What Is a 1099-R Rollover?

When you transition from one job to the next, you need to decide what to do with your retirement account. One option is to rollover your 401k to an individual retirement account (IRA). This will allow you to move the funds without paying taxes or an early withdrawal penalty.

What does it mean to rollover?

A rollover is when you move your money from one eligible retirement plan to another. You typically have 60 days to complete the rollover, from the time of distribution from the old plan to the time of deposit into the new plan. The benefits of a rollover are that your money will continue to grow tax-deferred, and you’ll avoid paying an early withdrawal penalty. It can also help you consolidate if you have multiple retirement accounts.

What are the different types of rollovers?

The two most common types of rollovers are direct and 60-day rollovers. The type of rollover will affect how taxes are withheld and how the distributions are reported. Rollover distributions are reported on a 1099-R.

- Direct rollover – This is when your plan administrator sends the funds directly to another retirement plan or to an IRA. No taxes will be withheld and the distribution code in Box 7 should be G.

- 60-day rollover – You can roll over some or all the funds to another retirement plan or IRA as long as you do it within 60 days of receiving it. This is also known as an indirect rollover. Your distribution will be subject to a 20% withholding. The distribution code in Box 7 will be either a 1 (early distribution if you’re under age 59 ½) or 7 (normal distribution).

- Trustee-to-trustee transfer – This occurs when you transfer funds from one IRA to another. No taxes will be withheld. You will not receive a 1099-R for this transaction.

There is no limit on transfers, but you can only do one rollover from the same IRA in a 1-year period. This does not apply to:

- Rollovers from traditional IRAs to Roth IRAs (conversions)

- Trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers

- Plan-to-IRA rollovers

- Plan-to-plan rollovers

What are the disadvantages of rolling over your retirement plan into an IRA?

The disadvantages of an IRA are:

- Less credit and bankruptcy protections than a 401k.

- You cannot borrow money from your IRA.

- You must wait until age 59 ½ to withdraw funds to avoid the 10% early withdrawal penalty.

- The fees are usually higher for an IRA than a 401k.

Do I need to report a rollover on my tax return?

Yes, you are required to report your rollover on your tax return. Even if the money didn’t directly go to you, it’s still considered a distribution and should be reported to the IRS. You will receive a form 1099-R which will be used to determine if the rollover amount is taxable.

How much taxes do you pay on a rollover?

Generally, if you do a direct rollover, you will not have any taxes withheld. However, if you do an indirect rollover, there’s a mandatory 20% tax withholding. If your retirement funds are being rolled over to a Traditional IRA, the rollover is not taxable, and any withholdings will be refunded to you. If the funds are moved to a Roth IRA, you will likely owe taxes. You may also have to pay a 10% early withdrawal penalty if you’re under age 59 ½ and don’t qualify for an exception.

Where do I report a rollover on Form 1040?

If you decide to rollover your retirement plan, your plan administrator will send you a Form 1099-R. The information from the following boxes of Form 1099-R will determine what flows to your Form 1040.

- Box 1 (Gross distribution) – Shows the total amount distributed.

- Box 2a (Taxable amount) – Should be “0” for a direct rollover but may have an amount if the rollover was indirect.

- Box 7 (Distribution code) – Should be “G” for a direct rollover, and typically is “1” or “7” for an indirect rollover.

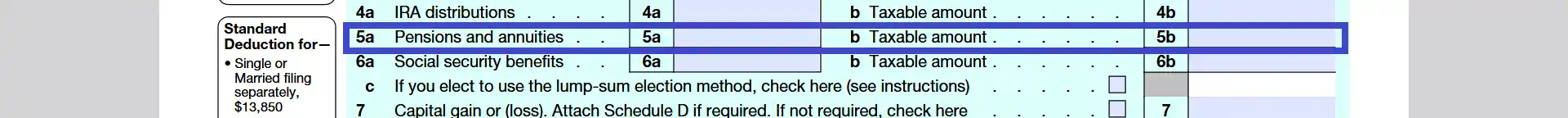

On Form 1040:

Line 5a (Pensions and annuities): The total amount distributed from Box 1.

