Where’s My Refund – Ohio?

You may check the status of your Ohio tax refund online by visiting: https://tax.ohio.gov/individual/refund-status

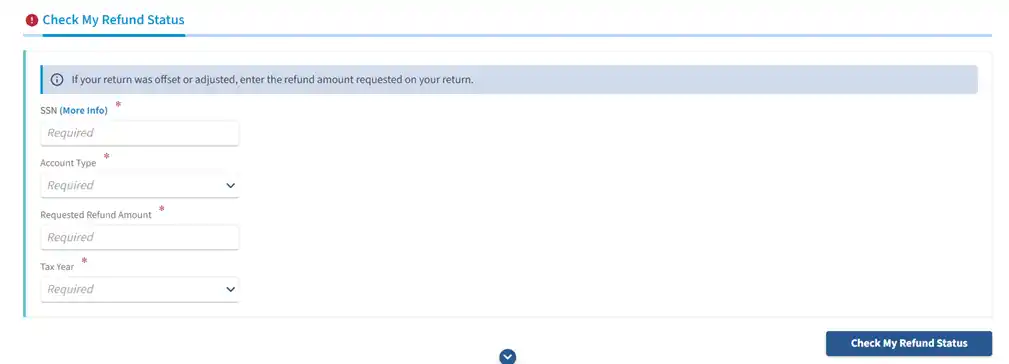

Click on “Check my Refund Status”.

- 1. Enter your social security number.

- 2. Enter account type.

- 3. Enter refund amount.

- 4. Enter tax year.

Click on “Check my Refund Status”.

Refund FAQs:

1. How soon will I receive my Ohio state tax refund?

For e-filed returns with a direct deposit, you should receive your refund in about 15 business days. If you e-filed but requested a paper check, refunds will generally be issued within 22 business days. For paper returns, refunds will be issued by mail within 8-10 weeks.

2. How do I get a replacement if my refund check is lost, stolen, or destroyed?

If you did not receive your refund, your check may be lost, stolen, or destroyed. You should contact the Department of Taxation through the options below:

- Call: 1-800-282-1780 (1-800-750-0750 for text telephones).

- Log in online at Check My Refund Status - eServices (ohio.gov) and select “Send a Message” under “Additional Services”.

3. Why was my refund taken to offset a debt?

If the Department of Taxation is notified that you owe money to another government agency, your Ohio income tax refund will be withheld to pay your debt.

- Please note: You may receive a “proposed” offset letter in the mail showing the agency you owe money to. If you receive a “proposed” offset letter, you can dispute the debt by submitting the “Ohio Non-Liable Spouse worksheet” and any supporting documents in response.