Where Is My Virginia State Refund?

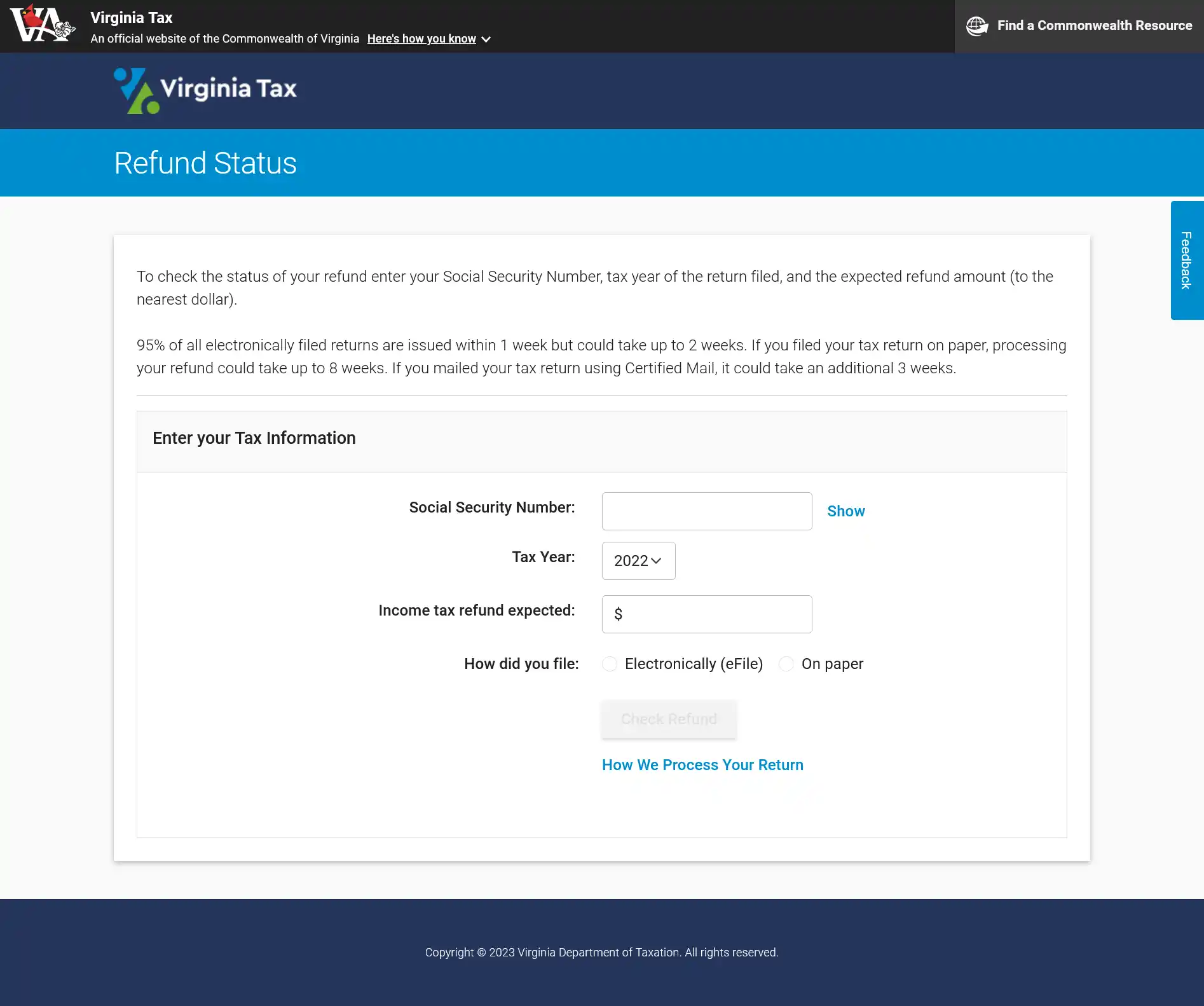

You may check the status of your Virginia tax refund online by visiting: Individual Online Account (virginia.gov)

1. Enter your Social Security Number.

2. Select the tax year.

3. Enter the refund amount.

4. Select how you filed.

Click on “Check Refund”.

Refund FAQs:

1. How soon will I receive my Virginia state tax refund?

Refunds are issued within 4 weeks for e-filed returns. For paper returns, processing times can take up to 8 weeks. Allow an additional 3 weeks processing time for tax returns mailed using Certified Mail.

2. Why was my refund taken to offset a debt?

Your refund will be withheld if you owe money for prior year taxes or a debt to another local government. This is called a debt offset. You will receive a letter in the mail explaining which debt was paid, how much of your refund was withheld, and the contact information of the agency. You will be mailed a check for any amount remaining from your refund.

3. Can I check my refund status over the phone?

The Virginia Department of Taxation gets millions of calls each year for refund status updates and there may be a long hold on the phone. You can call the automated phone line (804-367-2486). It is available 24 hours a day, 7 days a week. However, you are encouraged to use the online refund tool because it’s a quick and easy way to check the status.

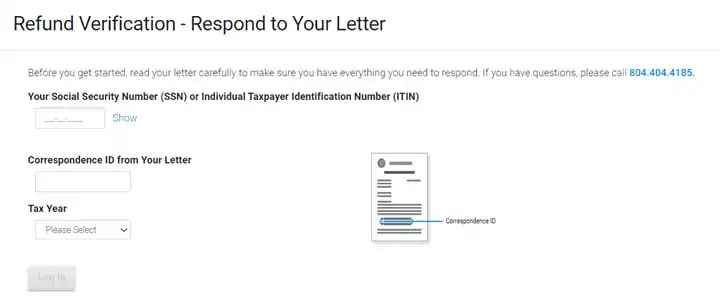

4. How do I proceed if I receive a Refund Verification Letter?

If you receive a Refund Verification Letter, respond with the requested information right away. The fastest way to respond is online. Go to: Refund Verification (virginia.gov)

- Enter your Social Security Number or ITIN.

- Enter the Correspondence ID from your letter.

- Select the tax year.

Click on “Log In”.

Please note, only the following letters can be responded to online:

- AUIN073A

- AUIN073M

- AUIN273A

- AUIN373A

- AUIN473A

- AUIN573A

You can also respond to the letter via mail or fax.

| Mail: | Fax: |

|---|---|

|

Virginia Department of Taxation |

(804) 344-8565 |

For additional questions, please call (804) 404-4185.