Line 5b (Taxable amount): The taxable amount from Box 2a. However, if your distribution was rolled over within 60 days, the taxable amount should be ‘0’.

How do I enter a rollover in ezTaxReturn?

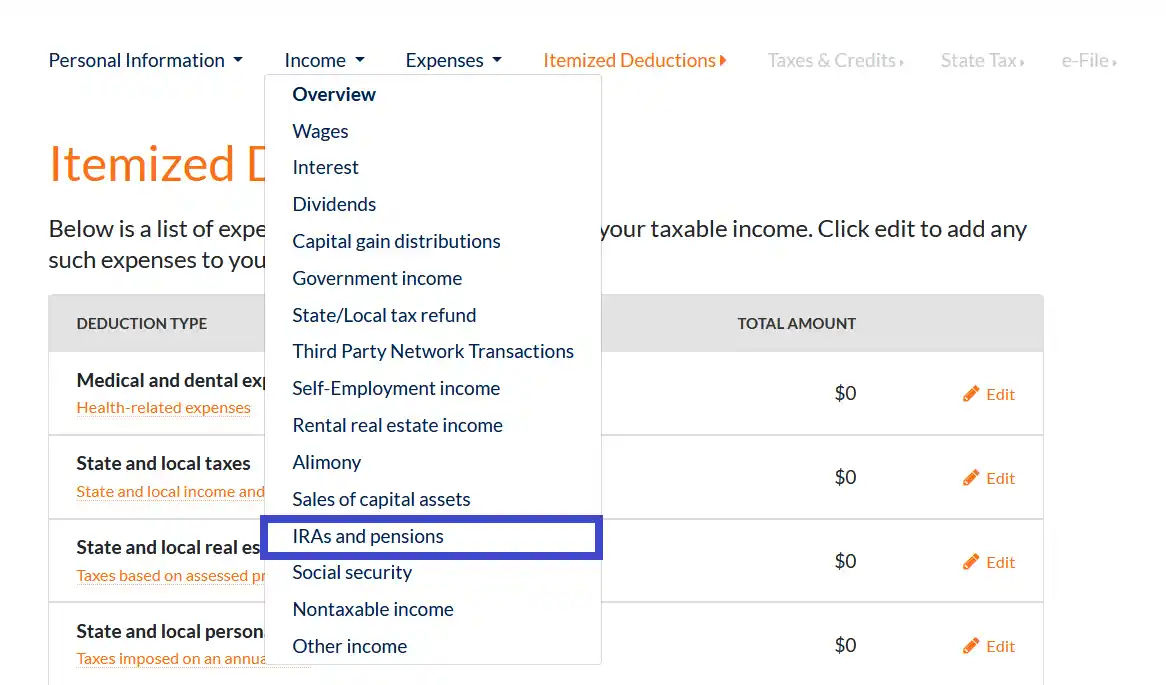

To enter a distribution, you must have received a Form 1099-R, which reports information regarding distributions. 1099-R forms are entered in the "IRAs and Pensions" section of the "Income" section of the program.

If you have already passed this section of the program, you can click the "Income" link on the navigation bar towards the top of the page and select "IRAs and Pensions" from the drop-down menu.

