How Do I Track My Wisconsin State Tax Refund?

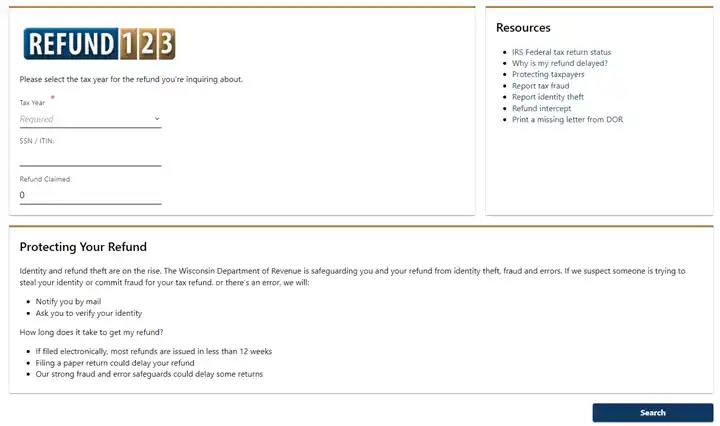

You may check the status of your Wisconsin tax refund online by visiting: My Tax Account (wi.gov)

1. Select the tax year.

2. Enter your Social Security Number.

3. Enter your refund amount.

Click on “Search”.

Refund FAQs:

1. How long does it take to get your Wisconsin tax refund?

Most refunds are issued in less than 12 weeks for e-filed returns. Your refund may be delayed if you filed a paper return.

2. Why was my state refund intercepted?

The Wisconsin Department of Revenue may withhold your refund if you owe a debt to another government agency. This includes:

- DOR

- Child Support

- Court Ordered Restitution

- IRS and federal government agencies

- Statewide Debt Collection by state and/or local governments

- Tribal governments in Wisconsin

- Other states.

3. Can you dispute a tax offset?

Yes, if you received a notice in the mail and disagree with the offset, call the number shown on the letter. You can also call:

- (608) 266 – 7879 – for state or government agency debts.

- (800) 829-7650 – for IRS debts.

4. Can I check my refund status over the phone?

The Wisconsin Department of Revenue gets millions of calls each year for refund status updates and there may be a long hold on the phone. You can call any of the numbers listed below. However, you are encouraged to use the online refund tool because it’s a quick and easy way to check the status.

(866) 947-7363 - Toll Free

(414) 227-4907 - Milwaukee

(608) 266-8100 - Madison