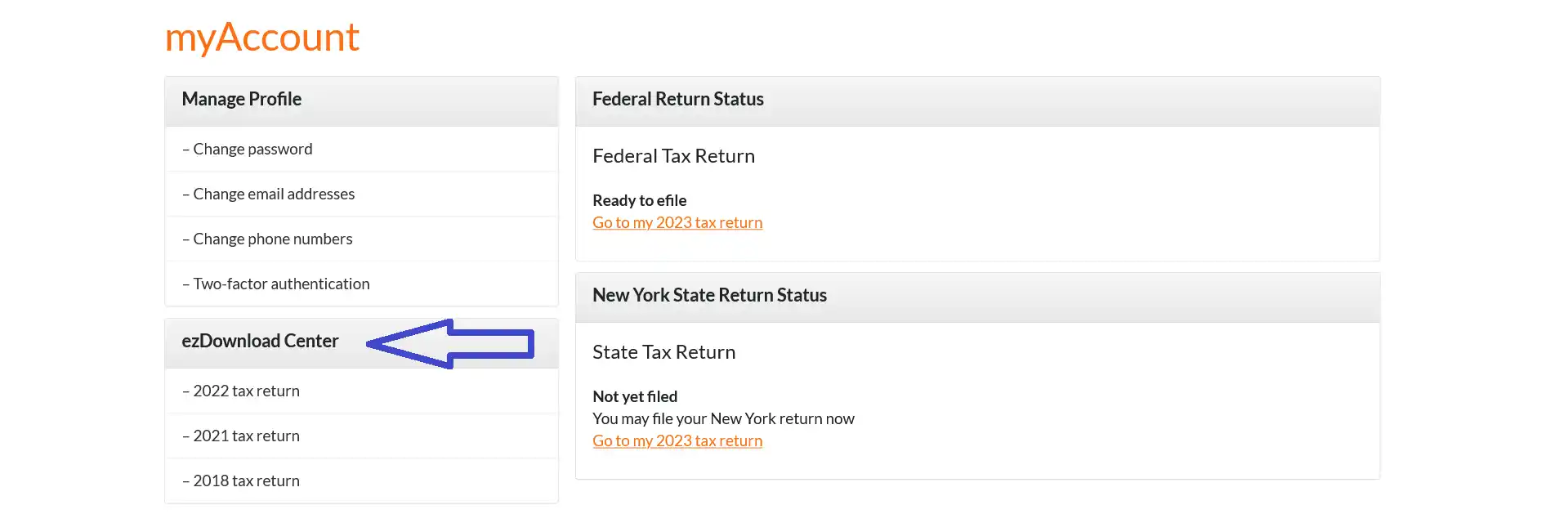

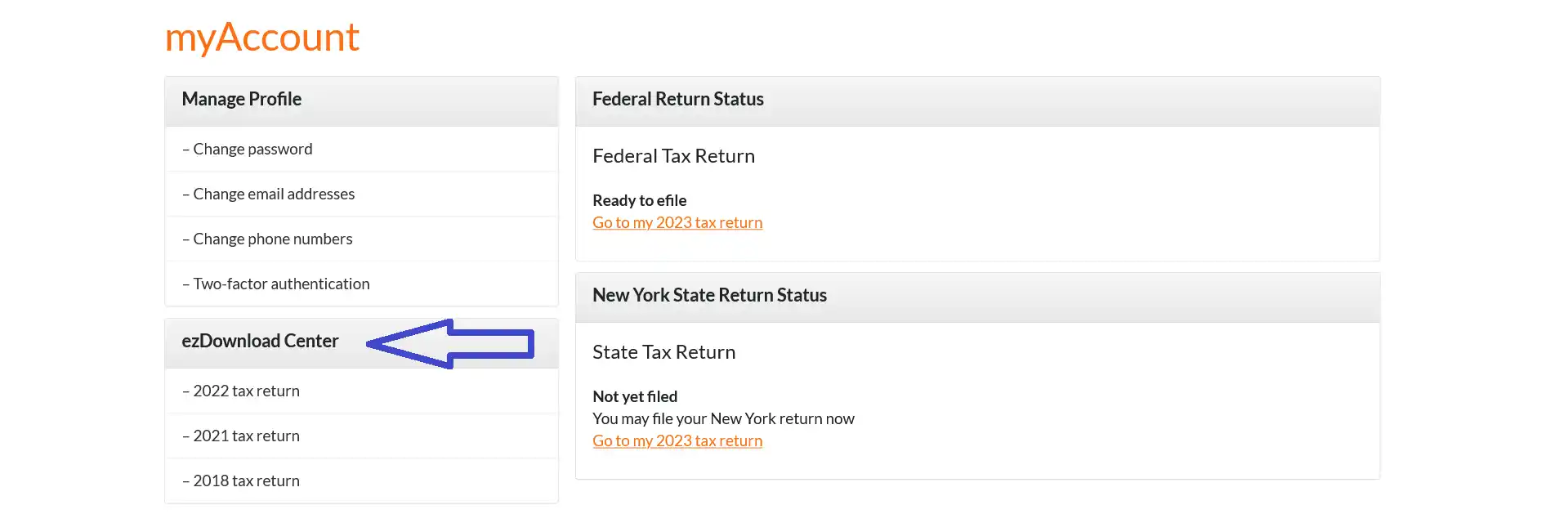

On your myAccount page, you will find links to all your available returns under the “ezDownload Center”. Please click on the year of the return that you wish to view and download.

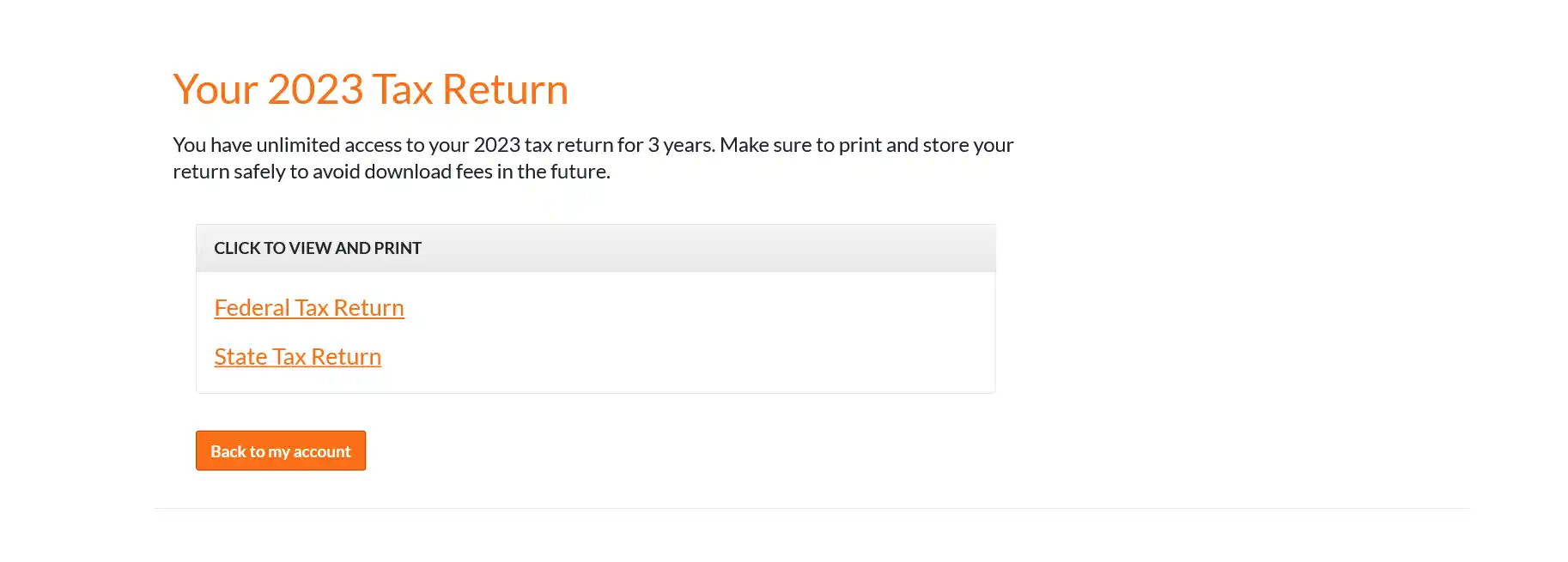

On the next page, click the links to view and print your returns.

A separate window will pop up displaying your return. From here you can click the printer icon to print your return.

Or click the folder icon to save it.

IMPORTANT: Adobe Reader needs to be installed on your computer to view and download your returns.

If you paid to do your taxes with ezTaxReturn.com, you can get unlimited copies of your returns for up to three years free of charge. Those who filed a free simple return must pay a small fee to access their returns after May 18th of that filing year.

How to download your prior-year returns that were NOT e-filed or accepted.

To access your returns, please select the tax year you need in the "ezDownload Center" on the "my Account" page.

Unfortunately, since only current year returns can be e-filed, your returns will need to be paper filed.

For the IRS mailing address, please click the link below:

https://www.irs.gov/uac/where-to-file-paper-tax-returns-with-or-without-a-paymentFor information on where to file your state return, please follow this link:

https://www.eztaxreturn.com/resources/tips-state-addresses.htmlPlease be sure to sign and include any documents you normally would when paper filing.