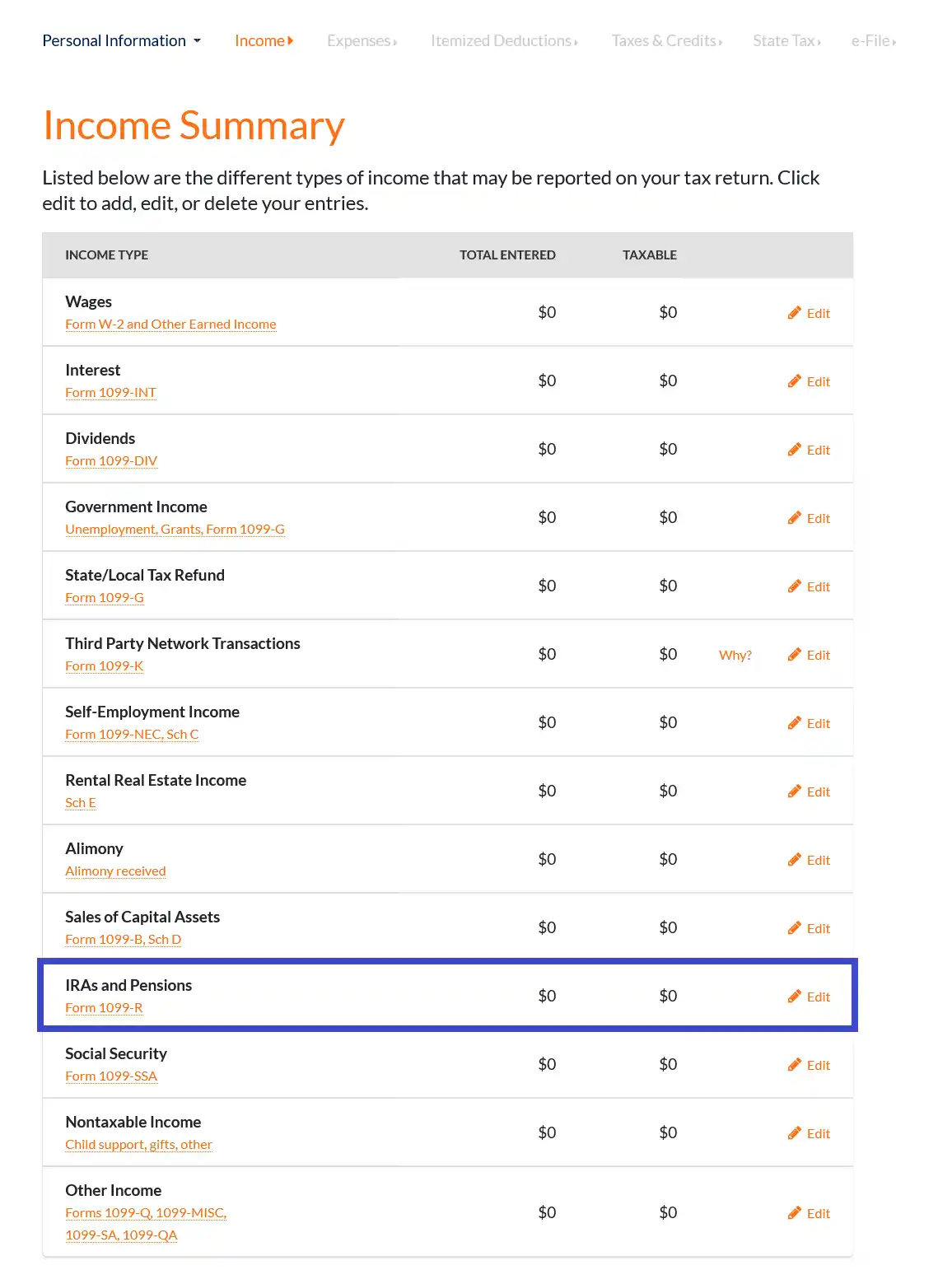

If you are on the "Income Summary" screen, click on the "edit" link on the "IRA's and Pensions" line to add, edit, or delete a 1099-R entry.

Please note, you only have 60 days to rollover a 401K or IRA distribution if you want to avoid paying taxes on the rollover.

If your distribution was not rolled over within 60 days, it may be taxable and you also may be penalized on it for early withdrawal.

If you did roll over the entire amount of the distribution into another IRA or qualifying retirement plan, then when the program asks you if you rolled over the whole distribution, you can choose that as an option.

Note: Our program currently does not support partial rollovers.