Adulting 101: Tips for Filing Your Very First Tax Return

You have lived through many milestones on your path to adulthood, and now that day has finally come. Everything that has come before, from your first steps as a toddler to your first time behind the wheel of the family car, has helped to prepare you for this day, and now there is...

Inflation Tax Basics

Today, we're going to talk about something that's been causing a real headache for all of us lately: inflation. Prices are going up like crazy, and a lot of that is due to the Federal Reserve's policies over the last couple of years. They're the ones who call the shots on the...

Income Tax Withholding and Estimated Tax Payments

Are you anticipating a tax liability? Didn’t ask your employer to withhold enough taxes? You may have a tax liability on your hands. A tax filer can end up paying more than what’s withheld based on their income and wage levels. You can avoid a potential tax liability by requesting...

How Does Inflation Impact Taxes?

We don’t want to over-inflate a balloon because it will pop. It’s simply too much pressure. This law of physics expands to more than just balloons. Inflation applies to taxes too. Every year the IRS adjusts the tax brackets to ease the pressure of (over)inflation and help Americans...

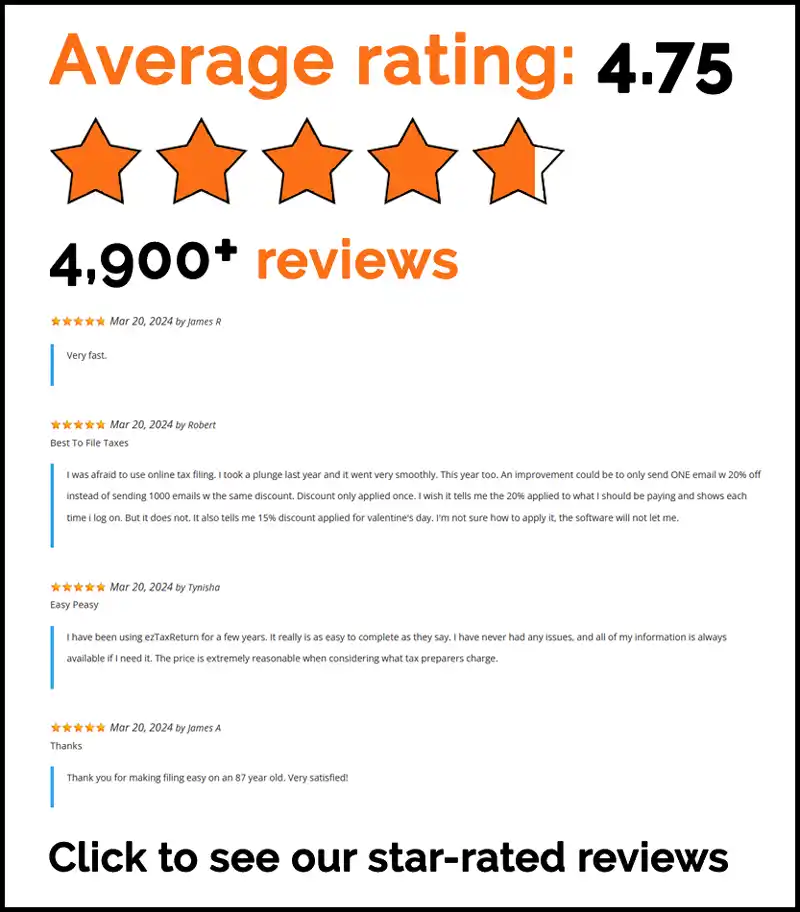

How to Know if Your Return Has Been Filed

Millions of Americans use tax preparation software to do their taxes because it saves them time and money. To file with ezTaxReturn, you must complete all the steps in the filing process. This means answering a series of questions, downloading your returns, and continuing through...

7 Money Challenges to Save up to $10,000 in One Year

Ready to start building your savings? If the answer is yes, then it's time to put your money where your mouth is. We've scoured the internet looking for the best money-saving challenges and narrowed it down to seven. One of which can help you save up to $10,000 in...

7 Strategies Everyone Can Use to Save Money on Their Taxes

Benjamin Franklin once said that “In this world nothing can be said to be certain, except death and taxes.” Although you can’t completely avoid your tax obligation, there are things you can do to reduce the amount you owe each year. Here are some basic tax-saving strategies...

Everything You Need to Know About Tax Refunds

Most people who file a tax return walk away with a refund. Although you may feel like you've won the lottery, a tax refund isn’t free money from the government. It’s actually your own money you’re getting back from Uncle Sam. During the year federal and state taxes are withheld from...