Where Can I Find My Prior Year AGI?

When you e-file your taxes, you’ll need to verify your identity by providing your prior-year adjusted gross income (AGI) or your prior-year self-select PIN. Most tax software providers will automatically enter the AGI for returning customers. However, if you’re a first-time customer, you must enter the information yourself.

Where can I find last year’s AGI?

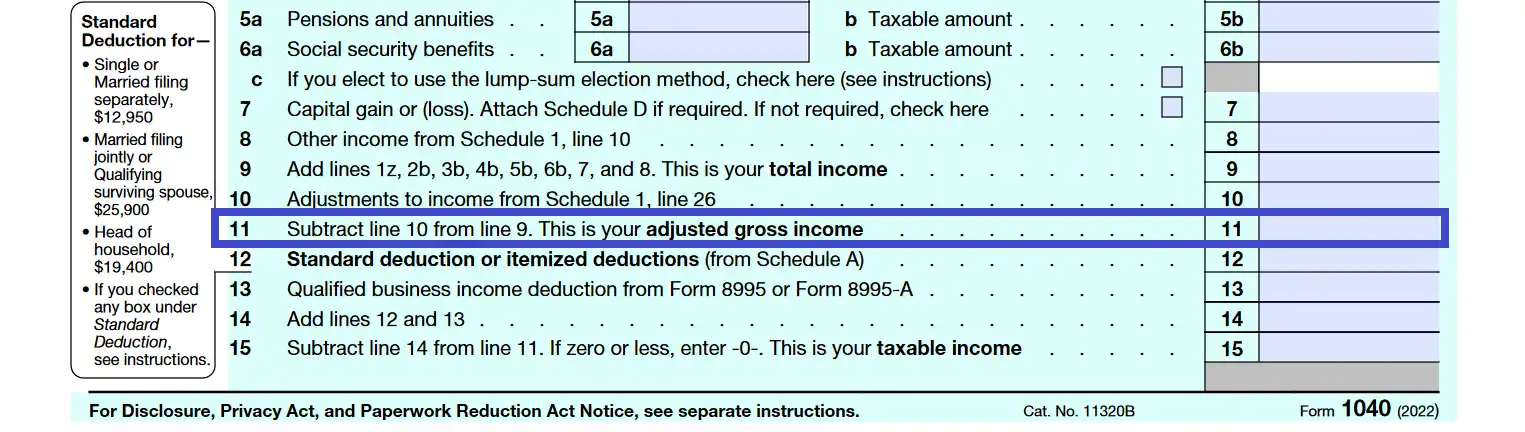

To locate your prior-year AGI, you will need a copy of last year’s tax return. Your prior-year AGI on line 11 of your 2024 Form 1040 or 1040-SR.

If you did not file last year, are still waiting for your 2024 return to be processed, or are a first-time filer over the age of 16, please enter $0 as your AGI.

How do I find last year’s AGI without my tax return?

If you cannot track down a copy of your tax return, you’ll need to request a tax transcript. This can be done in a few different ways. You can:

-

Request your transcript online (fastest method).

- Visit the IRS Get Your Tax Record page.

- Select “Get Transcript Online”.

-

Request your transcript by mail.

- Visit the IRS Get Your Tax Record page.

- Select “Get Transcript by Mail”.

- Arrives in 5-10 days.

-

Call the IRS automated phone transcript service at 800-908-9946 to have them mail it.

- Arrives in 5-10 days.

How do I find my spouse's AGI?

If you and your spouse filed a joint return last year, then you both would have the same AGI. If you filed separately, each of you will have different AGI’s. Enter the AGI from each person’s prior-year return. If either of you did not file, use “0” as that person’s AGI.

Should I use the AGI from my amended tax return?

No, you must use the AGI listed on the original return you filed last year.

What happens if you have negative AGI?

If your prior year AGI is negative, you will need to enter your AGI as a negative number.